Initiate a Sale or Refund

This article covers both sale and refund transactions

Initializing the Reader for Charging

When you're ready to charge a customer, you should create an In-Store

Context by

requesting a charge from a card reader. In this step, your application will specify, at minimum, the

readerId

,

merchantAccountIdand

transaction.amount

details to initialize the reader for payment acceptance. Note that the

merchantAccountIdis not validated against in the Sandbox

environment; however, this is a required value in the production

environment for all interactions with the card reader.

Charging is similar to authorizing, except that if the authorization is successful, Braintree will automatically capture the transaction. This is also known as creating a Sale Transaction.

To provide idempotency on the request charge mutation, you must also

include the HTTP header

Idempotency-Key with a unique value. UUIDv4 is recommended.

For example, if using

curl

to make the request, you would include

Idempotency-Key is an important way of preventing

duplicate charges to your customer in the event of an API

communication failure. For example, if you request a charge from

the reader, the customer completes the charge on the reader, but

for some reason, the POS does not get back the transaction result

before timing out. In this scenario, the POS could recover the

original transaction using the same

Idempotency-Key without accidentally creating a

duplicate charge.

--header 'Idempotency-Key: 94c9ea8b-31b0-488e-a231-57e32f0bfd70'- GraphQL Mutation

- GraphQL Variables

- Sample API Response

mutation RequestChargeFromInStoreReader($input: RequestChargeFromInStoreReaderInput!) {

requestChargeFromInStoreReader(input: $input) {

clientMutationId

id

status

reader {

id

name

status

}

}

}

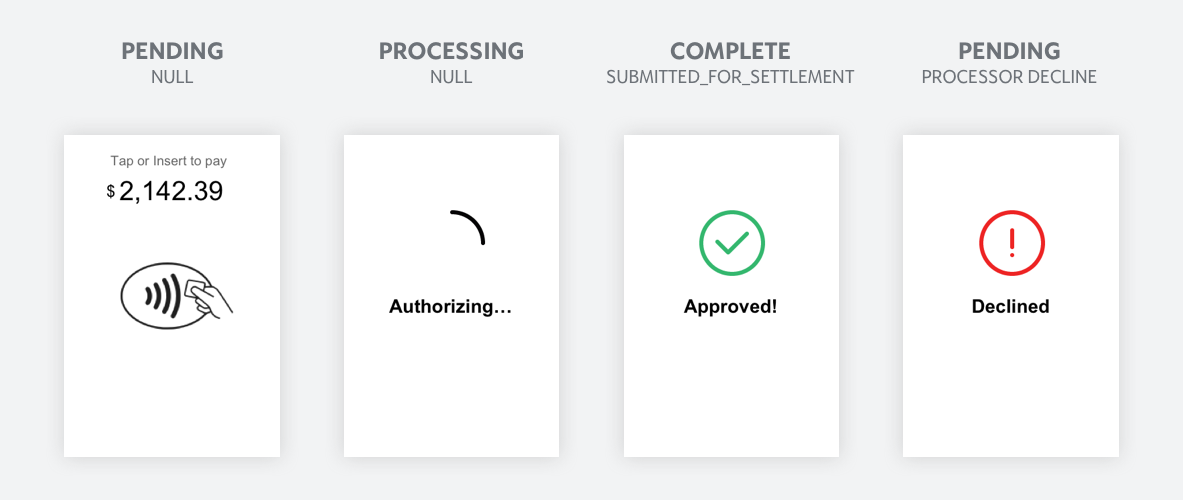

Checking the Reader Charge Status

After the reader is initialized for payment, your application must wait

for the customer to interact with it (i.e. insert a test card) and for the

payment attempt to be processed. Your application should use

the node query

to poll on a 2-second interval between responses for the current status of

the payment using the

RequestChargeInStoreContext.id

received at charge initialization and monitor the

RequestChargeInStoreContext.statusfield as the transaction

goes through the lifecycle.

When the

RequestChargeInStoreContext.status

changes to "COMPLETE", you will also receive a transaction object

RequestChargeInStoreContext.transactionin the response. Save

the completed

RequestChargeInStoreContext.transaction.id

in your database for referencing the transaction in subsequent operations.

All successful test transactions should have a transaction amount value below $2,000 for testing. For more info on using amounts to simulate various transaction outcomes, look at Testing Your Integration.

Testing the Unhappy Paths in Sandbox:

- GraphQL Query

- PENDING Response

- COMPLETE Response

- FAILED Response : Decline

- FAILED Response : Network Error

- FAILED Response: Gateway Reject

{

node(id: "{{last_braintree_instore_context}}") {

... on RequestChargeInStoreContext {

id

status

statusReason

reader {

id

name

status

}

transaction {

id

orderId

status

statusHistory {

... on PaymentStatusEvent {

status

timestamp

terminal

... on AuthorizedEvent {

processorResponse {

authorizationId

emvData

message

legacyCode

retrievalReferenceNumber

}

}

... on GatewayRejectedEvent {

gatewayRejectionReason

}

... on FailedEvent {

processorResponse {

retrievalReferenceNumber

emvData

message

legacyCode

}

networkResponse {

message

code

}

}

... on ProcessorDeclinedEvent {

processorResponse {

legacyCode

message

authorizationId

additionalInformation

retrievalReferenceNumber

emvData

}

declineType

networkResponse {

code

message

}

}

}

}

merchantAddress {

company

streetAddress

addressLine1

extendedAddress

addressLine2

locality

adminArea2

region

adminArea1

postalCode

countryCode

phoneNumber

}

amount {

value

currencyIsoCode

}

merchantAccountId

merchantName

createdAt

channel

customFields {

name

value

}

paymentMethodSnapshot {

... on CreditCardDetails {

origin {

details {

... on EmvCardOriginDetails {

applicationPreferredName

applicationIdentifier

terminalId

inputMode

pinVerified

}

}

}

brandCode

last4

bin

expirationMonth

expirationYear

cardholderName

binData {

issuingBank

countryOfIssuance

prepaid

healthcare

debit

commercial

}

}

}

}

}

}

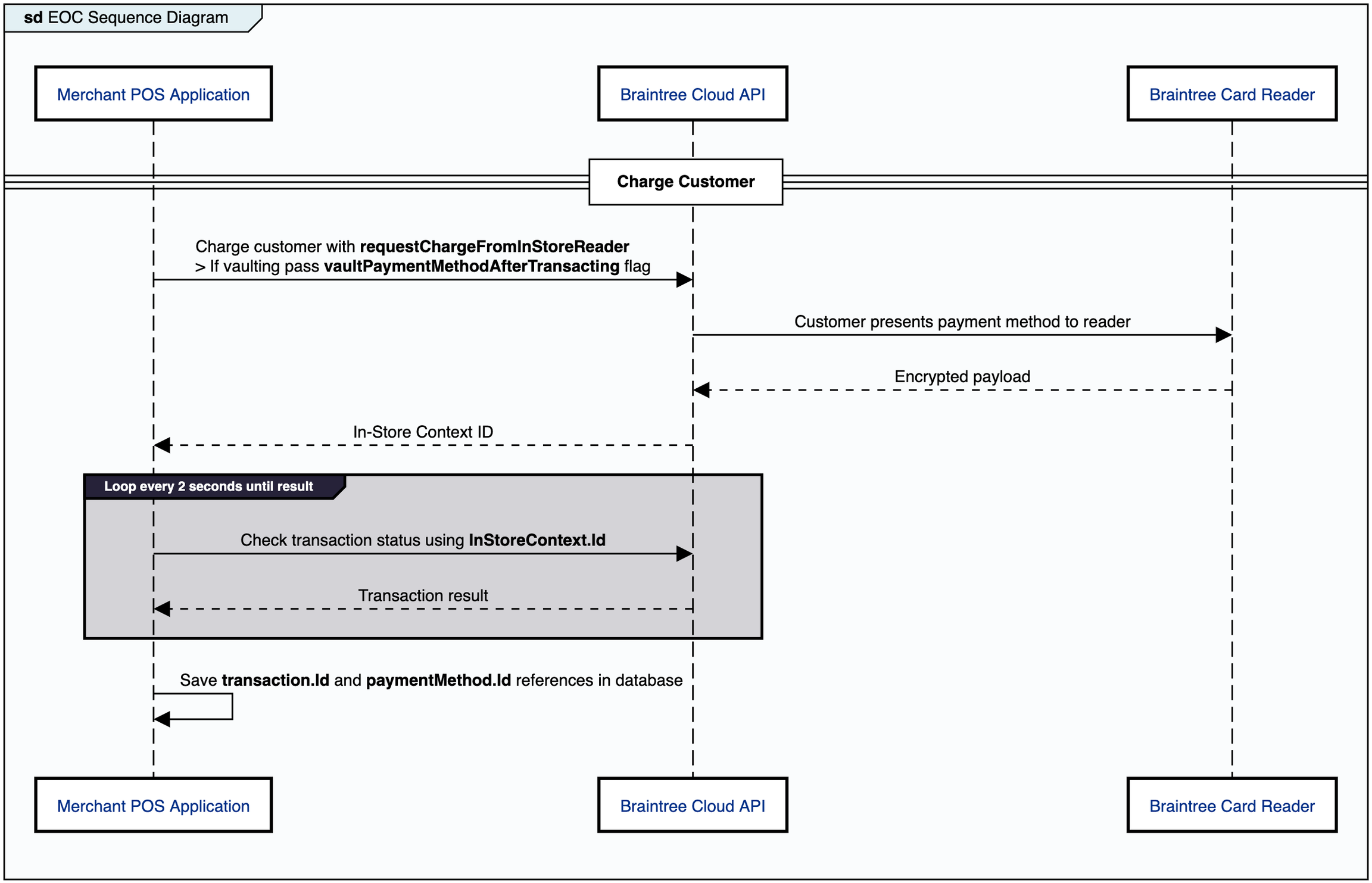

}Charge Flow Example Sequence Diagram

The following high-level sequence diagram depicts an example charge flow; however, this flow can vary depending on whether you are vaulting, and polling logic may also vary by application. This is just an example flow.

Recommended Timeout Logic

Knowing that every application will have different flows and architectural constraints the following recommended timeout logic is just a suggestion based on best practices, but every integration may be different.

Generally, the card reader has a built-in timeout logic of 180 seconds for a “maximum checkout time,” that is, from the moment you request a charge from the card reader, it will hang for 180 seconds if no payment instrument is presented. However, it is recommended for the POS application to have its own timeout logic to make sure the POS stays in sync with the card reader and provides a seamless experience to the customer.

Recommended sequence for initializing card reader and polling for

transaction result:

Step 1 |

Generate unique

|

Step 2 | Use an HTTP timeout window of 10 seconds if you do not get back a response |

Step 3 |

Send the request again using the same

|

Step 4 |

Once you get an

|

Step 5 |

Use an HTTP timeout window of 3 seconds if you do not get a

response while polling against the

|

Step 6 |

Send the

polling request

every 2-3 seconds until you get the final

transaction.status,

|

Cancelling a Charge

If you need to stop a transaction from being paid while the reader is

activated and requesting payment, you can

cancel

the

InStoreContext. Cancelling an

InStoreContext

places the reader back into

idle mode and returns you to the PayPal-branded

screensaver. It is important to note that canceling a charge is only

possible when a payment instrument has not yet been presented to the card

reader. After the card reader has been presented with payment, the only

way to stop that would be with a reversal or refund of payment.

InStoreContext and the API returns a context status

of "COMPLETE" that would indicate that the charge has already been

processed. In this scenario, you should

check the reader charge status

again to get the

transactionId and perform a reversal or

refund to cancel the charge.

*** As of August 2022, we have introduced a new API error code 96716, which occurs when you attempt to cancel a context ID that is already in a "PROCESSING" or "COMPLETE" state

- GraphQL Mutation

- GraphQL Variables

- Sample API Response

mutation RequestCancelFromInStoreReader(

$input: RequestCancelFromInStoreReaderInput!

) {

requestCancelFromInStoreReader(input: $input) {

id

status

reader {

id

name

status

location {

id

name

}

}

}

}Partial Authorizations

Partial Authorizations refer to transactions where a card with limited available funds is used to complete a purchase, and the available funds are less than the amount to be collected. This can occur with a debit card or a prepaid gift card. For example, if a merchant wants to charge $100, and the customer presents a card with only $50 available. With a partial authorization, the available $50 would be authorized or charged, while the POS system would need to recognize that there is a remaining balance to tender of $50. The POS should generally handle this like a split tender once it is determined that a partial authorization has occurred.

The way for the POS to know that a partial authorization has occurred

would be to parse out the

statusReason

from the context ID node query, which would show as

PARTIALLY_AUTHORIZED. The

context status

will be returned as

COMPLETE.

In the Sandbox environment, you may test partial authorizations by using

the

"amount":"1004"

in your request.

Partial Authorization Enablement

There are 2 ways to enable partial authorization on your account. You may

have your PayPal Solutions Engineer or Integration Engineer enable this

feature on your account. Alternatively, you may pass an API flag to

determine whether you want to allow partial authorizations on the

particular transaction using the

acceptPartialAuthorization

object. This API flag is a boolean ("true/false") variable that will

override the Braintree account-level configuration. We recommend using

this API flag if you would like to allow for partial authorization on some

transactions and not others, or if you want more control of the enablement

of this feature.

acceptPartialAuthorization

API flag. Please consult with your Solutions Engineer or

Integration Engineer to enable it.

Refunding Your Customer

There are 3 ways of refunding your customer once a charge has been completed.

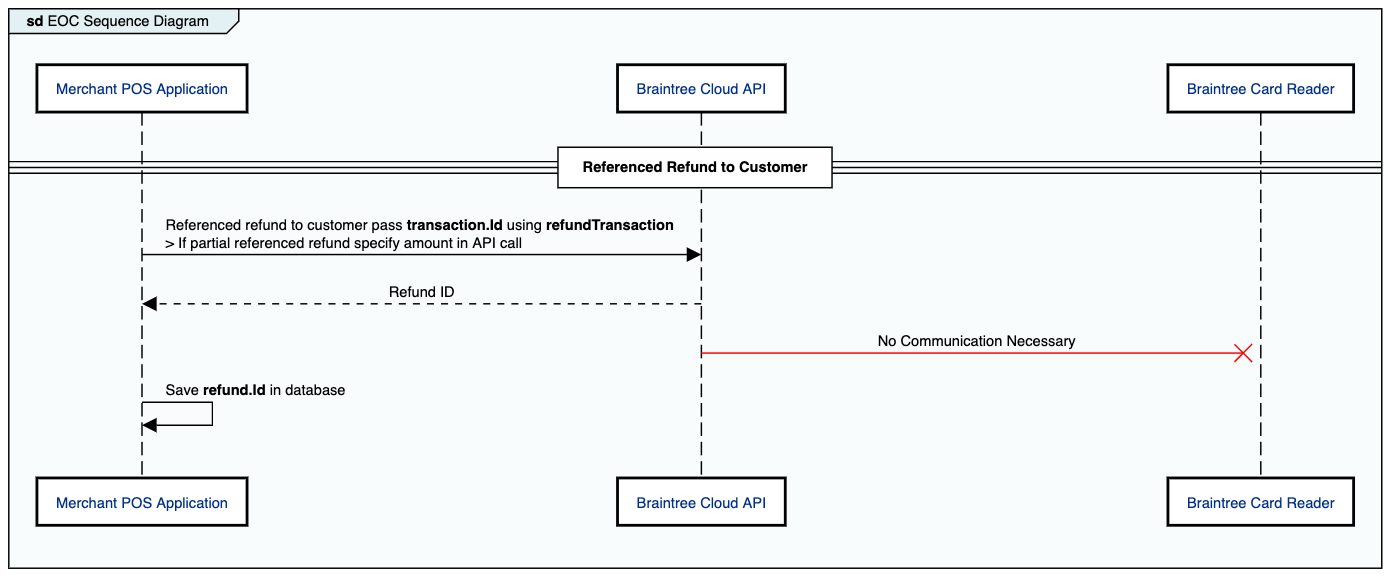

1) Performing a Referenced Refund:

To perform a referenced refund, you must have the

transactionId

from the authorization that you are attempting to refund against. This

results in a refund that is linked to the original authorization.

Typically, this is the preferred refund method as it allows for easy

accounting. It is important to note that referenced refunds can either be

in full or of a partial amount of the original authorization; however, the

refund amount can not exceed the full authorized amount.

- GraphQL Mutation

- GraphQL Variables

- Sample API Response

mutation refundTransaction($input: RefundTransactionInput!) {

refundTransaction(input: $input) {

refund {

id

amount {

value

}

orderId

status

refundedTransaction {

id

amount {

value

}

orderId

status

}

}

}

}Referenced Refund Example Sequence Diagram:

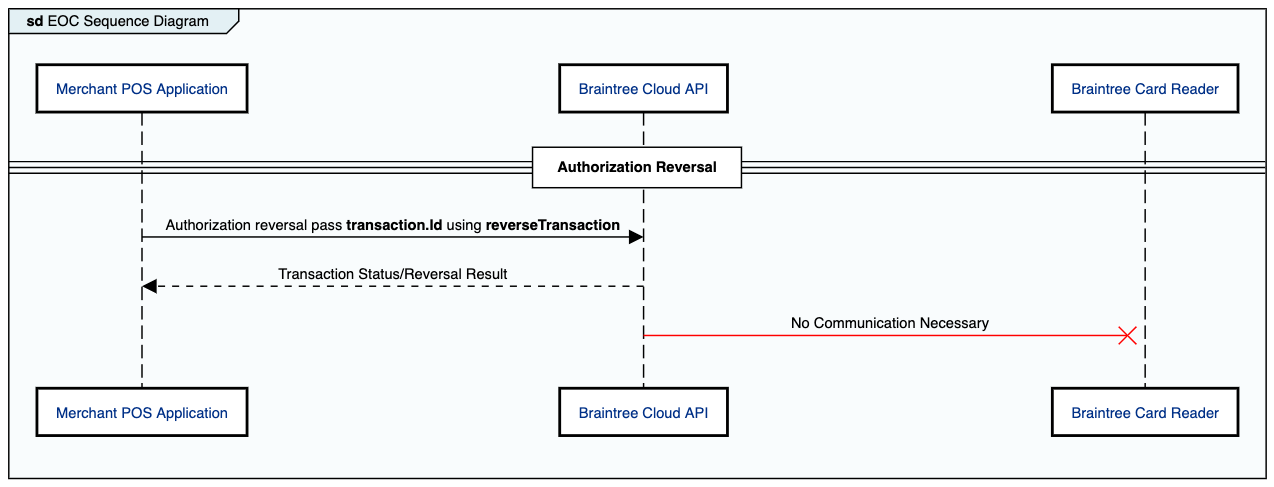

2) Using the Reversal API call

Sometimes, the POS might not know whether the original authorization has already been settled or not. In this scenario, it might be best to use a reversal call, which lets Braintree determine whether the transaction can be Voided or Refunded depending on the settlement status. For more details on how this works, follow this link and see the example below:

- GraphQL Mutation

- GraphQL Variables

- Sample API Response

mutation reverseTransaction($input: ReverseTransactionInput!) {

reverseTransaction(input: $input) {

reversal {

__typename

... on Transaction {

id

legacyId

orderId

status

statusHistory {

status

terminal

}

}

... on Refund {

id

legacyId

orderId

status

amount {

value

}

refundedTransaction {

id

amount {

value

}

orderId

status

}

}

}

}

}Reversal API Call Example Sequence Diagram:

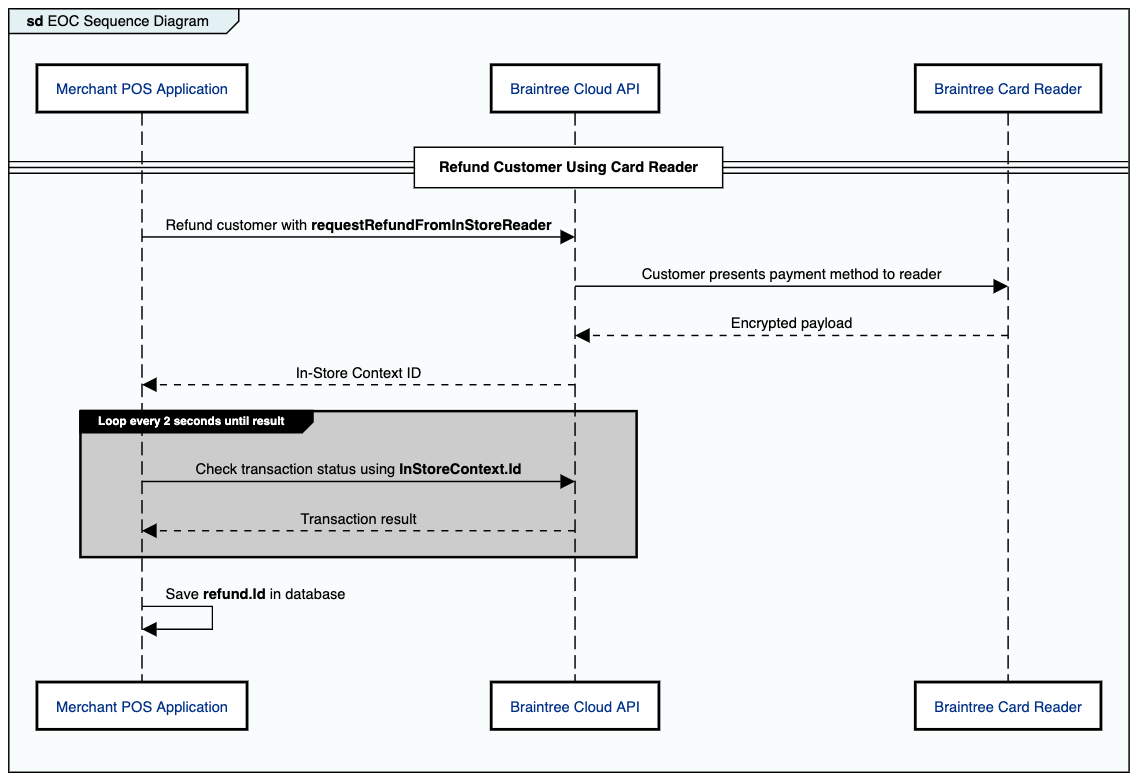

3) Performing an Unreferenced Refund or "Blind Credit":

To perform an unreferenced refund, your customer must be present at the time of refund, and a payment instrument must be presented to the card reader. The resulting refund will not be linked to the original authorization, so this is typically not the preferred way of refunding due to accounting reasons. Here are some of the common use cases below:

Refunds to customers without a receipt (when original order cannot be found)

Refunds to customers whose original authorization occurred while on your previous payment solution

Refunds to an alternate payment instrument or tender type

- GraphQL Mutation

- GraphQL Variables

- Sample API response

mutation RequestRefundFromInStoreReader($input: RequestRefundFromInStoreReaderInput!) {

requestRefundFromInStoreReader(input: $input) {

clientMutationId

inStoreContext {

id

status

reader {

id

name

status

}

}

}

}Once the refund is complete, you'll need to check the status of the context ID, similar to how this is done for a charge request. A status of "COMPLETE" indicates a successful refund.

- GraphQL Mutation

- GraphQL Variables

- Sample API Response

query ID($inStoreContextId: ID!) {

node(id: $inStoreContextId) {

... on InStoreContext {

id

status

reader {

id

name

status

}

transaction {

id

}

refund {

id

orderId

legacyId

status

paymentMethodSnapshot {

__typename

... on CreditCardDetails {

brandCode

bin

last4

expirationMonth

expirationYear

}

}

}

}

}

}Unreferenced Refund Example Sequence Diagram:

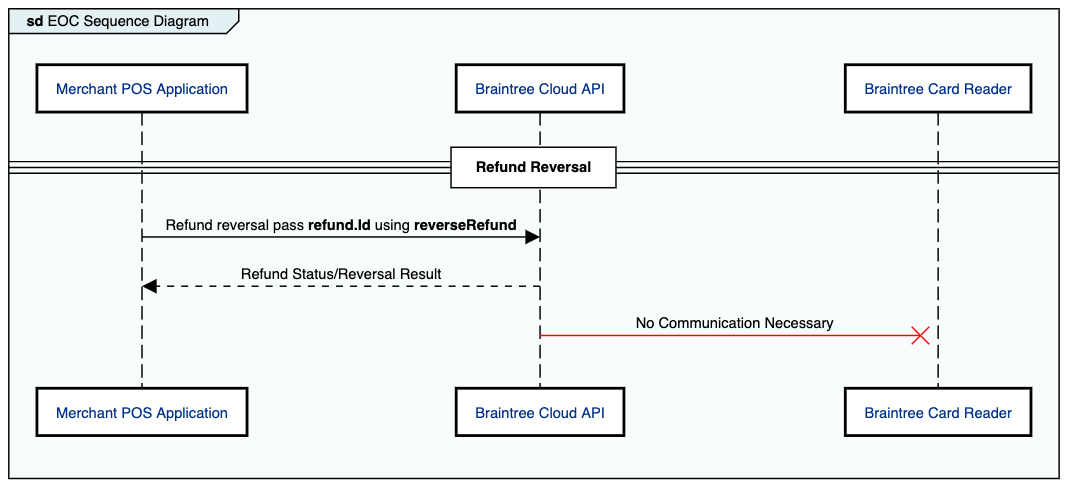

4) Reversing a Refund

If a refund was performed and you need to reverse that refund within the

acceptable reversal window, you can use the

reverseRefund

mutation. Keep in mind that you would need to have saved the

refundId

from the API response of the original refund attempt. See below example of

a refund reversal. You will notice that the

refundId

is a required variable input to perform the reversal.

- GraphQL Mutation

- GraphQL Variables

- Sample API Response

mutation reverseRefund($input: ReverseRefundInput!) {

reverseRefund(input: $input) {

refund {

... on Refund {

id

status

statusHistory {

status

terminal

}

}

... on Refund {

id

amount {

value

}

orderId

status

refundedTransaction {

id

amount {

value

}

orderId

status

}

}

}

}

}Refund Reversal Example Sequence Diagram:

5) Using Auth Adjustments for partial reversals

There may be some use cases where you want to perform a partial reversal

rather than fully reverse a payment. The example scenario is if a customer

wants to return a single item that was part of a larger purchase, and the

transaction may be in an authorized state (which would make a partial

refund not possible). In this scenario, you may use the

updateTransaction

API mutation to adjust the auth amount to the total purchase amount minus

the partial reversal amount.

Receipt Data Handling

To maintain EMV compliance you may need to add additional data elements to be displayed on the receipt you offer your customers. The table below highlights the data elements that are mandatory for EMV compliance and other data elements that are optional. Be sure to include the mandatory data elements listed in the "GraphQL API Field" column when you check the reader charge status so that you can parse them from the API response.

Data Element | Description | Mandatory vs. Optional | GraphQL API Field |

Merchant Name | The name of the merchant. | M | Transaction.merchantName |

Merchant Address Details | The address details of the merchant. | M | Transaction.merchantAddress |

Transaction Date and Time | The date and time of the transaction. | M | Transaction.createdAt |

Merchant ID (MID) | The unique reference of the merchant. | O | Transaction.merchantId |

Terminal ID (TID) | The unique reference of the terminal. | O | Transaction.paymentMethodSnapshot .origin.details.terminalId |

Transaction Number | The unique reference number of the transaction. | M | Transaction.legacyId |

Invoice Number | The unique reference number of the receipt. | M | Transaction.legacyId |

Card Type | The name of the card issuer. | M | Transaction.paymentMethodSnapshot. creditCard.brand |

Account Number | The account number printed on the card. All digits except for last 4 must be truncated. | M | Transaction.paymentMethodSnapshot. creditCard.last4 |

Application Preferred Name | The name of the application used to process the transaction (e.g. MasterCard). | M | Transaction.paymentMethodSnapshot .origin.details.applicationPreferredName |

Application Identifier | The unique reference number of the EMV application used for the transaction. | M | Transaction.paymentMethodSnapshot .origin.details.applicationIdentifier |

Approval Code | The authorization code received from the processor for the transaction. | M | Transaction.statusHistory[…]. processorResponse.authorizationId |

Authorization Mode | The authorizing entity (e.g. Issuer). | M | Transaction.paymentMethodSnapshot .origin.details.authorizationMode |

Transaction Kind | The type of the transaction (e.g. Sale/Refund). | M | Transaction.kind |

Card Entry Method | The method used to read the detail of the card (e.g. Chip). | M | Transaction.paymentMethodSnapshot .origin.details.inputMode |

Purchase Details | A brief description of the purchased goods or services along with their prices. | M | Transaction.lineItems* * - If not provided in the authorize/charge request, then these details must be provided by the merchant. |

Transaction Amount | The grand total amount for the transaction. | M | Transaction.amount.value |

Currency | If specified, the currency that the transaction was processed in. If no currency is identified on the receipt, the transaction is deemed to have taken place in the currency that is legal tender at the point of sale. | O | Transaction.amount.currencyCode |

PIN Verify Statement | The cardholder’s PIN verification status specific to the processed transaction (e.g. Verified). | M | Transaction.paymentMethodSnapshot .origin.details.pinVerified |

Return and Refund Policies | The terms and conditions for return and refund set forth by the merchant. | M | Merchant or POS generated message that indicates return policy |

The following are data elements that are mandatory for transactions that were declined:

Decline Code | The system generated decline code for the declined transaction. | M | Transaction.statusHistory[…] .processorResponse.legacyCode |

Decline Message | The merchant generated message for the respective decline code. | M | Merchant or POS generated message that reflects the decline code |

The following are data elements that are mandatory for transactions that were EMV chip declined:

Terminal Verification Results | A series of bits set by the terminal upon reading EMV card data, where each bit represents information about the transaction. This value is contained in the response EMV data under tag 95. | M | Transaction.statusHistory[…] .processorResponse.emvData |

Issuer Authentication Data | Issuer provided data received in response to an online authorization request to be delivered to the EMV chip card. This value is contained in the response EMV data under tag 91. | M | Transaction.statusHistory[…] .processorResponse.emvData |

Authorization Response Code | The 4-character code generated by the Issuer in response to an online authorization request that represents the authorization status of the transaction. This value is contained in the response EMV data under tag 8A. | M | Transaction.statusHistory[…] .processorResponse.emvData |

Manual Key Entry Transactions

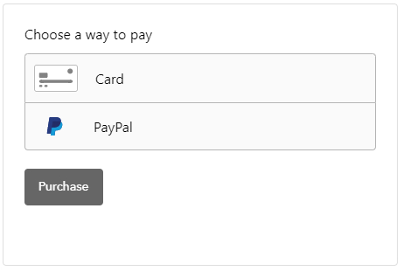

There are some use cases in which you may want to support the processing of a transaction without using the card reader by entering in the card details into another application UI. This could be for over-the-phone orders (MOTO) or as a manual key entry (MKE) fallback for when the card is not readable by the card reader, in which case you may want to enter the card details into the POS UI. To facilitate this while keeping your tech stack outside of PCI scope, we have a couple of solutions that can work for you.

1) Braintree Hosted Fields

The Braintree Hosted Fields enables you to render Braintree encrypted input fields in your application user interface. This allows for the manual key entry of card details directly into Braintree encrypted input fields. See how the Braintree Hosted Fields solution works.

2) Braintree Drop-in UI

The Braintree drop-in UI allows you to render Braintree encrypted forms in your application user interface. This would allow for the manual key entry of the card details directly into the Braintree Encrypted fields. The drop-in UI is a simple integration leveraging pre-built dynamic Braintree containers. See how the Braintree Drop-in UI solution works.

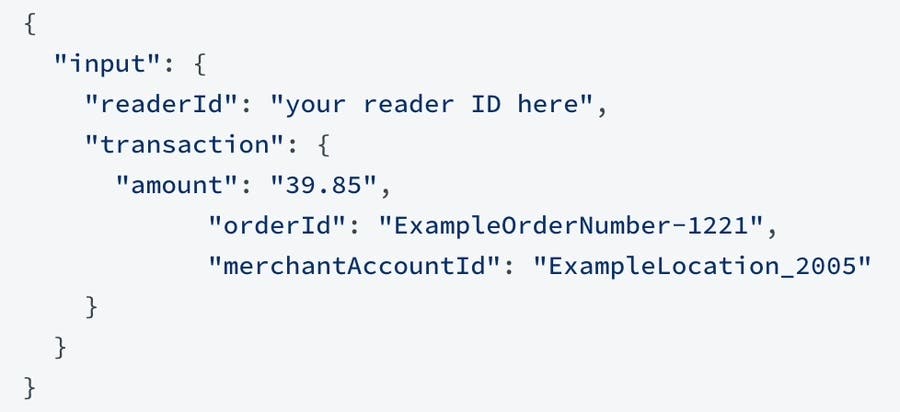

Important Tips for building out your charge/refund flows

Always make sure you are passing your Braintree Merchant Account ID (MAID) in your charge and refund requests. This should be added as an API variable, for example:

Use Idempotency Keys to prevent duplicate charges to your customers

Align your application with our recommended timeout logic

Make sure you are parsing key EMV receipt data from your API response to populate on your customer receipts for EMV compliance

Utilize the orderId API field to pass important data for reporting and reconciliation