Initiate a Card Present Authorization

This page covers the support of separate auth from capture on the Braintree In-Person solution from a card present perspective.

Feature Overview

For some use cases where a capture delay is required (ex: endless aisle, save the sale, tipping on receipt, hotel check-in), you may need to request an authorization rather than requesting a charge. This gives the API caller complete control over the authorization capture cadence rather than relying on automated Braintree capture logic. Generally, this operates similarly to e-commerce authorization flows, with some important differences.

Initializing the Reader for Authorization

When you're ready to charge a customer, you can create an In-Store Context

by requesting to authorize a card on the reader. In this step, your

application will specify at minimum, the

readerId

,

merchantAccountIdand

transaction.amount

details to initialize the reader for payment acceptance. Note that the

merchantAccountIdis not validated against in the Sandbox

environment; however, this is a required value in the Production

environment for all interactions with the card reader.

Authorizing is similar to charging, except that if the authorization is

successful, Braintree will NOT capture the transaction. It would be up to

the merchant to send a separate capture request using the

transaction.id

to complete the charge.

To provide idempotency on the

requestAuthorize

mutation, you must also include the HTTP header

Idempotency-Key with a unique value. UUIDv4 is recommended.

For example, if using

curl

to make the request, you would include

Idempotency-Key is an important way of preventing

duplicate charges to your customer in the event of an API

communication failure. For example: if you request a charge from

the reader, the customer completes the charge on the reader but

for some reason, the POS does not get back the result of the

transaction before timing out. In this scenario, the POS could

recover the original transaction using the same

Idempotency-Key without accidentally creating a

duplicate charge.

--header 'Idempotency-Key: 94c9ea8b-31b0-488e-a231-57e32f0bfd70'- GraphQL Mutation

- GraphQL Variables

- Sample API Response

mutation RequestAuthorizeFromInStoreReader($input: RequestAuthorizeFromInStoreReaderInput!) {

requestAuthorizeFromInStoreReader(input: $input) {

clientMutationId

id

status

reader {

id

name

status

}

}

}Checking the Reader Authorization Status

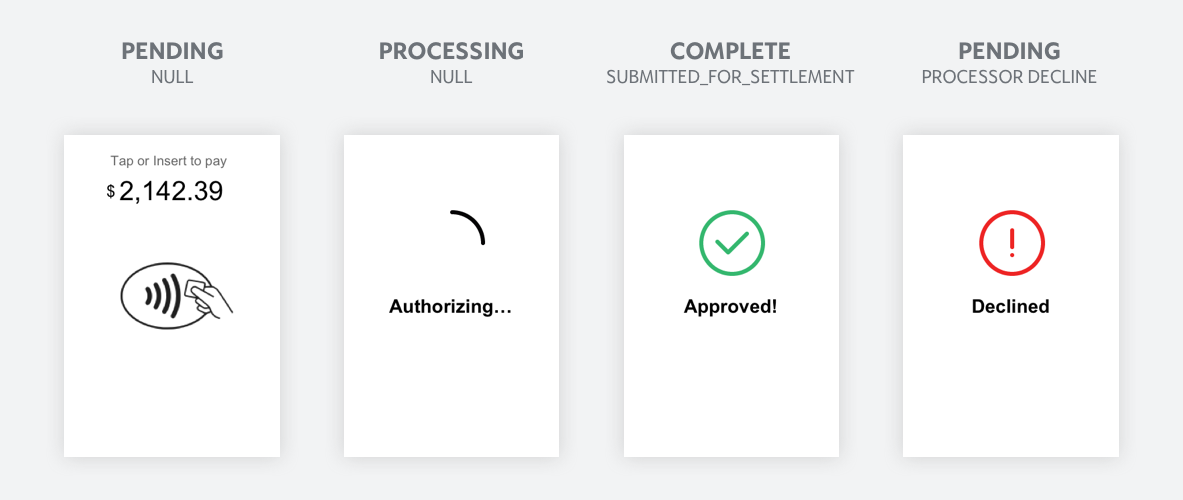

After the reader is initialized for payment, your application must wait

for the customer to interact with it (i.e. insert a test card) and for the

payment attempt to be processed. Your application should use

the node query

to poll on a 2-second interval between responses for the current status of

the payment using the

RequestChargeInStoreContext.id

received at charge initialization and monitor the

RequestAuthorizeInStoreContext.statusfield as the transaction

goes through the lifecycle.

When the

RequestAuthorizeInStoreContext.status

changes to "COMPLETE", you will also receive a transaction object

RequestAuthorizeInStoreContext.transactionin the response.

Save the completed

RequestAuthorizeInStoreContext.transaction.id

in your database for referencing the transaction in subsequent operations

(ie. capture, adjust auth, void, etc...).

All successful test transactions should have a transaction amount value below $2,000 for testing. For more info on using amounts to simulate various transaction outcomes, take a look at Testing Your Integration.

- Query

- Sample API response (successful auth)

{

node(id: "{{last_braintree_instore_context}}") {

... on RequestAuthorizeInStoreContext {

id

status

statusReason

reader {

id

name

status

}

transaction {

id

orderId

status

statusHistory {

... on PaymentStatusEvent {

status

timestamp

terminal

... on AuthorizedEvent {

authorizationExpiresAt

processorResponse {

authorizationId

emvData

message

legacyCode

retrievalReferenceNumber

}

}

... on GatewayRejectedEvent {

gatewayRejectionReason

}

... on FailedEvent {

processorResponse {

retrievalReferenceNumber

emvData

message

legacyCode

}

networkResponse {

message

code

}

}

... on ProcessorDeclinedEvent {

processorResponse {

legacyCode

message

authorizationId

additionalInformation

retrievalReferenceNumber

emvData

}

declineType

networkResponse {

code

message

}

}

}

}

merchantAddress {

company

streetAddress

addressLine1

extendedAddress

addressLine2

locality

adminArea2

region

adminArea1

postalCode

countryCode

phoneNumber

}

amount {

value

currencyIsoCode

}

merchantAccountId

merchantName

createdAt

channel

customFields {

name

value

}

paymentMethodSnapshot {

... on CreditCardDetails {

origin {

details {

... on EmvCardOriginDetails {

applicationPreferredName

applicationIdentifier

terminalId

inputMode

pinVerified

}

}

}

brandCode

last4

bin

expirationMonth

expirationYear

cardholderName

binData {

issuingBank

countryOfIssuance

prepaid

healthcare

debit

commercial

}

}

}

}

}

}

}Capturing funds against an Authorization

To capture the authorized funds, you must use the Capture Transaction mutation within a 24-hour window of the funds being authorized (except for eligible Lodging MCC codes, which have expiry windows of up to 30 days). For a card-present authorization, you are allowed only a single capture attempt. Any remaining authorized funds not captured after the initial capture request will be voided. You may capture a lesser amount than what was authorized or an amount up to the maximum over-capture threshold (subject to eligibility). For merchants processing on MCC codes ineligible for over-capture, the maximum amount allowed for capture is the amount authorized.

Example Capture request

- GraphQL Mutation

- GraphQL Variables

- Sample API Response

mutation CaptureTransaction($input: CaptureTransactionInput!) {

captureTransaction(input: $input) {

transaction {

id

status

}

}

}Using Incremental Authorizations

For some merchants, for example, those in the Hotels & Hospitality or some other industries, incremental authorizations (aka adjust auth) are an important feature for use cases such as tipping adjustment, hotel room damages, or hotel mini-bar charges, etc... This feature is subject to merchant eligibility based on MCC code, and it is also not supported for AMEX transactions and some other transaction types. This feature leverages the updateTransactionAmount API mutation with Braintree's GraphQL API.

Example Update Transaction Amount request

- GraphQL Mutation

- GraphQL Variables

- Sample API Response

mutation updateTransactionAmount($input: UpdateTransactionAmountInput!) {

updateTransactionAmount(input: $input) {

transaction {

id

status

customer{

email

firstName

lastName

id

}

}

}

}Using Estimated Auth (Pre-Auth)

Using an estimated authorization or a "pre-auth" can help avoid issuer

rejections and improve authorization rates for scenarios when you may not

know the final charge amount at the time of authorization. Some industries

where this may be common are hotels, vehicle rentals, bars, etc... It is

recommended that you use this feature if you are using incremental auth.

To trigger an estimated authorization you must pass the

paymentInitiator

flag with a value of "ESTIMATED". See example below:

- GraphQL Mutation

- GraphQL Variables

mutation RequestAuthorizeFromInStoreReader($input: RequestAuthorizeFromInStoreReaderInput!) {

requestAuthorizeFromInStoreReader(input: $input) {

clientMutationId

inStoreContext {

id

status

transaction {

id

orderId

status

customer{

id

}

paymentMethodSnapshot{

__typename

... on CreditCardDetails {

brandCode

bin

last4

cardholderName

expirationMonth

expirationYear

}

}

}

reader {

id

name

status

softwareVersion

}

}

}

}AMEX Over Capture Rules

MCC codes such as 4821 (Taxi Cabs and Rideshares) and 5812 (Restaurants) are allowed to capture up to 20% more than the authorized amount.

MCC codes such as 7011 (Lodging), 7512/7513/7519 (Vehicle Rentals), as well as Cruise Lines, Grocery merchants, and Retailers are allowed to capture up to 15% more than the authorized amount.

If you have a direct contract with AMEX, you may need to reach out to them to have them configure your account to allow for over-captures.

Important Tips When Integrating Separate Auth from Capture

Request Authorization is supported for offline transactions

Some MCC codes are allowed to capture more (aka over capture) than the authorized amount (typically used by restaurant merchants for tipping purposes)

Some MCC codes are allowed to use incremental authorizations (adjust auth) in order to incrementally increase the auth amount (typically used by Hotel & Hospitality merchants)

To enable over-captures or incremental authorizations, your Braintree account must be configured accordingly. Please work with your Solutions Engineer or Integration Engineer to facilitate this

Incremental Auth is not supported for AMEX transactions. For some use cases, you may need to perform an over-capture for an AMEX transaction

PayPal and Venmo QRC transactions are NOT supported for separate auth from capture

Passing of L2/L3 data is not supported in the authorization request; however, you may pass this data in the separate capture request