Managing Recurring Payments with Apple Pay Using PayPal

Nov 20, 2023

4 min read

Recurring payments have become an integral part of the modern digital economy, offering convenience and predictability for both consumers and businesses. Our previous post highlighted different methods of integrating Apple Pay® with PayPal. This blog explores recurring payments using PayPal and Apple Pay, showing how using it can streamline transactions and benefits end users.

How Recurring Payments with PayPal and Apple Pay Work

A recurring payment is an agreement between a buyer and a merchant. It allows the merchant to charge the buyer’s chosen payment instrument (typically a credit card) for a pre-approved amount at pre-approved intervals, which can be either fixed or variable.

Consumers visiting a merchant’s mobile website integrated with PayPal JS SDK and V3 Vault experience will find Apple Pay as one of the available payment methods for recurring payments. Once the consumer taps the Apple Pay button on the mobile website, the Apple Pay payment sheet is presented. This process mirrors the one-time Apple Pay experience for mobile web transactions.

The merchant’s website plays a crucial role in detailing the billing frequency and other terms of service. These details can also be reiterated on the payment sheet for added clarity. Recurring fees can take two forms: fixed amounts, such as monthly movie ticket subscriptions, or variable amounts like weekly grocery orders. The variability is subject to local authorizations.

Depending on the specific merchant use case, customers may be presented with line items that reiterate billing frequency, discounts, and any additional upfront fees on the consent screen. To ensure transparency, the final payment amount is prominently outlined on the total line, making customers fully aware of the charge they are authorizing.

The consumer can review the transaction details on the Apple Pay payment sheet. Once the consumer is ready, they authenticate using Face ID® or Touch ID®. When the transaction is complete, the consumer is shown the outcome before the payment sheet is dismissed, returning it to the merchant’s website.

Saving Token for Future Transactions

Merchants receive a persistent token, offering the flexibility to use it for immediate purchases or store it securely for future transactions. The choice depends on the merchant’s integration preferences.

When the merchant initiates an authorization request during customer order placement, successful authorization results in the secure storage of the Apple Pay instrument in the vault system. Payment indicators are utilized to ensure that critical factors like buyer authentication and card-on-file information are managed effectively, reducing the risk of rejected transactions.

Enhancing Transaction Security and Efficiency with Payment Indicators

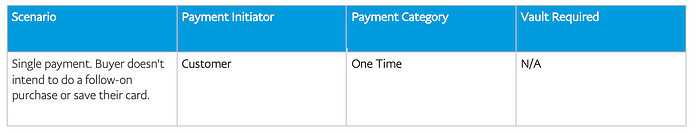

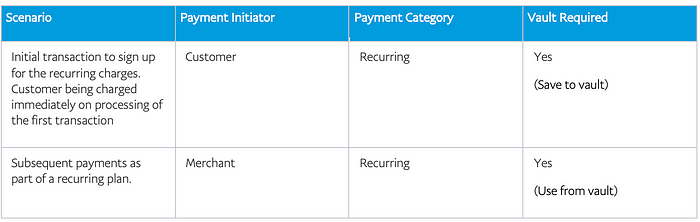

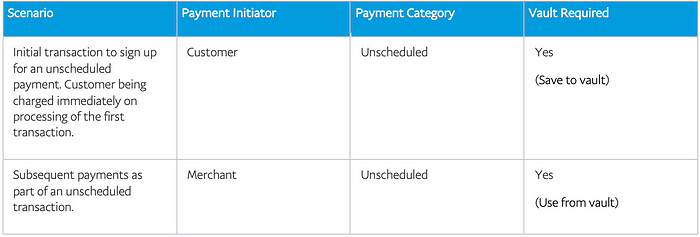

The payment indicators ensure that buyer authentication, card on file, and other factors are appropriately handled. The below tables show various use cases. Pass these payment indicators to avoid rejected transactions.

Use case 1. One-time transaction.

Use case 2. Recurring plan or subscription.

Use case 3. Unscheduled Payments.

Use case 3 is used for all recurring payments where the charges are not on a fixed interval. Additional documentation is available here.

Benefits of Recurring Payments with Apple Pay Using PayPal

Convenience: Customers can enjoy the ease of automated recurring payments, eliminating the need for manual transactions each time a payment is due.

Flexibility: Whether it’s fixed or variable recurring fees, this payment method adapts to various business models, allowing merchants to cater to a broader range of customers.

Transparency: Clear presentation of billing details on the consent screen ensures that customers know exactly what they’re paying for, promotes trust, and reduces disputes.

Secure Tokenization: Storing tokens for future transactions enhances security and simplifies subsequent purchases, offering peace of mind to both consumers and merchants.

Reduced Rejections: Effective management of payment indicators helps prevent transaction rejections, ensuring a seamless payment experience.

Conclusion

Handling recurring payments provides a win-win situation for both buyers and merchants. This payment method is poised to reshape the way we handle subscription services and recurring transactions.

Apple Pay, Face ID and Touch ID are registered trademarks of Apple Inc.

Recommended

Why You Should Attend PayPal’s Developer Meetup at Money20/20

4 min read

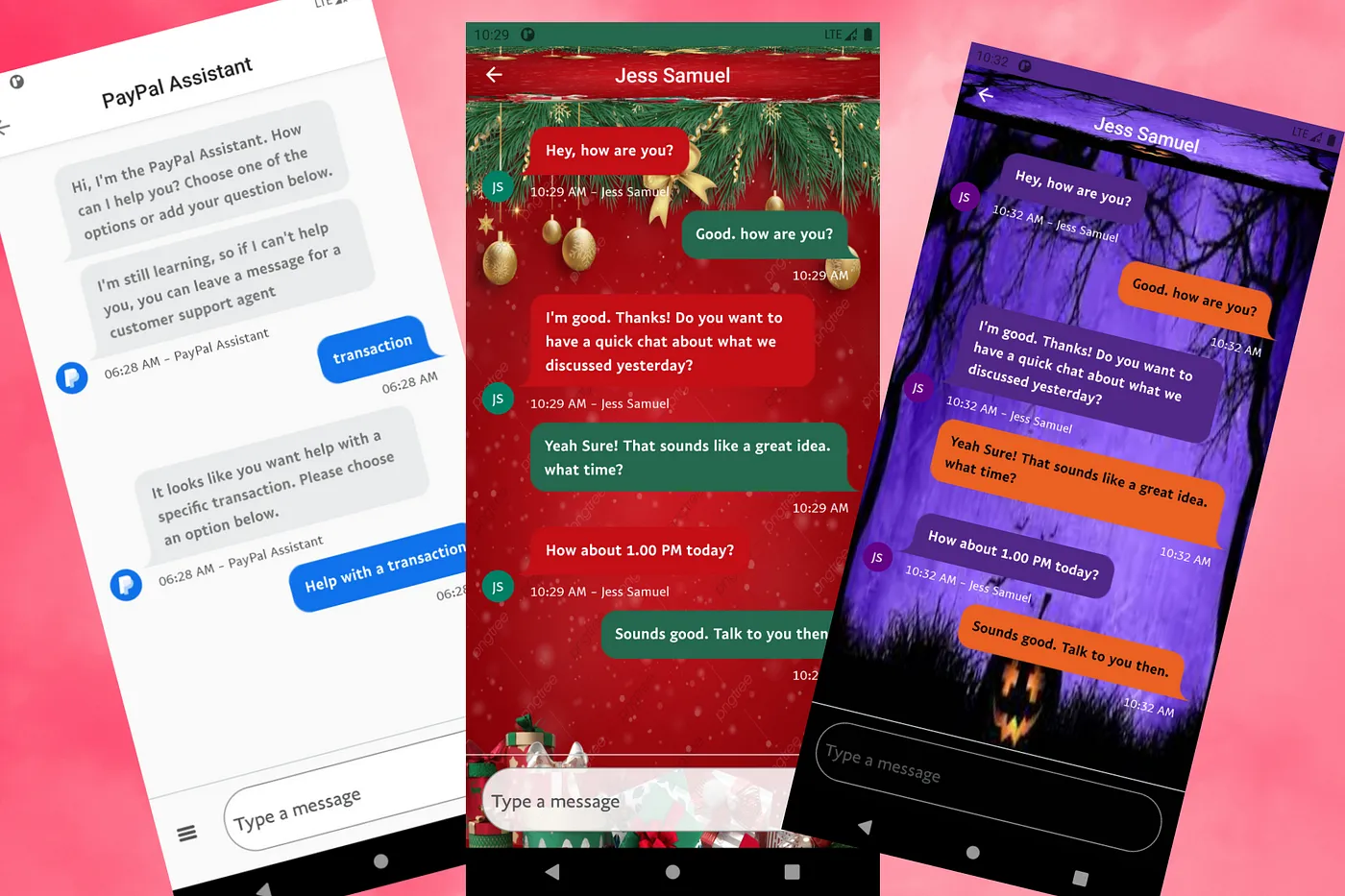

Building a Customizable Messaging Platform

10 min read