Pay by Bank for E-Commerce | Using Bank Accounts to Make Purchases with SMBs [SEPA]

Oct 08, 2024

5 min read

Starting in early 2025, PayPal will offer SEPA payments on the PayPal Complete Payments platform along with other payments options such as Apple Pay, google Pay, and Card Processing. With this launch, European small and medium sized businesses (SMBs) will now be able to offer pay-by-bank checkout options to their customers.

In this post, we’ll explore what SEPA is, how it works, and the benefits it can provide to SMBs.

What is SEPA?

SEPA, which stands for Single Euro Payments Area is an initiative of the European Union to simplify bank transfers in Europe. The goal of SEPA is to make cross-border payments in Euros as accessible and cost-effective as any domestic payment. It standardizes the format and processing of Euro transactions, ensuring consistency across both credit transfers and direct debits.

SEPA encompasses all EU member states, as well as countries including Norway, Switzerland, Iceland, and Monaco. SEPA is governed by the European Payments Council and the European Central Bank, both responsible for the maintenance, administration, and oversight of the SEPA initiative.

SEPA Direct Debits are a common choice of payment method for recurring transactions such as utility bills or subscriptions. It has seen extensive adoption across the SEPA region and has become prominent for payments across: e-commerce, rental payments, and alternative recurring payments (such as gym memberships, bill payments, or loan payments).

How does SEPA work?

SEPA transactions use IBAN (International Bank Account Number) and BIC (Business Identifier Code) for identifying and verifying bank accounts and institutions. Generally, a customer will authorize a SEPA Direct Debit from their account to pay a business (either in their own or another SEPA country). This mandate will include details such as payment amount and frequency.

The customer’s bank will verify the payment details, which includes the IBAN and BIC information.

From here, the payment is processed through the SEPA network and transferred to the recipient’s bank account. Funds are generally available within one to two business days.

Understanding SEPA Mandates

SEPA mandates are an essential component of the SEPA Direct Debit system. A SEPA mandate is a formal authorization given by a payer (customer) to a payee (business) to collect funds from their bank account. This mandate authorizes the payer’s bank to process these payments in accordance with the payee’s instructions. Signed mandates generally include important payment information such as the unique reference, buyer and seller identifiers, payment amount, payment type, and signature and date.

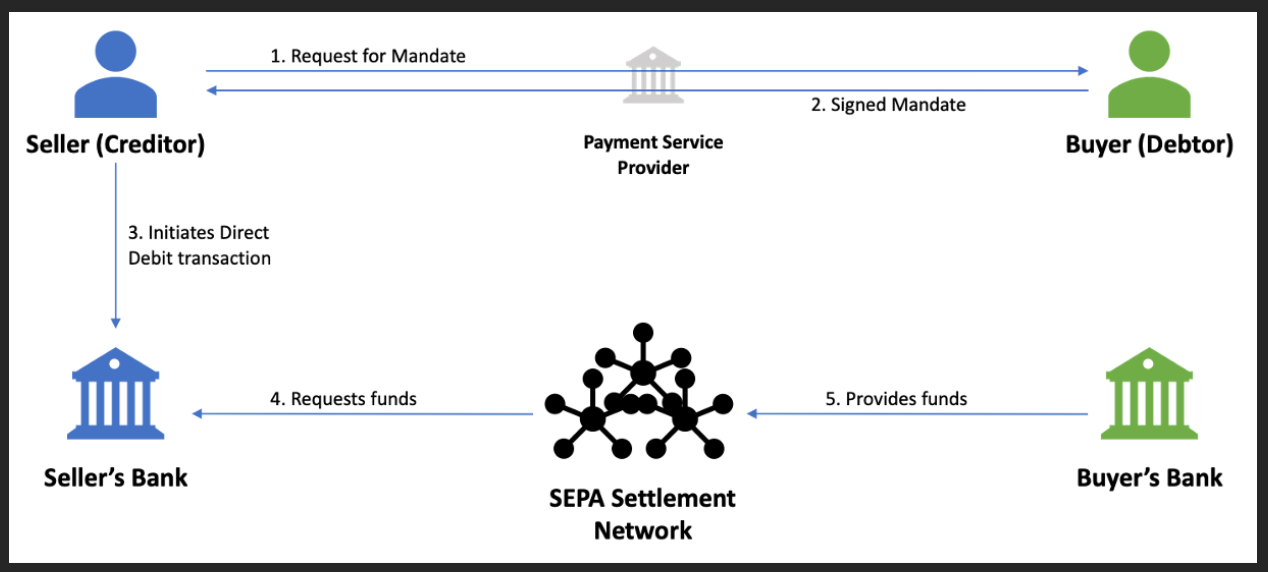

With SEPA mandates, the creditor or seller requests a signed mandate from the debtor or buyer before initiating the debit. Once the signed mandate is returned by the buyer, the creditor initiates a debit request based on the mandate and sends payment instructions to the bank, which are then forwarded to the debtor’s bank. The debtor’s bank will debit the specified amount and credit the creditor’s account.

Benefits of SEPA for SMBs

1. Reduced Transaction Costs

One of the most significant advantages of SEPA is the reduction in transaction costs for cross-border payments. Prior to SEPA, international transfers within Europe were often subject to high fees and longer processing times. With SEPA, these costs are significantly reduced, making it more affordable for SMBs to engage in cross-border trade.

2. Faster Payment Processing

SEPA enables faster payment processing times for Euro transactions across participating countries. Typically, SEPA Credit Transfers are completed within one business day, provided that the transfer is initiated before the cut-off time on a business day. This speed can help SMBs enhance cash flow management and ensure timely payments to suppliers and employees.

3. Enhanced Transparency and Security

SEPA provides increased transparency and security for electronic payments. The standardized processes include strict regulations and monitoring to prevent fraud and ensure compliance with anti-money laundering (AML) and counter-terrorist financing (CTF) measures. SMBs can benefit from this robust security framework, knowing that their transactions are protected, and they are meeting regulatory requirements.

4. Improved Access to International Markets

For SMBs looking to expand their reach across Europe, SEPA offers a straightforward way to engage with cross-border customers in SEPA supported countries and territories. By reducing the complexities and costs associated with international payments, SEPA makes it easier for small businesses to enter new markets within Europe, establish and attract customers from different countries.

5. Support for E-commerce Growth

The rise of e-commerce has opened new opportunities for SMBs to sell products and services online. SEPA facilitates seamless Euro transactions, which is particularly beneficial for e-commerce businesses targeting customers across Europe. With SEPA, online businesses can offer consistent payment experiences to their European customers.

Conclusion

In summary, SEPA payments can offer a nice competitive benefit for SMBs looking to reduce their costs while offering alternate payment methods to their customers. The SEPA network’s broad reach throughout Europe, coupled with its highly secured and well-regulated nature makes it an attractive payment method – especially for large and/or recurring transactions.

Keep an eye on this space for more on the launch of SEPA payments on the PayPal Complete Payments platform. To explore all of PayPal’s current payment offerings, visit https://developer.paypal.com/home/ to get started.

Recommended

Developer Day for Fastlane by PayPal: A Masterclass of Innovation

5 min read

PayPal Dev Days 2025: Building Smarter Commerce

5 min read