PayPal Provisioning Platform

Last updated: Apr 14th, 11:33am

PayPal Provisioning Platform is a limited-release solution available only to select partners at this time. For more information, reach out to your PayPal account manager.

How it works

The PayPal Provisioning Platform (P3) is a collection of proprietary PayPal APIs that power the Account Linking experience. This feature lets customers add their funding instruments to their PayPal Wallet using credentials or biometrics, eliminating the need for manual entry. P3 enables financial institutions to provision customers' financial instruments into their PayPal Wallet to ensure the data stays updated.

Account linking

Account linking helps our bank partners capture a higher share of customer spending on PayPal. This feature assists customers in adding their funding instruments to our PayPal Wallet and setting them as their preferred way to pay during the experience.

With the customer's consent, P3 helps partners to:

- Partner with PayPal and allow customers to seamlessly link their financial instruments similar to credit cards, debit cards, and associated rewards into their PayPal wallet.

- Help provide incentive and choice information to customers to help them select a financial instrument at checkout.

- Add the related card art to the financial instruments linked to the customer's wallet.

- Set up lifecycle updates to ensure the data linked to PayPal remains current after provisioning.

P3 can be integrated through any one of the user flows using APIs.

Additional details

To launch account linking for your customers, you will need to integrate with our P3 APIs. The number and complexity of these APIs will depend on the specific experience you choose to provide. The initial experience that you launch is referred to as the MVP, while any subsequent enhancements are considered fast follow-on work. The overall timing for integration may vary based on the MVP experiences and other influencing factors.

P3 is designed to provide you with flexibility by allowing you to choose the features you want to include in your Minimal Viable Product (MVP) and future phases for your customers. We categorize P3 features into 2 groups:

- Core features: These are the basic features available out-of-the-box, included with our core integration.

- Optional add-ons: These features require additional work beyond the core integration, such as extra APIs or other components.

Push-pull provisioning

The two primary options for integrating our services are push provisioning and pull provisioning.

Push provisioning helps your customers initiate the account linking process directly from your web or mobile app. This can be done from various locations such as your homepage, account page, digital wallet, or any other screens you choose. It's up to your discretion where you want this feature to be available. Additionally, your PayPal partner manager can provide best practice examples. If customers do not have a PayPal account, they can sign up during the push provisioning process.

Pull provisioning helps customers start the account linking flow from PayPal's digital properties, which is currently limited to the PayPal Wallet screen.

User flows

There are 2 user flows available to integrate with P3. Financial institutions can integrate P3 and provide their customers with a process that begins on the partner site or within the PayPal Wallet.

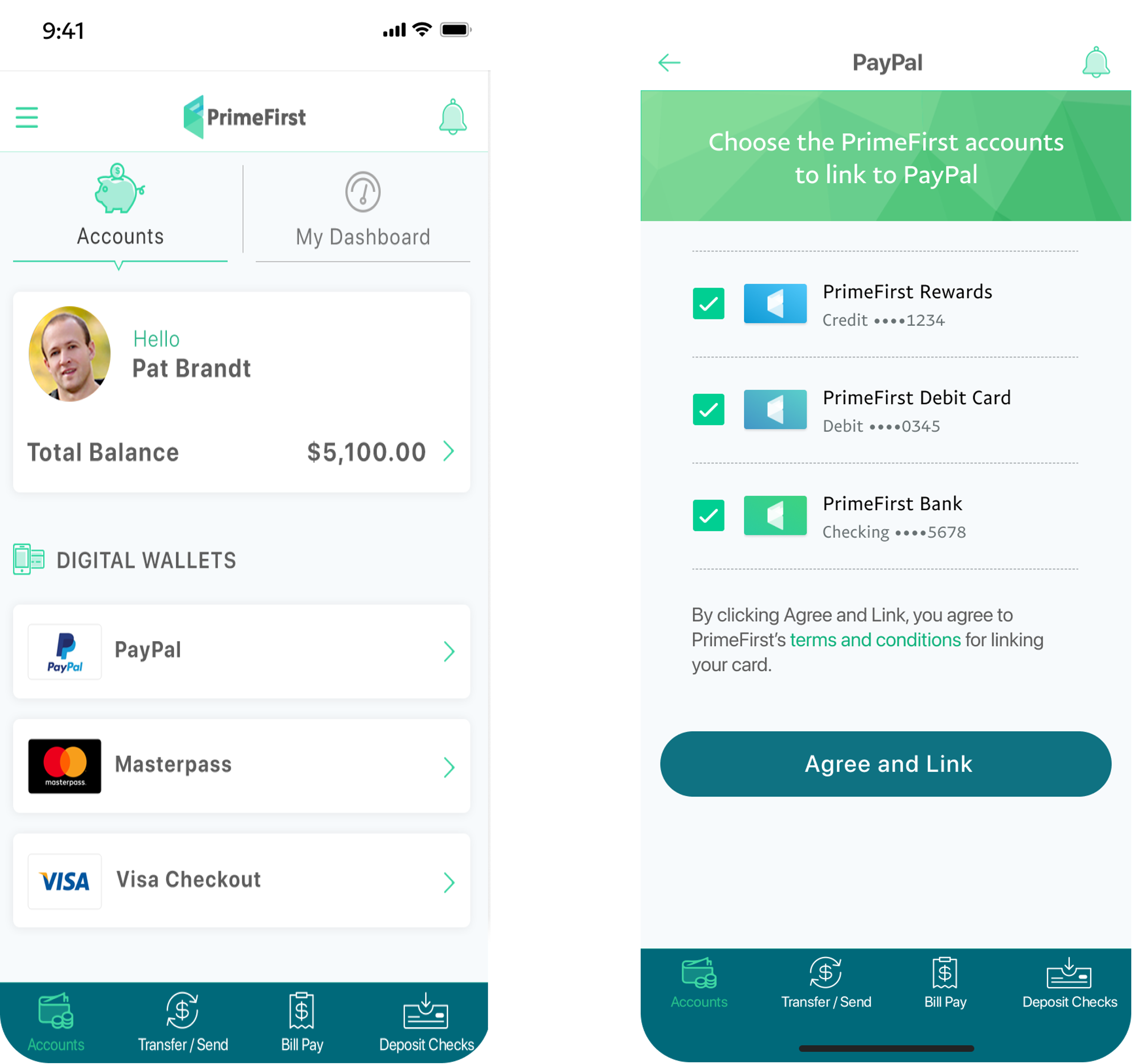

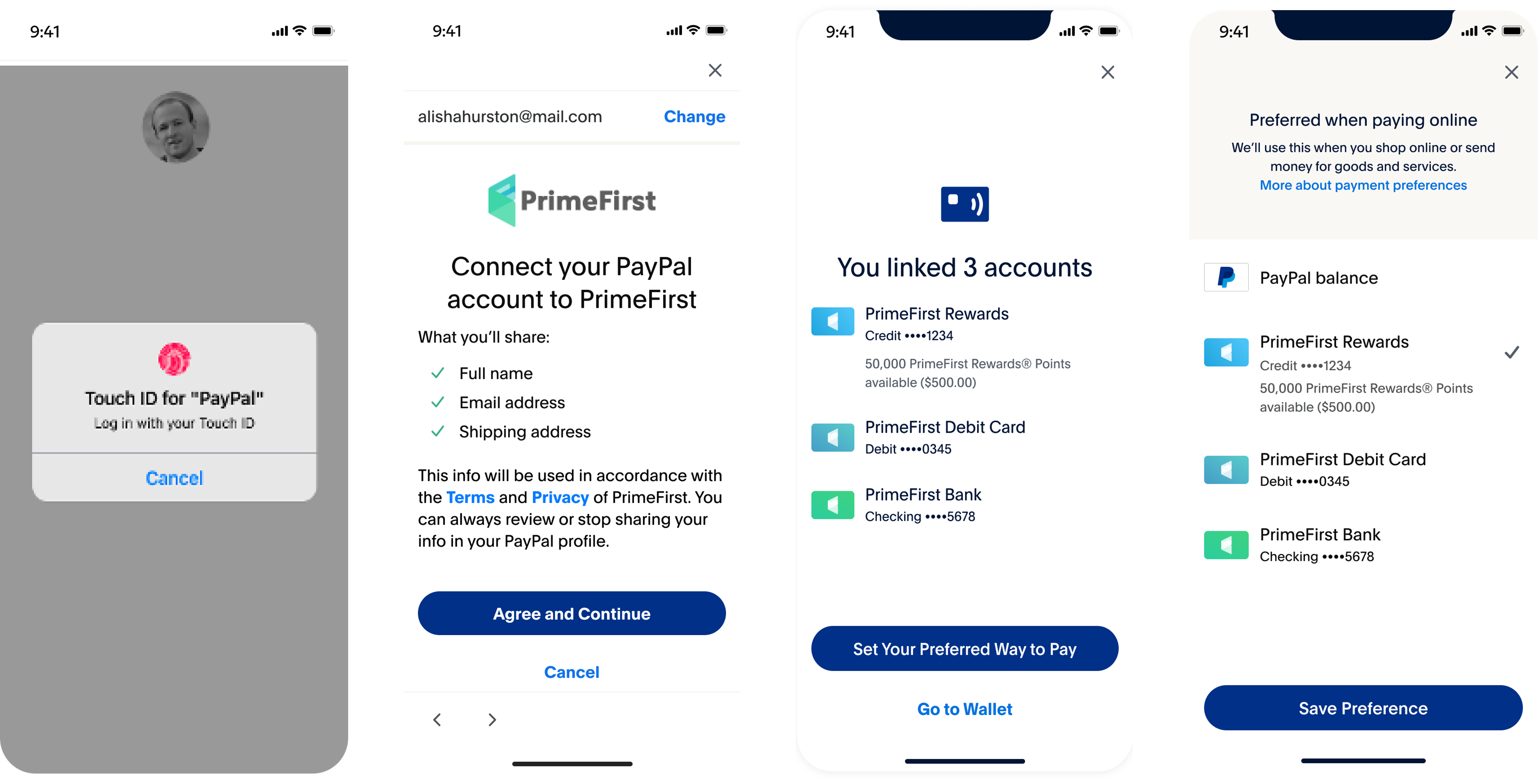

User starts from partner website

The following sample screens show the sequence when the user starts from the partner app or site and PayPal's system recognizes the email address or mobile phone number provided:

-

The user logs into the partner app and links payment methods from their bank for purchases.

- When redirected from the partner app to the PayPal app or site, the user is authenticated. Users can choose to link and select their preferred default payment method.

- After saving and submitting the selections within the PayPal app, the user is redirected to the partner site or app.

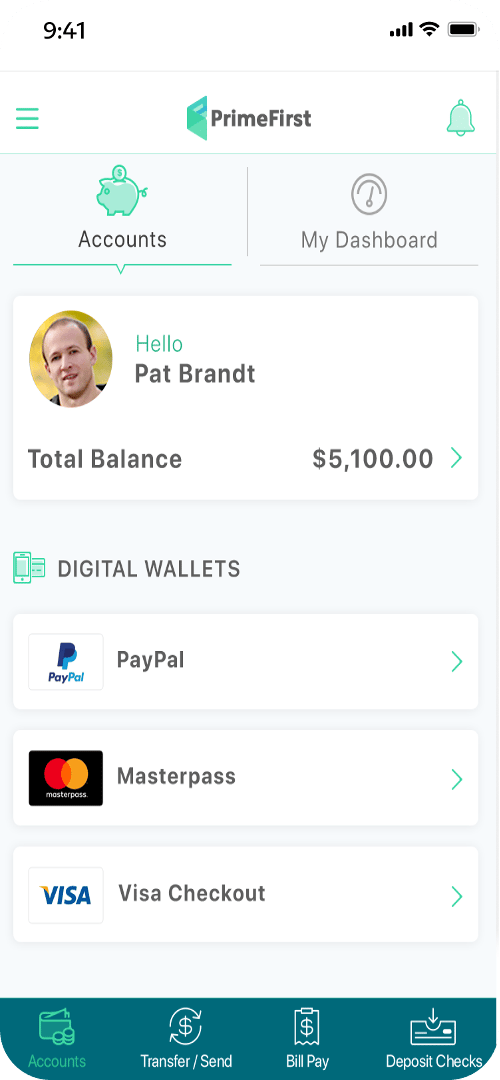

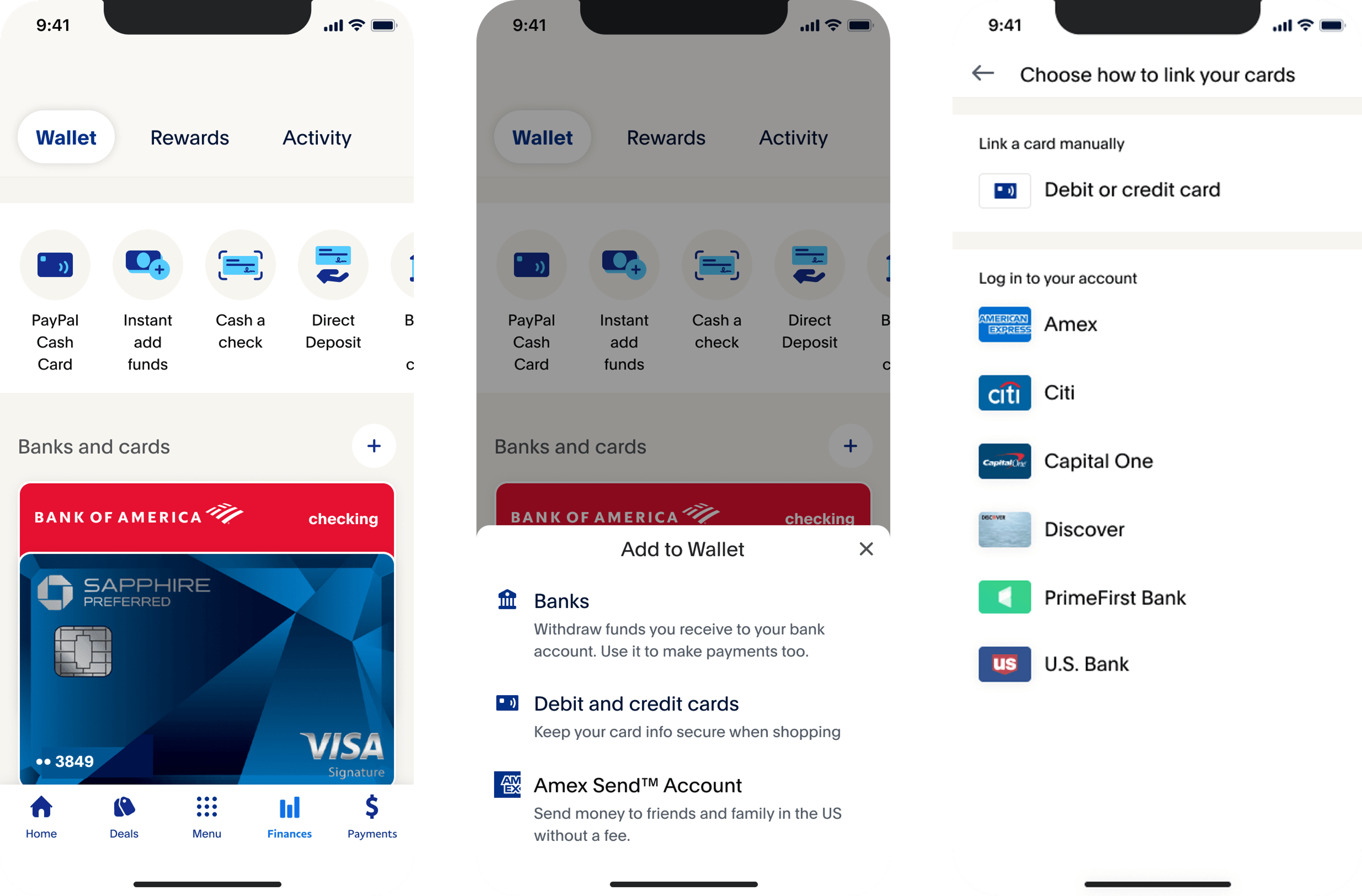

User starts from PayPal

The following sample screens show the sequence when the user starts from PayPal.

- The user logs into the PayPal app and selects the financial institutions to initiate linking.

- After the user selects Agree and Continue, the user is redirected to the partner site or app.

- The user logs into the partner app and selects the financial instruments to link to their PayPal Wallet.

- The PayPal app will display a success message that lists linked payment methods, and users save their preferred default payment method. The user will return to the PayPal site or app.

APIs

When you want to initiate linking from your website or app, you have 2 different integration options available. You can either make separate API calls to onboard the account information and then add the card data, or you can combine both the account information and card data into a single API call.

The two APIs associated with P3 are Consumer Referrals API and Instrument Linking API.