Platform Payouts

DOCS

Last updated: Sept 23rd, 6:49pm

Send money immediately to multiple recipients in 96 countries and 24 currencies using only their email, phone number, or payer ID.

How it works

Payouts make it easy for recipients to claim their money using either PayPal or Venmo:

- If they already have a PayPal or Venmo account, an email or mobile notification will prompt them to log in to their account to get payment details.

- If they don't have a PayPal or Venmo account, an email or mobile notification will prompt them to open a PayPal or Venmo account to claim their money.

Note: Venmo notifications require a U.S. mobile number and are mobile only.

Models

| Model | Description | Depiction |

|---|---|---|

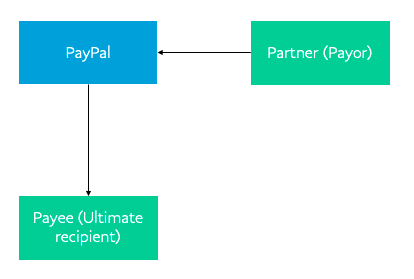

| Direct | In the direct model, partner integrated with PayPal is the sender of payouts. |  |

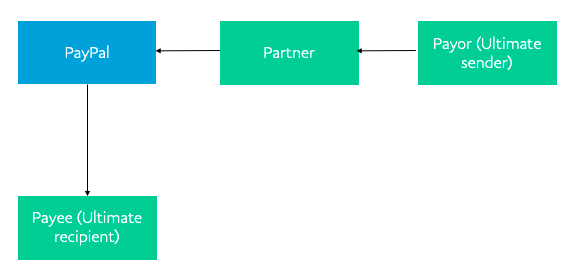

| Third Party | In the third party model, partner integrated with PayPal acts as the payouts facilitator and their customer is the sender (also referred to as the ultimate sender) of payouts. |  |

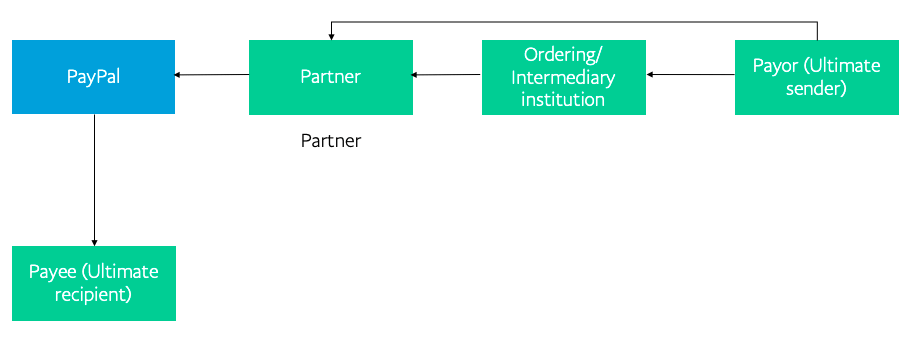

| Fourth Party | In the fourth party model, partner integrated with PayPal acts as the payouts facilitator and their customer's customer is the sender (also referred to as the ultimate sender) of payouts. The partner's customer would be acting as the third party in this model. |  |

Workflow

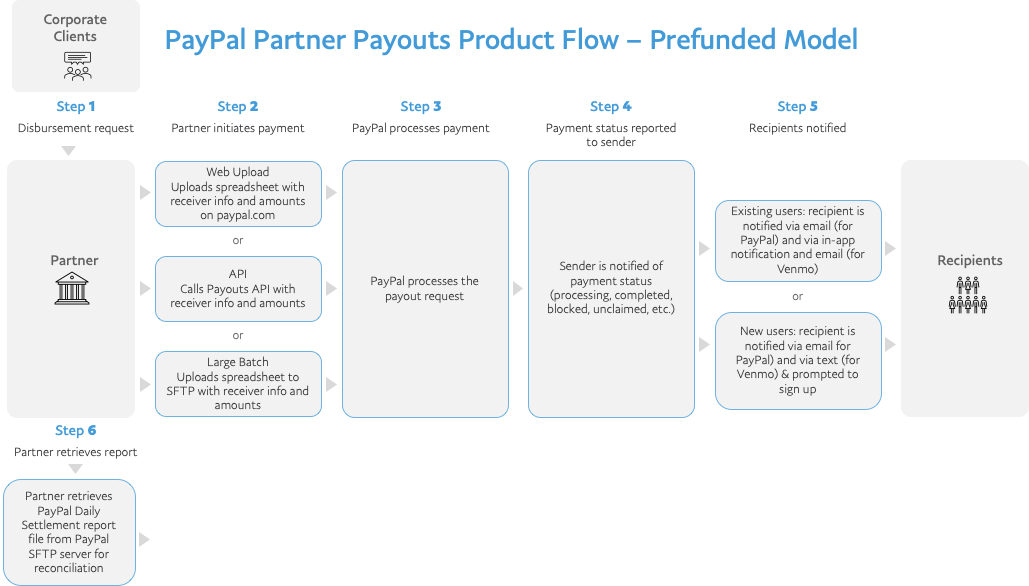

- The Payouts flow begins when a payout request is initiated. In the 3rd party and 4th party use cases, the details of the ultimate sender and any intermediary institutions involved will also need to be sent.

- The Payouts API validates the request and processes the payout.

- Payouts sends the client a status report.

- Payouts notifies the recipient that a payment is available. The recipient logs in to their PayPal or Venmo account, or creates a PayPal or Venmo account, to claim their money.

- In the partner use case, a settlement report is also sent at the end of the day for the payouts processed.

Supported capabilities

Payouts is global, secure, flexible, and easy for recipients and includes these features:

- Transaction types— B2B and B2C transactions only. No P2P support.

- Currency conversion— Send payments in another currency even if you don't maintain a balance in that currency.

- Detailed records— Your complete payout history is available online, and you'll receive a notification when your payments are sent. You can download transaction details into your accounting tools.

- Easy for recipients— Receiving a payout is as easy as opening an email or mobile notification.

- Global reach— Payouts works in over 180 countries and complies with KYC regulations.

- Reduced risk— PayPal's risk and compliance controls help protect you from fraud.

- Use customers' preferred digital wallets— Send payments to PayPal or Venmo recipients (Venmo in US only).

- Payouts facilitation— Allows partners to facilitate payouts on behalf of their customer or their local bank partner's customers also known as third party and fourth party models respectively.

Country availability

Payouts is supported in all countries where PayPal operates except below:

-

China

-

India

-

Turkey

-

Monaco

Note: China Domestic (CN) is not supported. China cross border (C2) is.

For more information, see Country support and Currency support.