Master QuickBooks Online Integration with PayPal for Seamless Payment Processing

Dec 26, 2024

7 min read

QuickBooks Online is a leading accounting software developed by Intuit that allows businesses to track income, manage expenses, and stay tax-ready. Proper integration of QuickBooks with PayPal is crucial to ensure smooth data flow between platforms, enabling businesses to operate efficiently. This post will explore the benefits of integrating QuickBooks Online with PayPal Connector and provide a step-by-step walkthrough.

What is QuickBooks Online Integration?

For developers, integrating QuickBooks Online with PayPal involves using the app to enable these systems to communicate. After connecting, the data from PayPal payments, including the payment amount, customer details, and fees, is synced to QuickBooks in real-time or at set intervals. This streamlines the accounting process, reducing errors, saving time, and improving the overall efficiency of business operations.

Suppose you are a developer working for a merchant. This integration allows you to automate the data flow from the merchant's payment gateway (PayPal) into their QuickBooks Online accounting system.

Why integrate QuickBooks Online?

The PayPal Connector by QuickBooks simplifies the process of accepting payments online. It allows businesses to accept credit cards, debit cards, and PayPal payments, all while accessing reduced card payment fees. Beyond payment processing, integrating PayPal with QuickBooks Online links two critical business systems, automatically syncing financial data for more efficient accounting and reporting.

Getting Started with QuickBooks Online Integration

There are a few ways to integrate PayPal standard checkout with QuickBooks Online:

Step 1:

As a first step, users must create an account in the Intuit Developer Portal. Once an account is created, the QuickBooks Online company provides a Sandbox account on developer.intuit.com that can be used for development and testing.

Step 2:

Next, create an app within your developer account. This will provide you with a client ID and client secret, necessary to connect your app to a QuickBooks company (either sandbox or production) and obtain OAuth tokens. You can find these client keys under the "Keys & OAuth" section of your app.

Step 3:

The next step is to use the client keys to generate OAuth tokens. You can accomplish this through the OAuth Playground or programmatically using one of the available SDKs. After generating the tokens, you can access the API and sync data between your app and QuickBooks. Be sure to save both the access and refresh tokens, as the access token expires after 60 minutes. You will need the refresh token to obtain new access tokens when needed. Additional information is available here.

Use cases:

The core integration features of QuickBooks Online can be applied to various use cases that benefit businesses in different ways. These use cases demonstrate how QuickBooks Online integration can streamline financial management and boost operational efficiency across different industries:

1. Synchronized Data transfer:

QuickBooks Online helps seamless data transfer between systems, syncing critical information such as customer details, invoices, payments, and inventory. This integration ensures data remains consistent across platforms, providing real-time updates and accurate records. For example, when a customer makes a payment through PayPal, the transaction is automatically reflected in QuickBooks, reducing manual input and improving financial accuracy.

2. Automate Tasks:

Developers can automate repetitive tasks such as data entry, invoice creation, and reconciliation with integration. This saves time and minimizes human error, ensuring greater accuracy in financial reporting. For instance, by syncing payments and invoices automatically, businesses can eliminate the need for manually matching records and reconciling accounts, leading to more efficient workflows and reduced administrative overhead.

3. Enhance Business Intelligence:

Integrated data from QuickBooks can be leveraged for better decision-making and financial analysis. With real-time access to synchronized data, businesses can generate insightful reports and forecasts. For example, a business owner can track cash flow trends, monitor outstanding invoices, and analyze customer payment behaviors, enabling more informed financial strategies and growth-oriented decisions.

Benefits of using QuickBooks for ecommerce

Key benefits identified after integrating PayPal with QuickBooks Online:

- Efficient order management: Integrating PayPal with QuickBooks streamlines order management by automatically syncing transactions and payments, reducing time for manual updates, and ensuring invoices are accurate and current.

- Inventory tracking: Integration helps in real-time inventory tracking, as sales made through PayPal are reflected in QuickBooks, as a result maintaining accurate stock levels and better managing inventory costs.

- Streamlined Accounting: All payment data flowed automatically into QuickBooks invoices for easy reconciliation.

- Real-Time Data Access: Syncing every 5 minutes helps users log into QuickBooks to view updated financials in real-time.

- Increased Accuracy: Automatic sync eliminated manual errors that threw off financial reporting.

- Time Savings: Users can save up to 5+ hours weekly by removing manual data entry.

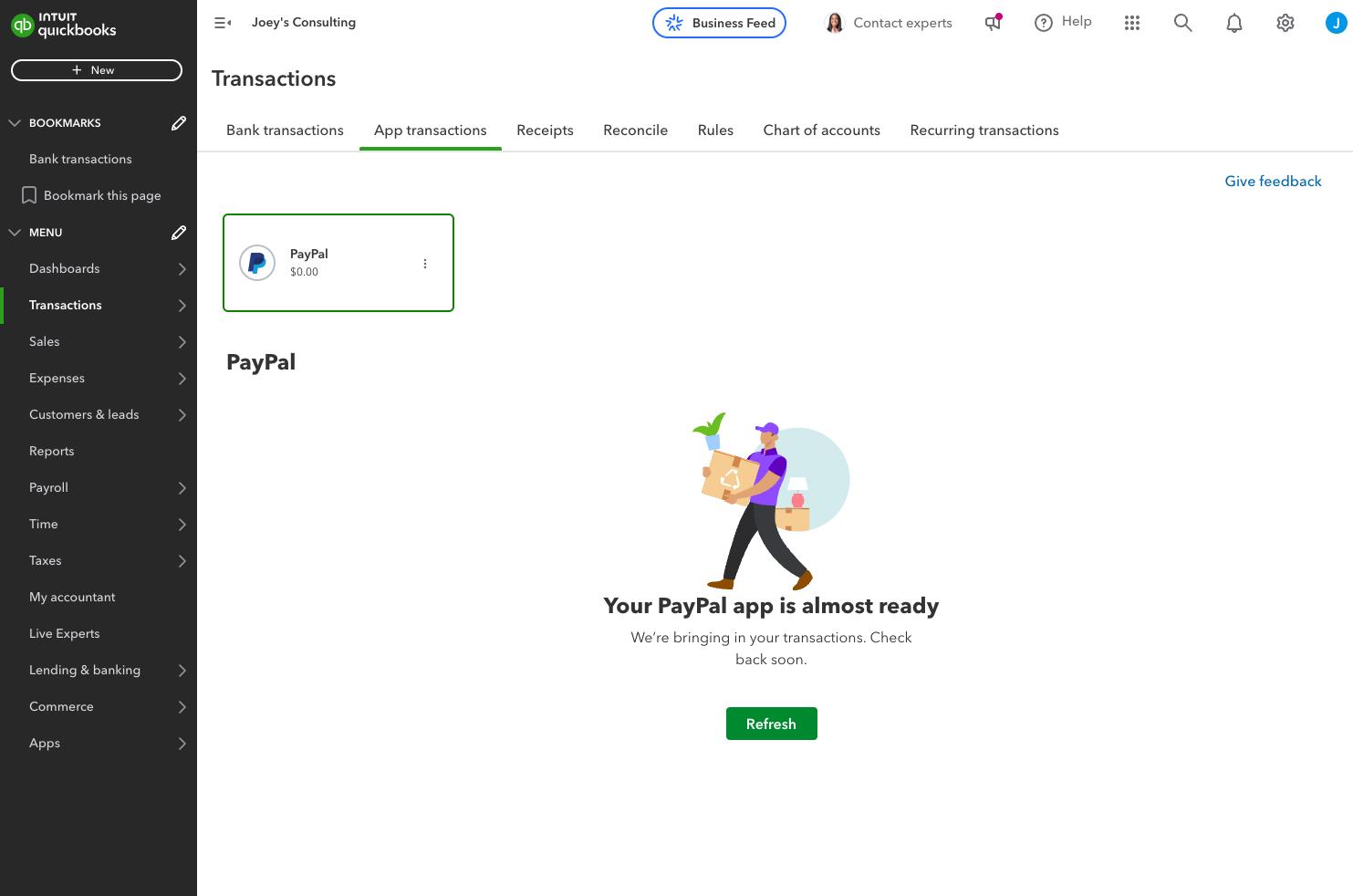

How to integrate QuickBooks Online with PayPal Connector

With just 3 easy steps, you can integrate QuickBooks Online with your PayPal account:

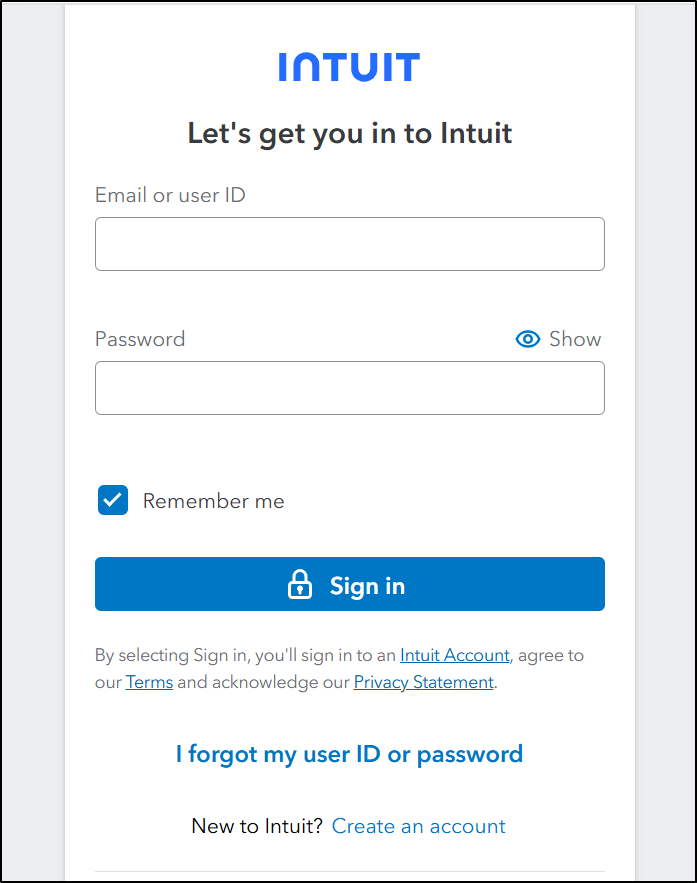

Step 1:

Log in or sign up for QuickBooks Online. Install the "Accept Card Payments with PayPal" app from the QuickBooks App Store. If you use an older version of the PayPal app, upgrade to the latest version for enhanced functionality.

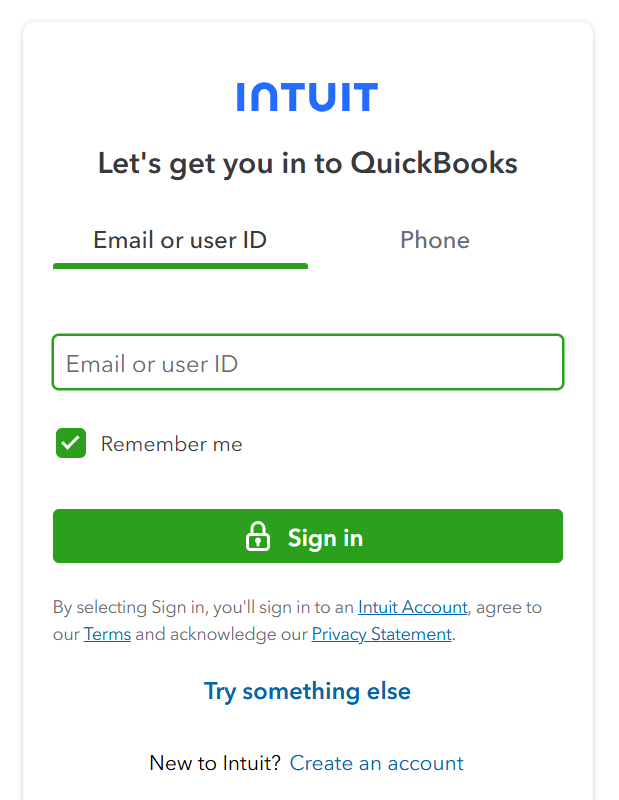

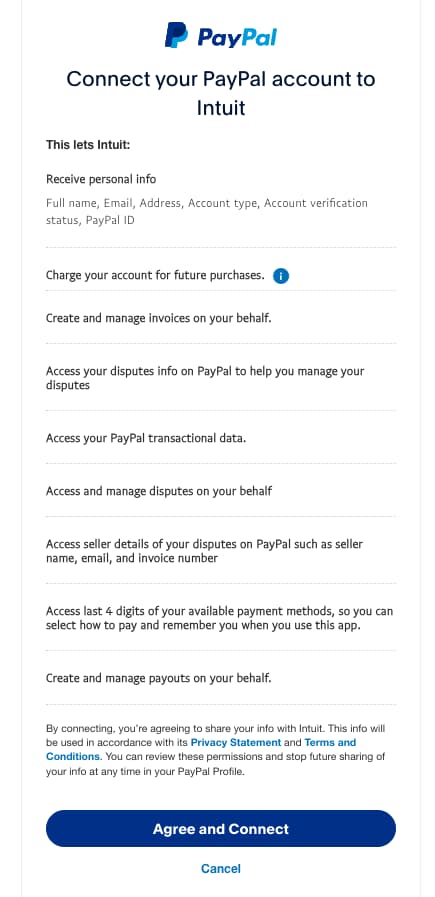

Step 2:

Connect your PayPal account to QuickBooks. During this step, grant the necessary permissions for QuickBooks to access your PayPal account, and confirm the connection via the email confirmation you receive.

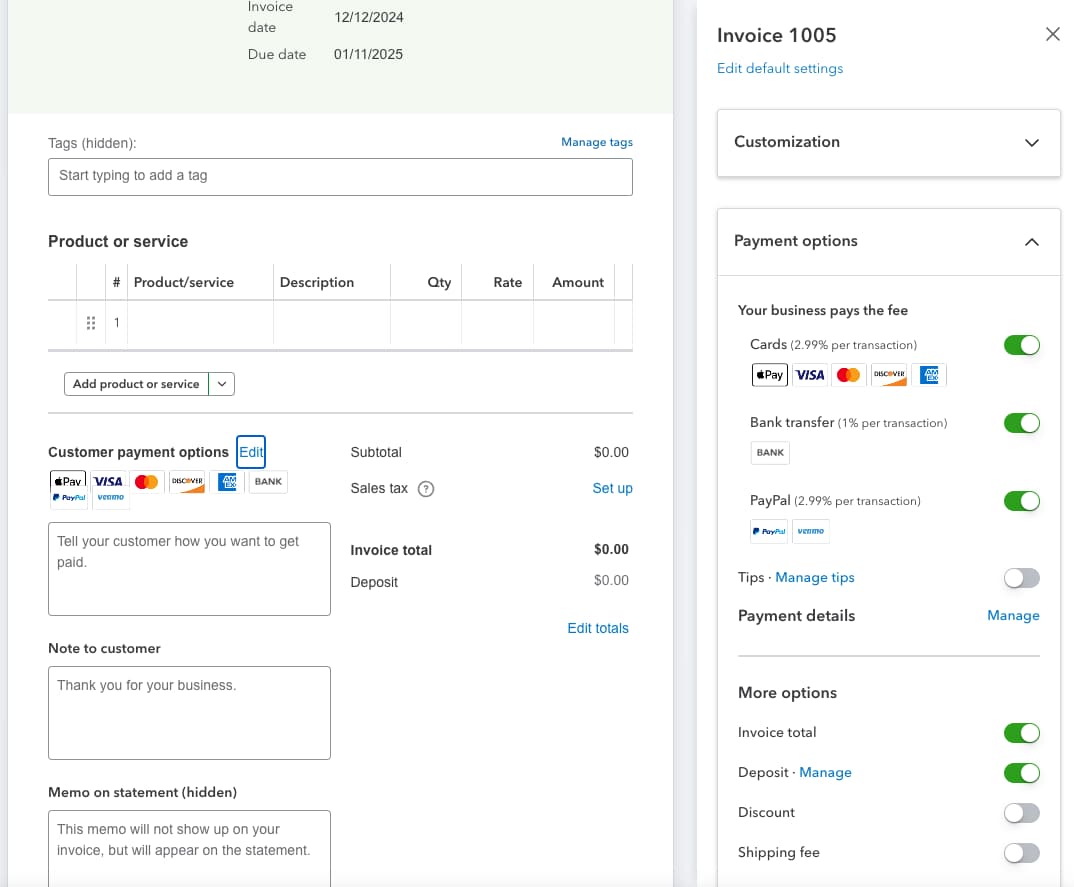

Step 3:

Create and send an invoice. Select the "Accept Card Payments with PayPal" option when creating an invoice in QuickBooks. After that, you are all set to start accepting payments using PayPal.

Best practices for a smooth Integration

To ensure a smooth and efficient integration between QuickBooks and PayPal, following a few best practices is essential. Start by implementing data validation checks to ensure all transaction details are accurately mapped between the two platforms. Effective error handling is also crucial to log errors and use retry mechanisms to prevent data loss during synchronization. Additionally, regularly monitor the integration by reviewing transaction logs, reconciliation reports, and sync statuses to identify and resolve any issues that may arise quickly.

Frequently asked questions about QuickBooks Online

1. What is integration in QuickBooks?

Integration in QuickBooks refers to connecting QuickBooks with other platforms, such as PayPal, to automate data flow like transactions, customer details, and payments, streamlining accounting processes and reducing manual entry.

2. How do I integrate with QuickBooks API?

To integrate with QuickBooks API, register your app on the Intuit Developer portal, obtain API credentials, and use those credentials to authenticate API calls that sync data like transactions, customers, and invoices between your system and QuickBooks.

Read more about QuickBooks API Integration here: https://developer.paypal.com/api/rest/

3. How many integrations does QuickBooks have?

There are a few ways to integrate QuickBooks Online:

- Native PayPal App: The Official PayPal App offers pre-built integration at a reasonable price.

- Third-Party Apps: Alternatives like CashFlow Manager also connect PayPal and QuickBooks.

- Custom Development: Custom integration can be built via the PayPal and QuickBooks APIs for advanced needs.

4. How do I integrate QuickBooks with my website?

To integrate QuickBooks with your website, you can use third-party apps or plugins specifically designed for platforms like Shopify, WooCommerce, or Magento. First, choose a compatible integration app from the QuickBooks marketplace that matches your website platform. Then, follow the setup instructions provided by the app to link your QuickBooks account, enabling automatic syncing of orders, payments, and customer data. Ensure that the app supports all the features you need for seamless integration.

Recommended

Managing Recurring Payments with Apple Pay Using PayPal

4 min read

Why You Should Attend PayPal’s Developer Meetup at Money20/20

4 min read

Building a Customizable Messaging Platform

10 min read