Reducing PayPal API Call Volume with Smart Querying and Batch Operations

Nov 17, 2025

10 min read

PayPal's batch operations allow developers and businesses to process thousands of transactions simultaneously through a single API call, dramatically reducing overhead compared to individual request patterns. This comprehensive guide covers the latest 2025 updates, implementation strategies, and best practices for leveraging PayPal's enhanced batch API features to streamline mass payments, order management, and transaction operations while maintaining security and compliance standards.

Understanding Individual vs Batch Request Patterns in PayPal APIs

The fundamental difference between individual and batch request patterns lies in transaction grouping and API efficiency. Individual request patterns process one transaction per API call, requiring separate network requests for each payment, refund, or order capture. This approach works well for single transactions like checkout processes but becomes inefficient for high-volume operations. Batch request patterns group multiple transactions into a single API call, enabling businesses to process thousands of operations simultaneously. PayPal batch operations can handle thousands of payouts with a single API call or CSV upload, making them ideal for scenarios like payroll processing, vendor payments, or mass refunds.

| Aspect | Individual Request | Batch Request |

| API calls per transaction | 1:1 ratio | Many : 1 ratio |

| Network overhead | High for multiple transaction | Minimal |

| Processing time | Linear scaling | Exponential efficiency |

| Best usecases | Single checkouts, real-time payments | Mass payouts, bulk refunds, payroll |

| Error handling | Immediate per transaction | Batch-level with detailed reporting |

Can You Request Multiple Orders or Transactions in a Single API Call?

PayPal's Payouts API and batch features are specifically designed to handle mass payment use cases, allowing thousands of transactions in a single API call. A batch request submits a structured list of instructions for orders, captures, or refunds in one interaction, rather than processing each transaction separately through individual API calls.

The following PayPal APIs natively support batching:

- Payouts API: Handles mass payments to multiple recipients

- Delayed Disbursement: Hold funds from a buyer before disbursing it to your seller for additional vetting

- Referenced Payouts: Processes recurring or template-based payments

APIs that require individual calls include:

- Orders API v2: Individual order creation and capture

- Payments API: Single transaction processing

- Subscriptions API: Individual subscription management

Batch endpoints significantly improve performance by reducing network latency, minimizing API quota usage, and providing consolidated error reporting. For high-volume businesses processing hundreds or thousands of transactions daily, batch operations can reduce processing time from hours to minutes while maintaining transaction integrity.

How Batch Operations Work in PayPal APIs

PayPal batch operations follow a structured workflow that begins with data preparation and ends with comprehensive reporting and reconciliation. The technical process requires either a structured CSV spreadsheet or formatted JSON payload containing recipient or transaction data.

The batch processing workflow includes:

- Data Preparation: Organize transaction data in required formats

- Authentication: Secure API credential validation

- Submission: Send batch request to the appropriate endpoint

- Processing: PayPal validates and executes transactions

- Monitoring: Track batch status and individual transaction results

- Reconciliation: Review reports and handle any errors

Batch requests require specific technical components, including valid API credentials, properly formatted request bodies, and appropriate error handling mechanisms. The system processes batches asynchronously, providing status updates and detailed reporting throughout the execution cycle.

Step 1: Set Up Your PayPal Developer Account and Sandbox Environment

Developers must first create or access their PayPal Developer Account that is managed through the PayPal Developer Dashboard, navigate to the PayPal Developer site and select Log into Dashboard.

To set up your development environment:

- Register for a PayPal Developer account

- Create Sandbox business and personal test accounts

- Generate REST API credentials (Client ID and Secret)

- Configure webhook endpoints for batch status notifications

- Review the official developer documentation for API testing procedures

Step 2: Prepare and Format Batch Requests for Orders, Captures, and Refunds

Proper data formatting is crucial for successful batch operations. A spreadsheet with recipient information is required for PayPal mass payments, and the structure must include all mandatory fields to avoid processing errors. Required fields for batch payouts include:

| Field | Description | Format |

| Recipient Email | PayPal account email | Valid email address |

| Amount | Payment amount | Decimal with currency precision |

| Currency | Three-letter currency code | ISO 4217 format (USD, EUR, etc) |

| Unique ID | Trsanction identifier | Alphanumeric string |

| Note | Payment description | Optional field text |

Batch files must follow specific formatting requirements depending on the submission method. CSV files require proper column headers and data validation, while JSON payloads need correct structure and field naming conventions. Batch files and their structure for PayPal transactions are detailed in comprehensive API documentation.

Best practices for batch file preparation include validating all email addresses, ensuring amount precision matches currency requirements, and using unique identifiers for each transaction to enable proper tracking and reconciliation.

Step 3: Configure API Credentials for Secure Batch Operations

API credentials authenticate access and enable secure transaction processing for all PayPal batch operations. These credentials consist of a Client ID and Secret that must be properly configured and securely stored.

To obtain and configure API credentials:

- Access your PayPal Developer Dashboard

- Create a new application or select an existing one

- Generate REST API credentials for your target environment

- Store the Client ID and Secret credentials securely using environment variables

- Ensure that the necessary capabilities are enabled such as Payouts, Transaction Search, and Payment/ Order APIs.

Proper credential configuration ensures that batch operations maintain PayPal's security standards while providing the necessary access for high-volume transaction processing.

Step 4: Executing Batch Payouts, Order Captures, and Refunds Efficiently

The execution phase involves submitting prepared batch requests to appropriate PayPal endpoints and monitoring their progress. The Payouts API can send thousands of payouts in a single call, making it ideal for paying multiple vendors or gig workers efficiently.

The batch execution process follows these steps:

- Endpoint Selection: Choose the appropriate API endpoint based on operation type

- Payload Preparation: Format the request body with transaction data

- API Submission: Send the authenticated request to PayPal

- Status Monitoring: Track batch processing status through webhooks or polling

- Result Processing: Handle successful transactions and manage errors

PayPal provides comprehensive reporting tools for monitoring batch execution, including real-time status updates and detailed transaction logs. Use these reporting features to track processing progress and identify any transactions requiring attention.

Step 5: Testing, Monitoring, and Handling Errors in Batch Operations

Thorough testing in the Sandbox environment minimizes errors before live deployment and ensures robust batch processing workflows. PayPal's testing environment supports all batch operations with simulated transactions and comprehensive error scenarios.

Testing strategies should include:

- Data Validation: Test various data formats and edge cases

- Error Scenarios: Simulate invalid recipients, insufficient funds, and network failures

- Volume Testing: Process large batches to validate performance

- Integration Testing: Verify webhook handling and status monitoring

PayPal provides reporting tools such as the Disbursement Reconciliation Report for real-time monitoring and reconciliation of batch operations. These reports enable businesses to match batch payouts to deposits and maintain accurate financial records.

Effective error handling includes logging all failures, implementing retry logic for temporary issues, and establishing clear escalation procedures for persistent problems. Use PayPal's detailed error codes and descriptions to diagnose and resolve issues quickly.

New Limits on Batch Sizes and Transaction Volumes in 2025

PayPal has updated batch processing limits for 2025 to balance system performance with business needs. Businesses can now send thousands of payouts efficiently, but they must adhere to new guidelines to avoid processing disruptions.

| Limit type | 2024 | 2025 | Change |

| Maximum Batch size | 5,000 transactions | 15,000 transactions | +150% |

| Daily batch limit | 50 batches | 100 batches | +100% |

| Monthly volume cap | 500,000 transactions | 100,000 transactions | +100% |

| File size limit | 10 MB | 25 MB | +150% |

These limits exist to ensure system stability, prevent fraud, and maintain regulatory compliance. The increased limits reflect PayPal's enhanced infrastructure capabilities and growing demand for high-volume batch processing.

Large batch payouts help you send payouts to an unlimited amount of recipients at once. Large batch payouts are recommended for more than 15,000 payouts in one batch. For fewer payouts in a batch, use Standard Payouts or PayoutsWeb.

Businesses approaching these limits should implement monitoring systems to track usage and plan capacity accordingly. PayPal provides usage reports and alerts to help businesses manage their batch processing within established parameters.

Smarter Workflow by combing related calls

Developers often make multiple API calls that could easily be combined. Or example, fetching transactions details, customer profiles, and payment statuses separately can lead to a spike in call counts. By designing a workflow that sequences related operations within the same context, you reduce redundant requests.

Using Webhooks to listen to PayPal's events such as transaction status, details and customer information, also cuts down for periodic polling. Instead of querying PayPal repeatedly for updates, your system can respond only when an event occurs resulting in a smart, event-driven model.

An example for event-driven models is during the creation of a Checkout experience using our Order APIs.

In any typical online store, merchants spend significant resources querying transaction details, customer profiles, payment statuses, and other related operations. Instead of making multiple API calls, a consolidated workflow can be implemented using the orders API.

When creating an order using the Orders API, merchants can retrieve multiple details within the order object, such as the:

- Transaction details (amount, status, fees)

- Customer information (name, email, shipping address)

- Payment status (approved, authorized, completed)

- Additional information can be also included in the same API call (e.g., shipping-related details)

This avoids the need for multiple calls to fetch status, transaction history, or details about each separate component (customer profile, payment data). We always recommend doing a GET call post buyer approval to get the latest status of the transaction and some additional details. But, immediately after order creation the response has details like the status, transaction details, thus avoiding the need for multiple subsequent queries for payment status or confirmation.

Here are some resources on Payouts and PayPal REST APIs that can be helpful for developers during API Integration.

Stay tuned for more on API integrations here.

Recommended

Developer Day for Fastlane by PayPal: A Masterclass of Innovation

5 min read

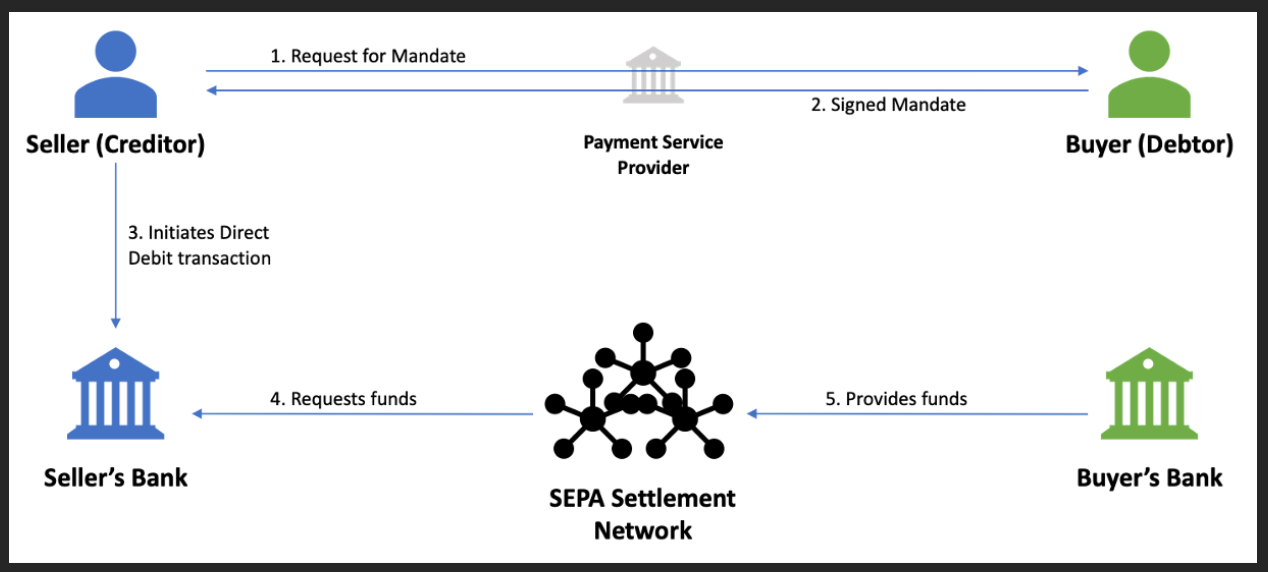

Pay by Bank for E-Commerce | Using Bank Accounts to Make Purchases with SMBs [SEPA]

5 min read

PayPal Dev Days 2025: Building Smarter Commerce

5 min read