Least Cost Routing overview

Last updated: Aug 15th, 7:51am

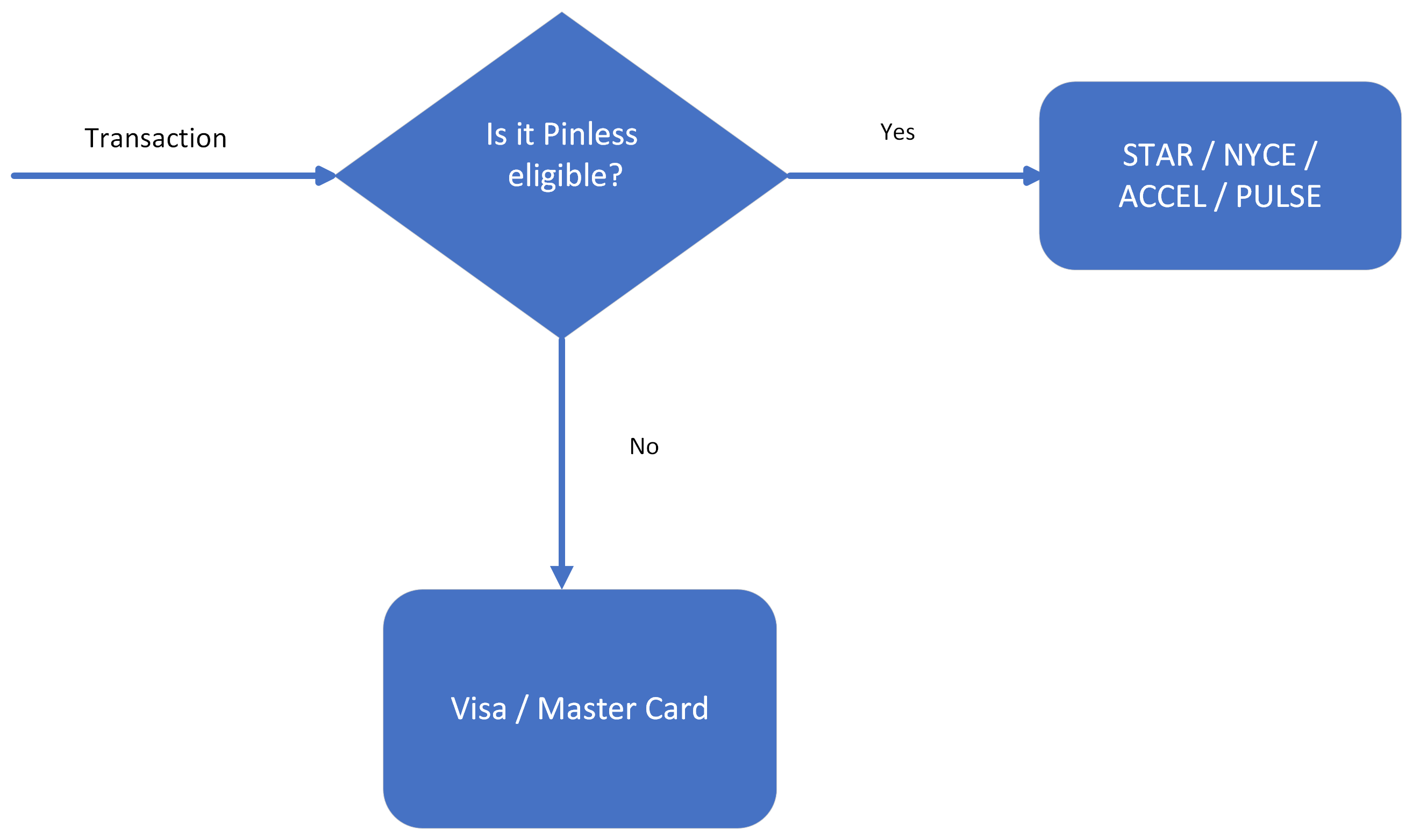

Least Cost Routing is a feature in which transactions with eligible debit cards are processed through Least Cost Routing networks instead of Visa or Mastercard. This feature is only for US-based Bill Pay aggregators and Braintree Enterprise merchants set up on the Interchange Plus Plus (IC++) pricing model.

Merchants can reduce their pass-through transaction fee with Least Cost Routing. Braintree will route eligible debit cards cost-efficiently. When multiple debit networks are available on the card transaction, the card will be routed to the network with the lowest pass-through fee. Merchants will have a consistent experience for transactions processed as Least Cost Routing or Signature Debit. The pass-through fee for Least Cost Routing is lower than that of Visa and Mastercard.

Eligibility

Least Cost Routing works only if:

- The debit cards are issued by US banks and the merchants are based in the US. The currency of the transaction should be USD.

- The debit card should be eligible to be processed in at least one STAR, NYCE, PULSE, or ACCEL network. Among the eligible networks, the transaction will be processed through a network that will impose the least cost depending on various transaction attributes such as amount, type of transaction (recurring or non-recurring), and merchant category code.

- The primary card brand of the payment method is Visa or Mastercard.

- You use the chargeCreditCard mutation in GraphQL.

If you save the card details after a transaction, that transaction will not be routed through Least Cost Routing networks. You will have to complete another transaction after saving the card details to route it through Least Cost Routing networks. You can also route through the Least Cost Routing networks without saving card details.