Pay by Bank for E-Commerce | Using Bank Accounts to Make Purchases with SMBs [ACH]

Sept 10, 2024

5 min read

Starting early 2025, PayPal will begin offering ACH payments on PayPal Complete Payments (PPCP). With this launch, small and medium sized businesses (SMBs) will now be able to provide pay-by-bank checkout options to their customers.

In this post, we’ll explore what ACH is, how it works, and the benefits it can provide to SMBs.

What is ACH?

ACH, or Automated Clearing House, is a network that allows for electronic funds transfers between banks in the United States. It is commonly used for recurring payments and deposits, including paychecks, rent payments, automatic bill payments, and general funds transfers between accounts. It is a secure and efficient way to process transactions and is widely used for both individual and business banking needs.

ACH payments continue to represent a significant share of B2B transaction volume. In 2023 alone, ACH transactions accounted for nearly $16 trillion in transaction value, with estimates suggesting this figure will surpass $17 trillion in 2024.There were 8.3 billion ACH payments in the second quarter of 2024, an increase of 6.3% over the same time period in 2023. ACH exceeded 100 million payments in a month for the first time in April 2024, with 107.8 million.

The ACH network is overseen by NACHA, the National Automated Clearing House Association. NACHA is an independent organization owned by a large group of banks, credit unions, and other financial services organizations. It establishes the rules and standards that govern the ACH system.

How do ACH payments work?

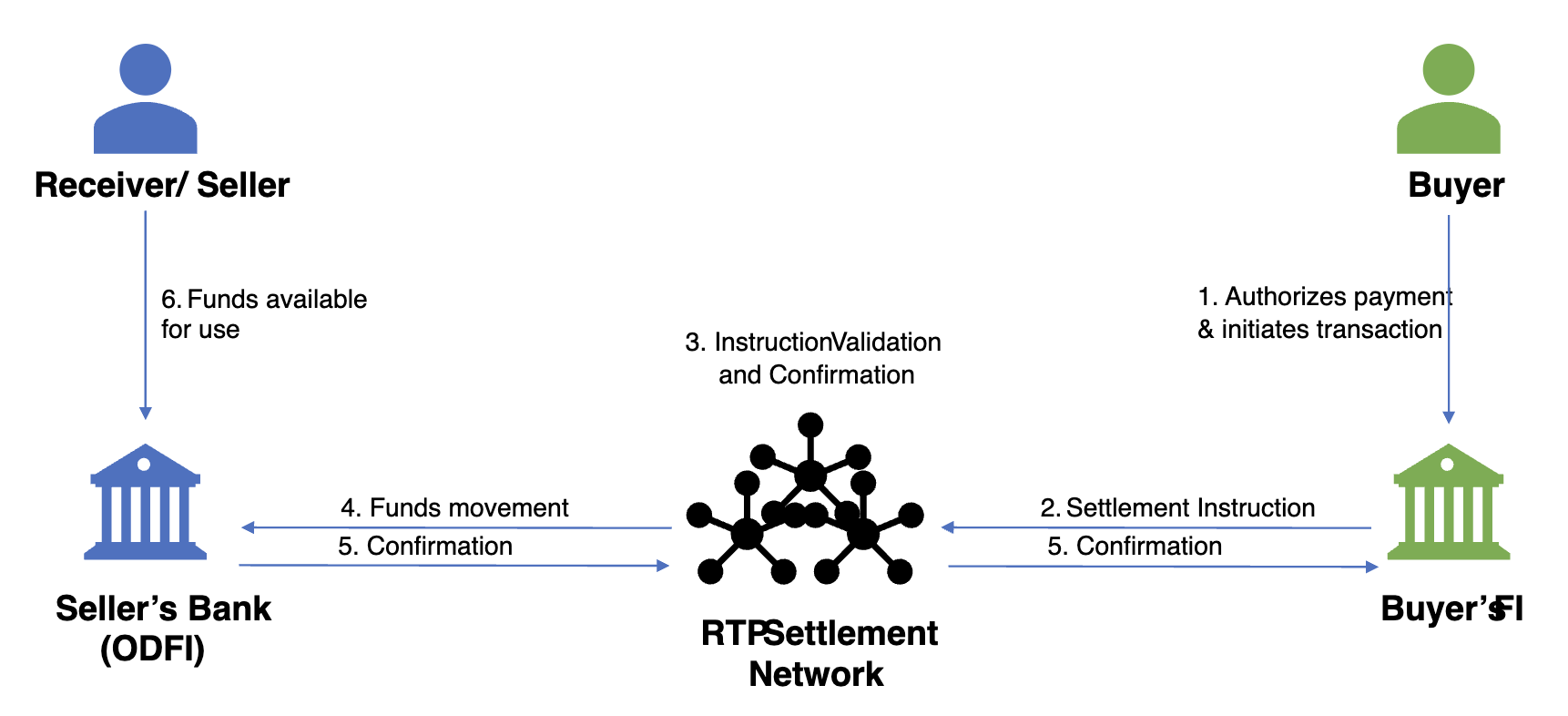

ACH payments work through a systematic process that involves several key steps and entities. The process begins when an individual or organization (buyer) authorizes a payment.

After verification of payment-critical information of the buyer’s account (RDFI – Receiving Depository Financial Institution) such as routing account, account number, payment amount and date, funds are released from the RDFI for processing through the ACH network.

Note: For ACH transactions, the entity on whose behalf the transaction is conducted is referred to as the ‘Receiver.' This designation applies regardless of the transaction type or the direction of the funds (i.e. credit or debit).

Funds are generally settled within one to two business days, though same-day ACH options are also available for faster processing.

These funds once settled are available in the seller’s financial entity– most likely a bank account. The banks or financial institutions that process the payment transaction based on the authorization from the receiver are known as the ODFI (Originating Depository Financial Institution).

Note: For ACH transactions, the entity which processes the transaction is termed as the ‘Originator’ and can either deposit funds to the receiver's account (credit) or accept payments from the receiver’s account (debit). Flow of funds is from RDFI->ODFI; so funds will be release from RDFI.

Why does ACH make sense for Businesses?

The processing time of ACH makes it a less convenient option for quick, everyday transactions such as buying lunch or shopping at your favorite clothing store.

However, ACH is an effective solution for payment needs that historically have required checks, especially for larger denominations and recurring transactions. As such, for businesses, especially SMBs, ACH can offer a number of benefits that other payment options can’t:

1. Cost Savings ACH payments can offer SMBs improved cost savings. Traditional payment methods such as card payments or wire transfers can incur high processing fees. ACH transactions, on the other hand, are typically much cheaper. The fees for ACH transactions are generally a fraction of the cost of other payment methods, making them an attractive option for SMBs.

2. Improved Cash Flow Management ACH payments can help businesses better control their cash flows. Since ACH transactions are generally used for larger payments or scheduled/recurring payments, they can help businesses better plan their payments and collections more effectively. Additionally, ACH payments are generally processed faster than traditional checks – usually within one to two business days – which means businesses can access their funds faster.

3. Enhanced Security ACH transactions are considered more secure due to the required bank verification processes and necessary compliance regulations under Nacha. Unlike paper checks, which can be lost or stolen, ACH payments are processed electronically, reducing the risk of fraud. Businesses can also implement additional security measures, such as encryption and multi-factor authentication, to protect their ACH transactions.

4. Improved Regulatory Compliance ACH transactions are governed by the National Automated Clearing House Association (NACHA) rules and regulations, ensuring a standardized and compliant payment process. By using ACH, SMBs can be confident that they are adhering to industry standards and regulatory requirements, minimizing the risk of non-compliance issues.

What’s Next?

From cost savings and improved cash flow management to better security and compliance, ACH payments provide SMBs with a dependable and efficient solution for modern payment processing. By adopting ACH, SMBs can streamline their operations, lower expenses, and deliver a better experience for their customers. In an increasingly competitive business landscape, leveraging the advantages of ACH can give SMBs a notable edge.

Keep an eye out here for more details to come on the launch of ACH payments on PPCP. To explore all of PayPal’s current payment offerings, visit https://developer.paypal.com/home/ to get started.

Recommended

A Faster Guest Checkout: How to Integrate Fastlane by PayPal

8 min read

Exploring the Growth of Real Time Payment Systems

5 min read