Exploring the Growth of Real Time Payment Systems

Sept 10, 2024

5 min read

Real-time payments (RTP) are transforming the financial landscape, setting a new standard for how money moves between consumers and businesses. As digital payment solutions become the norm, RTP delivers unmatched speed, convenience, and immediate access to funds. Experience the future of financial transactions today with the revolutionary power of real-time payments.

What are Real-Time Payments?

Historically, global payments have been a tangled web of varied institutions and processes, often leading to inefficiencies and delays. Enter real-time payments (RTP)—a revolutionary system that offers a unified, streamlined approach to money transfers.

Unlike traditional banking methods that can drag out transactions for days, real-time payments ensure immediate fund transfers around the clock, 24/7. This instant processing is not only reshaping how money is moved but also delivering unparalleled benefits to both consumers and businesses. With projections indicating that RTP will represent over 25% of all electronic payments globally by 2028, this technology is not just a trend but the future of financial transactions.

How do Real-Time Payments Work?

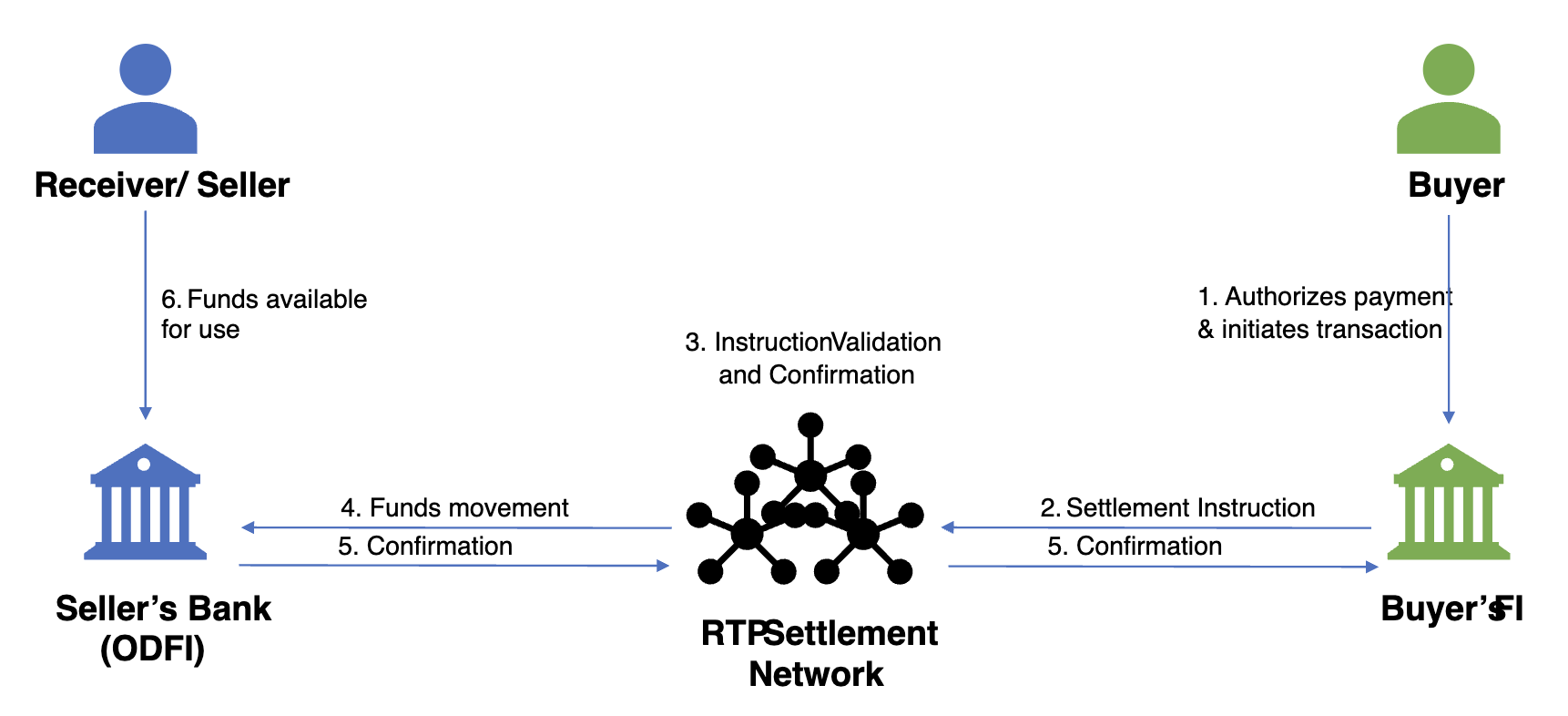

Real-Time Payments (RTP) are powered by an advanced RTP system, with oversight typically provided by a financial authority such as a government body or central bank, depending on the country.

Here’s how it works:

The payment process begins when a buyer initiates a transfer via their banking app, online platform, or another payment medium. The buyer inputs the recipient’s payment details or unique identifier and then authorizes the transaction using a PIN or password.

Once authenticated, the funds are swiftly processed through the RTP network, which routes the payment to the sender’s bank. With immediate settlement, the recipient gains instant access to their funds. This seamless process ensures fast, efficient, and reliable transactions every time.

The following are some of prominent RTP solutions across the globe:

USA: FedNow

India: UPI (45% YoY growth)

Brazil: PIX (78% YoY growth)

Thailand: PromptPay (38% YoY growth)

China: IBPS (4% YoY growth)

South Korea: Interbank CD/ATM (11% YoY growth)

Australia: NPP

Hong Kong: FPS

In this blog, we’ll explore the rise of real-time payment systems and examine the prominent RTP infrastructures in the USA, India, and Brazil.

FedNow : [USA]

The launch of FedNow in 2023 marks a pivotal moment for real-time payments in the United States. Designed to create a nationwide infrastructure for instant transactions, FedNow is rapidly expanding its reach across the country.

Much like India’s UPI, FedNow offers:

- Instant Availability: FedNow enables consumers and businesses to transfer and receive funds instantly, at any time, day or night.

- Inclusive Access: With its platform open to financial institutions of all sizes, FedNow fosters inclusivity and encourages healthy competition within the payment ecosystem.

- Robust Security: FedNow integrates advanced security measures to safeguard transactions from fraud and cyber threats, ensuring peace of mind for users.

As the US positions itself as a growing force in the RTP market, FedNow is projected to achieve a 25% compound annual growth rate(CAGR) over the next five years. This presents a significant opportunity in the North American payments landscape, heralding a new era of efficiency and innovation.

UPI: United Payments Interface [India]

India’s Unified Payments Interface (UPI) has revolutionized real-time payments since its launch in 2016 by the National Payments Corporation of India (NPCI). UPI has significantly reshaped the way money is transferred in India with its innovative features:

- Seamless Integration: UPI allows users to connect multiple bank accounts to a single mobile app, facilitating effortless transfers across various banks.

- Instant Transactions: Enjoy real-time transactions 24/7, including weekends and holidays, delivering unmatched convenience.

- Widespread Adoption: UPI’s user-friendly design and extensive acceptance have made it the go-to payment method for millions, from small vendors to major corporations.

In 2023, India led the RTP market with nearly 130 billion transactions, with UPI accounting for an impressive 84% of all electronic payments. This widespread adoption highlights UPI’s transformative impact on the financial landscape.

PIX : [Brazil]

Pix is Brazil’s real-time payment system launched by the Central Bank of Brazil. Launched in 2020, PIX facilitates instant fund transfers and payments using unique identifiers. PIX has now accounted for more than 13% of spend in Brazil and more than 5% of transactions.

Similar to UPI and FedNow, PIX has become popular due to its:

Low Cost: PIX is largely free for individuals to use and compared to other payment methods, is generally much lower cost for businesses to accept

Accessibility: PIX is widely available across Brazil’s bank account holders, making it a powerful tool to promote financial inclusion.

Versatility: PIX supports a wide range of transactions, including B2B, B2C, bill payments, government disbursements, and much more.

Brazil has seen remarkable growth in its RTP usage, boasting a 78% YoY growth rate in 2023 and more than 35B transactions.

Conclusion

Real-time payments are not just a trend in major markets; they’re also gaining momentum in countries like Singapore, Sweden, and Australia. These nations are quickly adopting RTP to enhance their financial systems and improve payment efficiency.

Real-time payments are reshaping the financial landscape by delivering speed, centralization, and accessibility like before. As the pace of transactions accelerates, more countries will integrate RTP infrastructure to boost financial inclusion and streamline payment processes.

As this technology evolves, payment providers, banks, and FinTechs must adapt their strategies to harness its benefits while addressing the risks that come with innovation. Embracing real-time payments is essential for staying competitive and meeting the demands of a rapidly changing financial world.

Recommended

A Faster Guest Checkout: How to Integrate Fastlane by PayPal

8 min read

Pay by Bank for E-Commerce | Using Bank Accounts to Make Purchases with SMBs [ACH]

5 min read