Accept Afterpay payments

DocsLimited

Last updated: Nov 4th, 9:10pm

Afterpay (Clearpay in the UK) is an interest-free Buy Now Pay Later (BNPL) payment method that allows buyers to split their purchases into instalments—either in four payments or, for qualified US buyers, over 6 or 12 months. Through PayPal's integration, merchants can offer flexible payment options while receiving full payment upfront, creating a checkout experience that drives conversion and buyer satisfaction.

| Countries | Payment type | Payment flow | Settlement currency | Minimum amount | Refunds |

|---|---|---|---|---|---|

| US, UK | Buy now, pay later (BNPL) | Redirect | USD, GBP | From $1 USD / £1 GBP. See Payment amount limits. | Yes, full/partial/ multiple refunds within 120 days |

Key features

Afterpay helps your business:

- Receive full payment upfront while buyers pay in installments with a 95% on-time payment rate.

- Offer flexible payment options with Pay-in-4 interest-free installments or monthly payment plans over 6-12 months for qualified US buyers.

- Expand to key markets with support for the US and UK markets, where Afterpay operates as Clearpay in the UK.

- Increase average order value as buyers are more likely to complete higher-value purchases when they can pay in instalments.

- Simplify integration through PayPal's existing payment platform with minimal development effort.

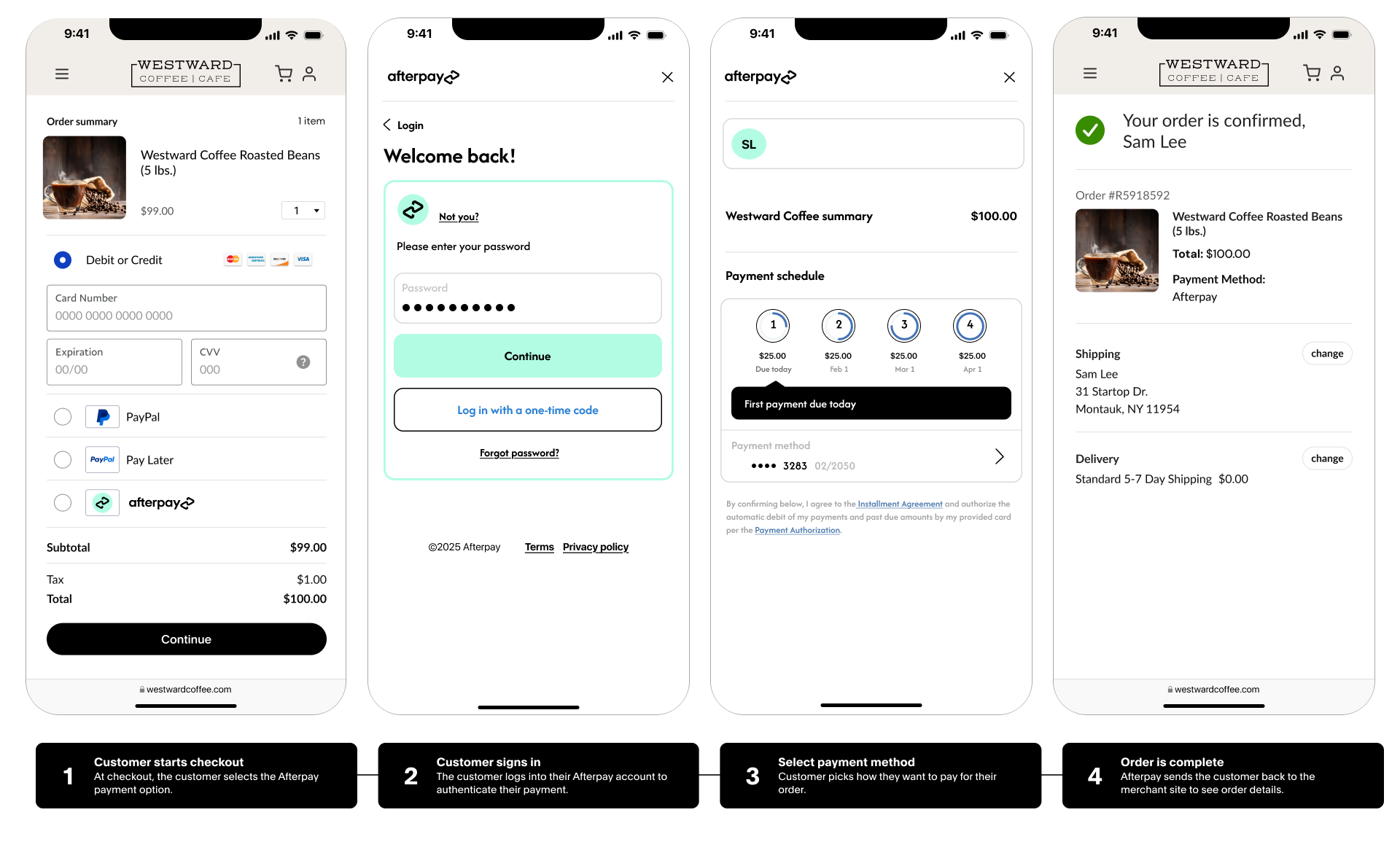

How it works

- Buyer: Selects Afterpay as their preferred payment method at checkout

- Merchant | Partner: Creates an order using PayPal's Orders v2 API with Afterpay as the payment source

- PayPal: Returns an order ID and a redirect link for Afterpay approval

- Merchant | Partner: Redirects the buyer to Afterpay for payment approval

- Buyer:

- Logs into their Afterpay account

- Reviews payment schedule (Pay in 4 instalments or monthly payments)

- Approves the payment

- PayPal:

- Processes the Afterpay payment, where Afterpay pays the full amount to the merchant on behalf of the buyer

- Automatically captures the full payment amount upon approval

- Redirects the buyer back to the merchant's website

- Sends webhook notification to the merchant

- Settles money to the merchant's PayPal account within T+5 (5 business days)

- Merchant | Partner: Confirms payment completion and fulfils the order

Note: The buyer separately settles the payment to Afterpay according to their chosen instalment schedule.

Buyer flow

Eligibility

- Account type: Verified PayPal Business account required with KYC completion.

- Geographic availability: Available to merchants in the US and UK markets.

- Buyer coverage: Buyers in the US and UK can pay using Afterpay (Clearpay in the UK) without creating a PayPal account.

- Platform availability: Available for PayPal for Business integrations using the Orders v2 API.

- Transaction amounts: Accept payments starting from 1.00 USD and 1.00 GBP. For detailed limits, see Payment amount limits.

- Settlement: T+5 settlement with funds available for withdrawal.

- Merchant categories: Restricted merchant categories apply. See Prohibited merchant categories.