Enable Disputes and use the API actions

Manage disputes and chargebacks

Last updated: May 6th, 1:30am

A dispute or chargeback arises when a buyer raises concerns regarding a transaction, such as:

- Non-receipt of goods or services: Buyers may raise concerns if they do not receive the goods or services they paid for.

- Discrepancies in product or service description: Buyers may dispute the transaction if the received goods or services do not match the description provided in the listing.

- Request for additional details: Buyers may require additional transaction details, such as a copy of the transaction or a receipt, to resolve uncertainties or discrepancies.

- Unauthorized transactions: Disputes can arise when buyers claim they did not authorize the transaction or suspect their account or financial instrument is compromised.

- Billing-related issues: Buyers may dispute transactions due to billing errors, such as overcharging or experiencing duplicate debits.

- Misdirected transactions: Transactions sent to the wrong person or account can result in disputes and require resolution.

- Frauds and scams: Instances of fraud or scams, where buyers get deceived into making unauthorized transactions, are also common sources of disputes and chargebacks.

With PayPal Protections and evolving government regulations, payment providers can address many consumer issues in digital payments. At PayPal, we streamline dispute management and unify merchant responses. Our Dispute API helps merchants handle disputes effectively, enabling coordinated, structured resolutions based on thorough investigation.

Note: The listed scenarios related to disputes and chargebacks are not exhaustive. API users must watch out for updates regarding new dispute reasons, revised dispute response types, and other relevant updates in this space. PayPal is committed to promptly communicating these changes to ensure users stay informed.

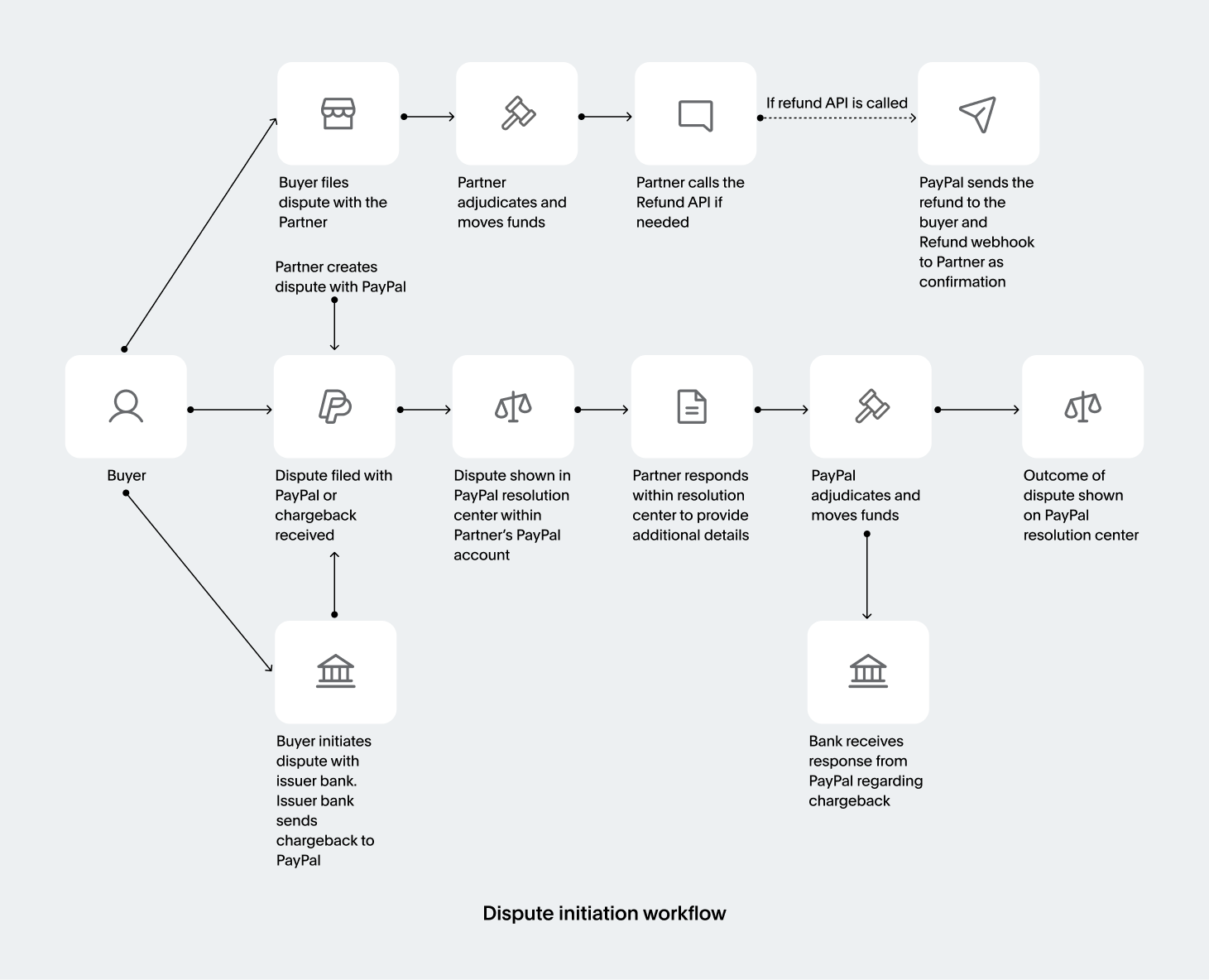

How disputes work

Buyers have several avenues for addressing issues with PayPal transactions. They can file a case with PayPal through the Resolution Center to dispute the charge or ask their bank or credit card company to reverse it.

When buyers file a dispute through PayPal, it is called a dispute. Conversely, if they report it to their credit card company, it is commonly labeled as a chargeback, while reversals initiated through their bank are termed ACH reversals or ACH returns.

PayPal's Disputes API coordinates responses to various case types. Depending on where a buyer reports the issue—PayPal, a bank, or a credit card company—that entity investigates and resolves it. Although steps may vary based on the reporting entity, PayPal aims to streamline and ensure consistency in case management.

Categories of buyer issues (Reason codes)

| Reason code | Description |

| Item/Service not received (INR) | The buyer claims they ordered and paid for an item but didn't receive it. |

| Significantly not as described (SNAD) | A buyer has received the item, but it does not match the merchant's description as it looks considerably different or damaged during shipping. For example, the buyer ordered a gold-foil mirror but received a blue polished silver mirror instead. |

| Billing errors | Multiple transactional or payment errors may result in duplicate charges or incorrect amounts. |

| Unauthorized | A buyer claims they did not make the purchase and that the transaction occurred without their consent or they were victims of identity, debit, or credit card fraud. |

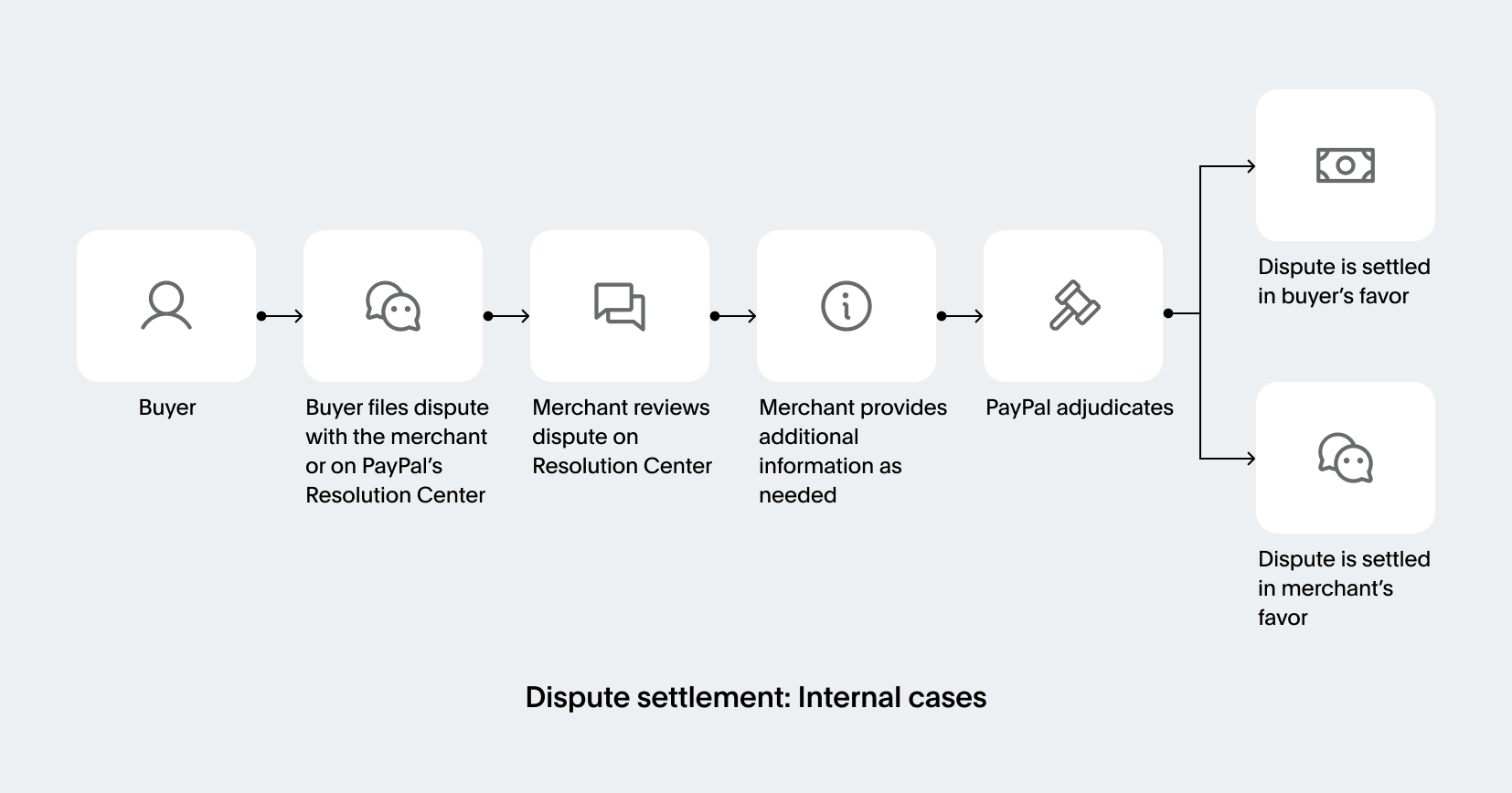

Internal cases

When a buyer files a case with PayPal by calling customer support or visiting the PayPal Resolution Center, the case becomes internal, and PayPal decides the outcome.

Stages of an internal case

- Dispute or an inquiry stage: A pre-claim process established to reduce the occurrence of chargebacks and claims. PayPal facilitates a platform for merchants and buyers to negotiate and resolve issues amicably without direct intervention. This process applies only to cases where the buyer has reported the following issues:

Item/Service Not ReceivedorSignificantly Not as Described. - Claim: Should the buyer and merchant fail to resolve the issue amicably during the dispute stage, either party can escalate the case to PayPal. Upon escalation, PayPal carefully reviews the case details and may request further information to determine the outcome.

How an internal dispute works

- Buyers can dispute transactions by calling PayPal customer support or through PayPal's Resolution Center.

- Buyers have 180 days from payment to dispute items for

Item/Service Not ReceivedorSignificantly Not as Described. - Disputed funds are held until resolved.

- Disputes may last up to 20 days unless escalated to a claim, and buyers can close disputes if satisfied with the merchant's response.

- Merchants can respond by issuing a full or partial refund, providing tracking, offering a replacement, or arranging a return.

- Unresolved disputes may get escalated to a claim, where PayPal intervenes.

- Apart from the issues such as INRs and SNADs, another frequent cause for claims arises from billing errors and suspected unauthorized transactions. If a buyer is incorrectly charged or charged twice, or the buyer's account is compromised, resulting in unauthorized purchases, the account holder can file a claim. Resolution of such complaints occurs through the claims process rather than disputes.

- Additional details will be requested from both the buyer and the merchant through email, followed by a thorough review of this information before reaching a decision.

- If the merchant loses the case, they can appeal by submitting additional information, allowing PayPal to reconsider the outcome.

Workflow of an internal dispute

- The buyer files a dispute directly with the merchant or on PayPal's Resolution Center.

- The merchant reviews the dispute on PayPal's Resolution Center and provides additional information.

- The buyer is refunded if the dispute is settled in the buyer's favor.

- If the dispute is unresolved, it gets escalated to a claim, and PayPal decides the outcome.

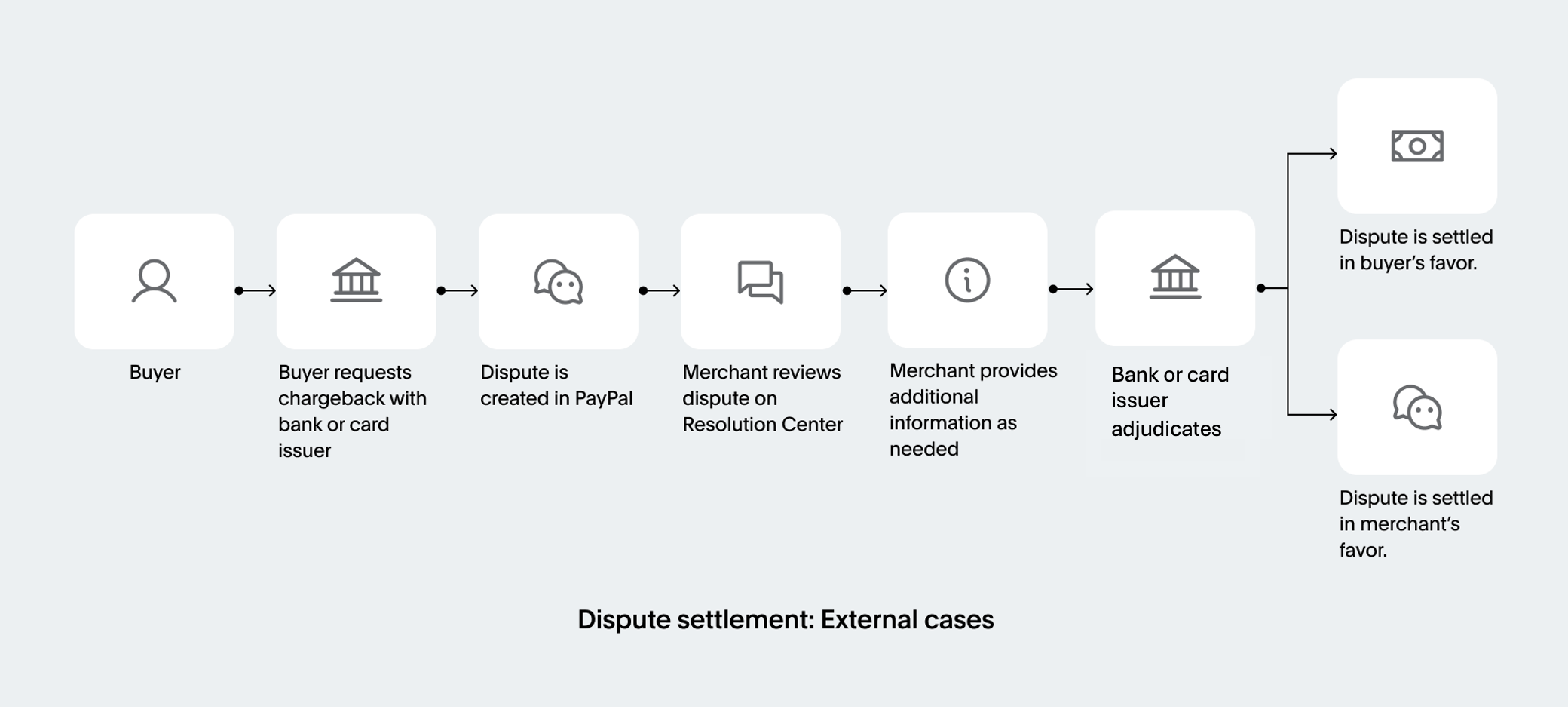

External cases

When a buyer files a case with their bank or card issuer, it becomes an external case, and the bank or the card issuer decides the outcome.

Types of external cases

- Chargebacks: Chargebacks occur when buyers report or dispute a charge with their debit or credit card issuer, causing them to issue a refund.

- Pre-chargeback alert: A pre-chargeback alert is a type of case notification sent to merchants to help identify transactions possibly receiving a chargeback. These aren't actual chargebacks but only an indicator of possible chargebacks. You'll get a 20-hour window to issue refunds for transactions without fulfilling orders and avoiding any applicable fees.

- ACH returns: A bank reversal, sometimes known as an ACH Return, occurs when a bank requests that we reverse a PayPal payment.

Workflow of an external case

- The buyer files the issue with the bank or card issuer.

- The case is created in PayPal.

- Merchants can issue a full refund or submit evidence denying the claim.

- PayPal helps merchants represent the facts to the card issuer by submitting evidence shared by the merchant.

- The bank or the card issuer investigates and provides the outcome back to PayPal and the merchant. PayPal only facilitates a representation here.

Actions available with the Disputes API

The following methods provide a reference for permissible actions as a user. You can also use the Disputes API to automate actions in the Resolution Center.

The following table shows the methods available as actions in the Resolution Center.

| Method | Resolution Center Actions |

|---|---|

| List disputes | Access the Resolution Center to view all cases listed under the Open Cases tab. Cases needing urgent attention are highlighted under the Needs Your Attention tab. |

| Show dispute details | Select the Case ID to examine all case details. Alternatively, navigate to the Case details page through the context menu and select Case details. |

| Send message to other party | Access the Case details page to communicate with the buyer. This helps address their concerns and resolve the issue amicably. |

| Make an offer to resolve a dispute | For INR and SNAD disputes and claims, merchants can offer buyers alternatives, such as issuing a partial refund, offering a refund for returning an item, or offering a replacement. |

| Deny offer | This option, exclusive to buyers, allows them to reject the offer from the merchant if they are not satisfied. |

| Accept claim | To acknowledge a claim, choose to refund the buyer and close the case, either from the Case details page or the merchant dashboard's context menu. |

| Appeal dispute | If a case is closed, merchants can appeal by selecting I disagree with the claim and providing additional information for PayPal's review. |

| Cancel dispute | This option, exclusive to buyers, allows them to close the case if they find the merchant's response or evidence satisfactory. |

| Change reason | This option, exclusive to buyers, allows them to change the reason for their case if the nature of their issue changes. |

| Acknowledge returned item | At any stage in the dispute lifecycle, merchants can request that the buyer return an item for a full refund. If the buyer agrees, PayPal allows the merchant to acknowledge the return of the item. |

| Provide evidence | If the merchant disagrees with the buyer's claim, they can deny it by presenting evidence enabling PayPal to resolve the case. |

| Provide supporting information | If the merchant disagrees with the buyer's claim, they can provide evidence to PayPal at any point. |

Dispute use cases

You can use the Disputes API to:

- Automate handling large volumes of disputes.

- Manage PayPal disputes from your internal dispute management tool instead of the PayPal Resolution Center.

- Show open PayPal disputes to merchants in a shopping cart without providing management of the disputes.

How do you want to integrate?

Choose how to manage your disputes