Accelerating Agentic Payments with PayPal

Dec 16, 2025

6 min read

The future of commerce is autonomous, and PayPal is at the forefront in enabling AI-driven payment experiences. Agentic commerce represents a paradigm shift where artificial intelligence agents independently handle shopping, payments, and order management on behalf of consumers and merchants. As businesses seek to streamline operations and deliver personalized customer experiences, PayPal's agentic commerce tools provide the secure, developer-friendly infrastructure needed to build scalable AI-powered payment automation. This comprehensive guide explores how developers and businesses can leverage PayPal's Agent Toolkit and Model Context Protocol to create intelligent payment workflows that operate with minimal human intervention while maintaining high security standards.

Understanding Agentic Payments and Commerce

Agentic commerce involves AI agents autonomously discovering, deciding, and purchasing on behalf of consumers, fundamentally transforming how digital transactions occur. These intelligent systems can browse products, compare prices, negotiate terms, and complete purchases without direct human input, creating seamless shopping experiences that adapt to individual preferences and behaviors.

Agentic payments specifically refer to the transaction execution component within these workflows, where AI agents initiate, manage, and confirm financial transactions autonomously. Unlike traditional payment flows that require multiple manual steps and user confirmations, agentic payments empower AI assistants to handle everything from invoice generation to refund processing based on predefined parameters and learned behaviors.

This evolution toward autonomous transaction management delivers significant benefits in efficiency, personalization, and scalability. AI agents can process payments faster than human users, optimize routing for better approval rates, and provide 24/7 transaction capabilities that traditional systems cannot match.

PayPal's Agentic Commerce Tools and Frameworks

PayPal has developed a comprehensive suite of tools specifically designed to empower developers and businesses in building robust agentic commerce applications. At the core of this ecosystem is the PayPal Agent Toolkit, a powerful package that enables developers to create sophisticated agentic workflows for automating payments, shipment tracking, returns processing, and customer service interactions.

The Model Context Protocol (MCP) serves as the secure foundation for these interactions, providing a standardized system that allows AI agents to communicate with PayPal's financial services while maintaining strict data protection standards. This protocol ensures that sensitive payment information remains secure and that AI agents operate within clearly defined parameters and permissions.

Key features of PayPal's agentic commerce framework include:

· AI-agnostic integrations that work seamlessly with leading AI platforms including OpenAI's ChatGPT, Claude, and other major language models

· Event-driven architecture supporting real-time, scalable commerce operations that can handle high transaction volumes

· Multi-language support with official SDKs for TypeScript and Python, enabling developers to work in their preferred programming environments

· Advanced tokenization that secures payment flows by replacing sensitive data with unique, non-reversible tokens

The interaction between these components creates a secure, efficient pathway for AI agents to manage complex payment workflows. When an AI agent needs to process a transaction, it communicates through the MCP server, which handles authentication, validates permissions, and executes the requested payment operations using PayPal's secure APIs. This architecture ensures that agents can perform sophisticated financial tasks while maintaining the security and compliance standards that businesses require.

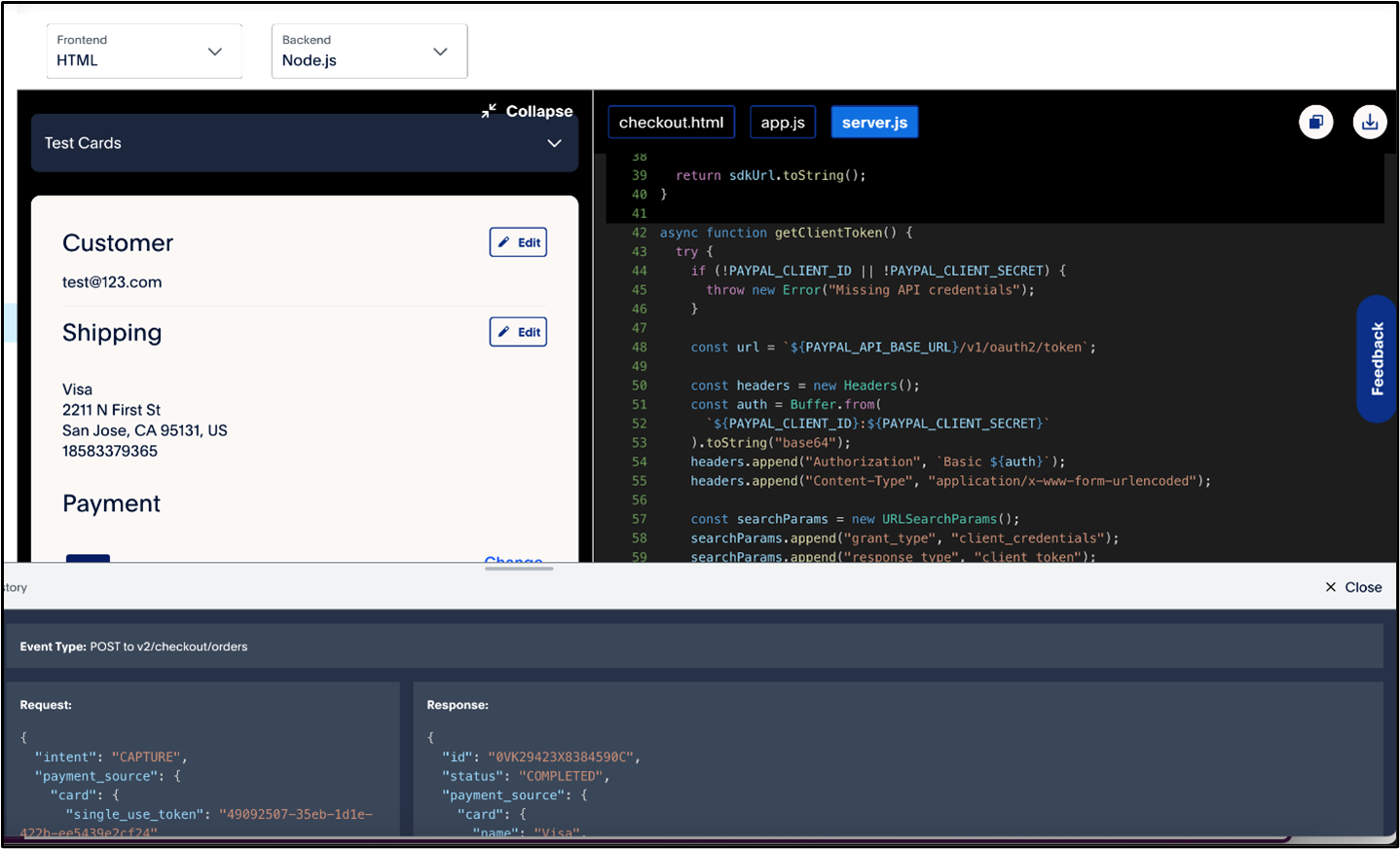

Building Agentic Commerce Apps with PayPal

Developing agentic commerce applications with PayPal involves a systematic approach that leverages the company's specialized tools and frameworks. The development process begins with setting up the necessary infrastructure and progresses through integration, testing, and deployment phases.

The high-level development workflow follows these essential steps:

Environment Setup: Install the PayPal Agent Toolkit and configure the MCP server according to your application requirements

Authentication Configuration: Establish secure connections using PayPal's tokenized authentication system

Workflow Design: Define the specific payment and commerce operations your AI agents will handle

Integration Development: Connect your AI models with PayPal's APIs through the MCP interface

Testing and Validation: Ensure your agentic workflows operate correctly across different scenarios

Deployment and Monitoring: Launch your application with appropriate logging and performance tracking

PayPal's development tools are available free of charge to developers, with standard transaction fees applying to live payment processing. This approach removes barriers to entry and allows developers to experiment and build sophisticated agentic commerce solutions without upfront costs. The platform provides comprehensive documentation, code samples, and developer support to accelerate the integration process.

For developers ready to begin building, PayPal offers detailed implementation guides that walk through specific use cases and provide practical examples of how to structure agentic workflows for different business scenarios.

Enabling AI Assistants to Manage Payments and Orders

AI assistants equipped with PayPal's agentic capabilities can autonomously handle comprehensive payment and order management tasks, transforming how businesses operate their commerce workflows. These digital agents can generate invoices, initiate payments, track orders, and manage subscriptions using secure PayPal APIs, all while operating within predefined business rules and user permissions.

The practical applications of AI-powered payment management span across multiple business functions:

Invoice Management: AI assistants can automatically create and send invoices based on completed services or delivered products, customize invoice templates according to client preferences, and follow up on overdue payments with personalized communication.

Payment Processing: Agents can confirm payments in real-time, process refunds when conditions are met, and handle payment disputes by gathering relevant information and initiating resolution workflows.

Order Fulfillment: AI systems can track shipments across multiple carriers, provide customers with proactive delivery updates, and automatically handle return requests when items don't meet expectations.

Subscription Management: Agents can manage recurring billing cycles, handle subscription upgrades or downgrades, and process cancellations while ensuring proper prorating and refund calculations.

The workflow for AI assistant payment management typically follows this sequence:

Transaction Initiation: The AI agent receives a trigger (order completion, service delivery, subscription renewal)

Payment Processing: The agent uses PayPal APIs to create payment requests or process existing authorizations

Confirmation and Documentation: The system generates receipts, updates records, and notifies relevant parties

Follow-up Actions: The agent handles any subsequent requirements like shipping notifications or customer service inquiries

This autonomous approach significantly reduces manual workload while improving transaction speed and accuracy. Businesses report substantial improvements in operational efficiency when AI agents handle routine payment tasks, freeing human staff to focus on strategic activities and complex customer interactions.

Integrating Invoices, Subscriptions, Refunds, and Tracking with PayPal APIs

PayPal's agentic APIs offer comprehensive solutions for core financial tasks essential for autonomous commerce workflows. These APIs connect AI systems with PayPal endpoints to handle invoicing, recurring payments, refunds, and order tracking.

For invoice automation, AI agents use PayPal's Invoicing API to create, customize, and send invoices based on transactions, automatically populating details, calculating taxes, and scheduling delivery. Subscription management utilizes PayPal's Subscriptions API to manage recurring billing, including subscription plans, upgrades, downgrades, and cancellations, making it optimal for SaaS businesses and service providers.

Secure integration ensures AI agents never access sensitive financial data directly, relying on tokenized flows for PCI DSS-compliant operations. Developers should implement robust error handling and escalation mechanisms to balance automated efficiency with accuracy and quality customer service.

Accelerate Agentic Payments with PayPal

PayPal is revolutionizing commerce by empowering AI agents to seamlessly manage complex payment workflows. With advanced APIs tailored for invoicing, subscriptions, and secure transactions, PayPal provides businesses the tools needed to build intelligent and reliable agentic systems. By combining automation, scalability, and compliance, PayPal unlocks new opportunities for innovation and efficiency in payment processing. Explore how PayPal can accelerate your agentic payment workflows and redefine autonomous commerce at PayPal.ai

Recommended

A Faster Guest Checkout: How to Integrate Fastlane by PayPal

8 min read

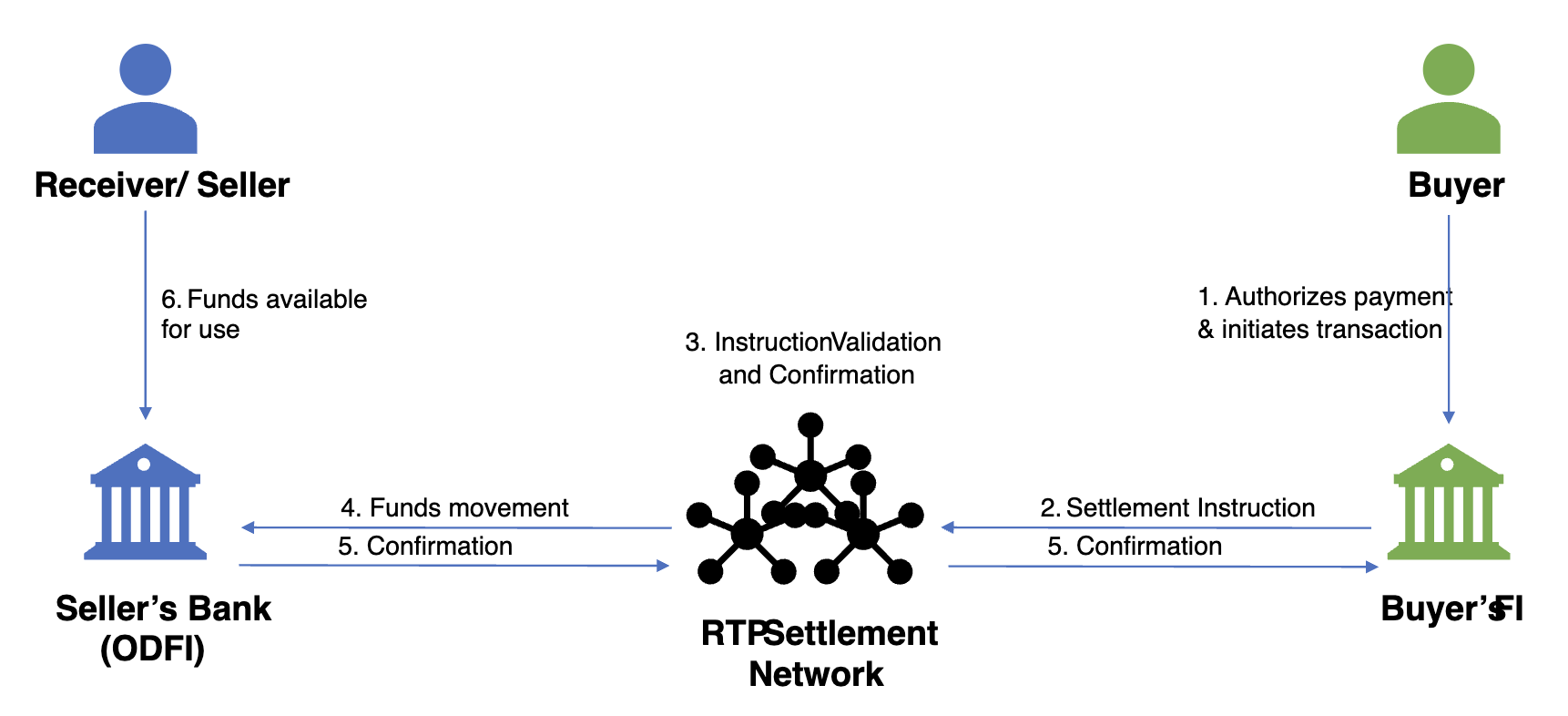

Exploring the Growth of Real Time Payment Systems

5 min read

Pay by Bank for E-Commerce | Using Bank Accounts to Make Purchases with SMBs [ACH]

5 min read