How converting and accepting multiple currencies works with PayPal

Feb 25, 2025

5 min read

With over 160 currencies in circulation globally, the ability to manage currency conversion and accept multiple currencies has become vital for businesses of all sizes. Whether you’re an e-commerce store looking to expand your customer base overseas, a freelancer working with international clients, or a brick-and-mortar retailer wanting to welcome foreign tourists, understanding how to handle multi-currency payment processing can set you apart from the competition.

However, navigating the complexities of accepting payments in foreign currencies comes with its own set of challenges. You may have concerns about fluctuating exchange rates, transaction fees, or the technical aspects of implementation. This comprehensive guide aims to address these issues head-on, exploring the potential benefits of offering multi-currency options, as well as the risks involved.

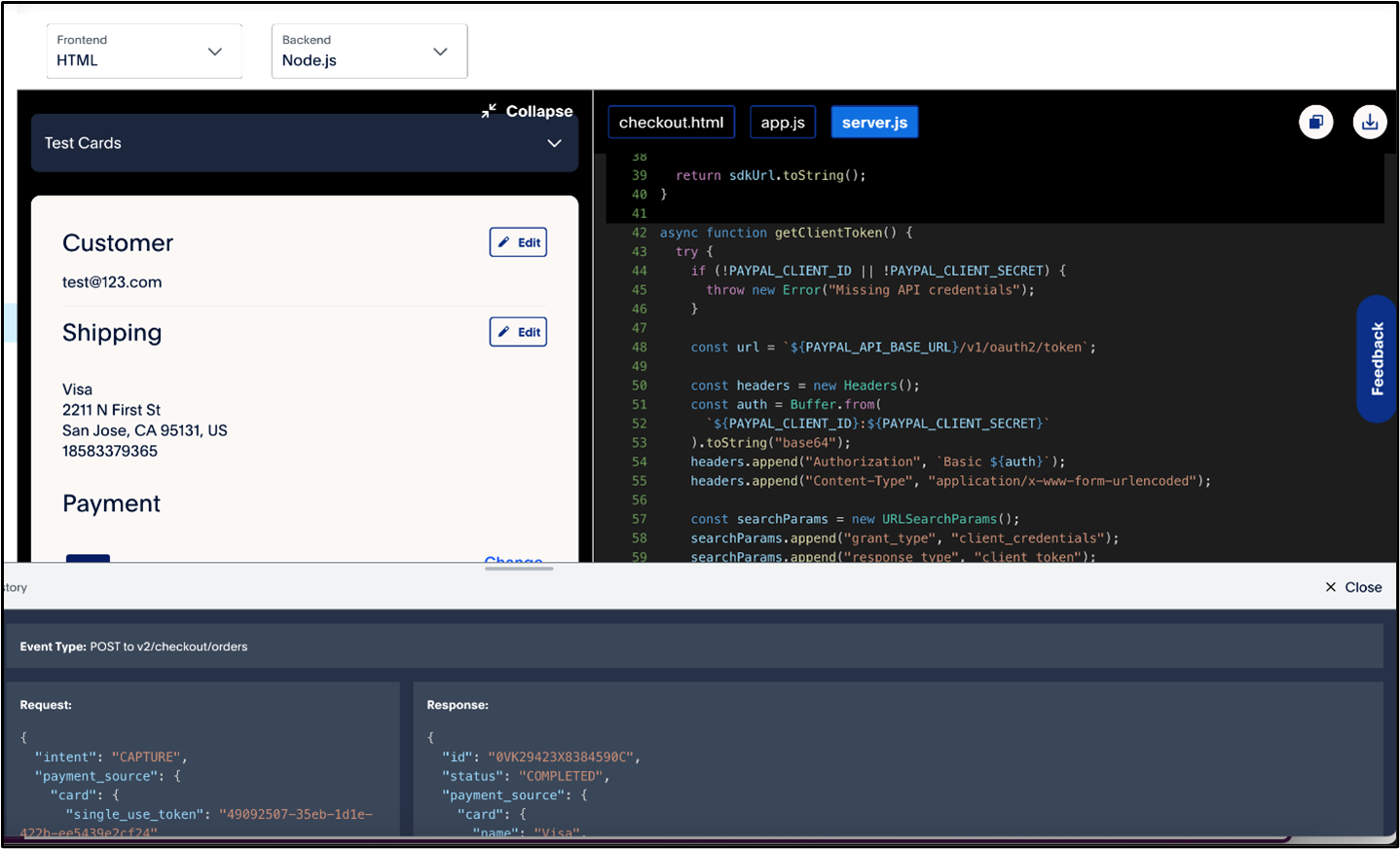

We’ll delve into what PayPal supports for currency conversion and how to effectively implement these systems in your business. By the end of this guide, you’ll have a well-rounded understanding of the landscape of currency conversion and multi-currency payment processing, equipping you to make informed decisions that enhance your global reach.

What Is Currency Conversion with PayPal?

Currency conversion through PayPal refers to the process of exchanging one currency for another during payment transactions. This feature is vital for businesses that cater to international customers. When a buyer pays in a currency that differs from the seller's primary currency, PayPal automatically converts the payment amount using its established exchange rates.

Key Features of PayPal's Currency Conversion

Let's take a look at the key features of PayPal's currency conversion feature:

Seamless Automatic Conversion

PayPal performs automatic conversions for payments made in foreign currencies into the primary currency of the seller’s account. For example, if you run a business in Canada but receive payments in British pounds, PayPal will convert those funds into Canadian dollars at the point of sale.

Clear Fee Structure

There are fees associated with currency conversion on PayPal. The conversion rates provided by PayPal include an additional percentage above the market exchange rate, which accounts for their service fees. Users should familiarize themselves with this fee structure to understand the costs involved in currency conversions.

Manage Currency Preferences

PayPal allows users to hold multiple currencies within their accounts. You can set a primary currency for your transactions while also adding various other currencies that you may wish to accept, streamlining your operations.

Facilitating International Sales

Accepting payments in multiple currencies can greatly enhance the purchasing experience for international customers. With PayPal, users can preview the amount and pay in their local currency, which can lead to higher sales and customer satisfaction. Merchants can also accept payments for BNPL transactions in the currency of their choice. For example, if a merchant from Singapore would like to give the Pay Later option to US buyers, they need to present USD as a currency.

Steps to Accept Multiple Currencies on PayPal

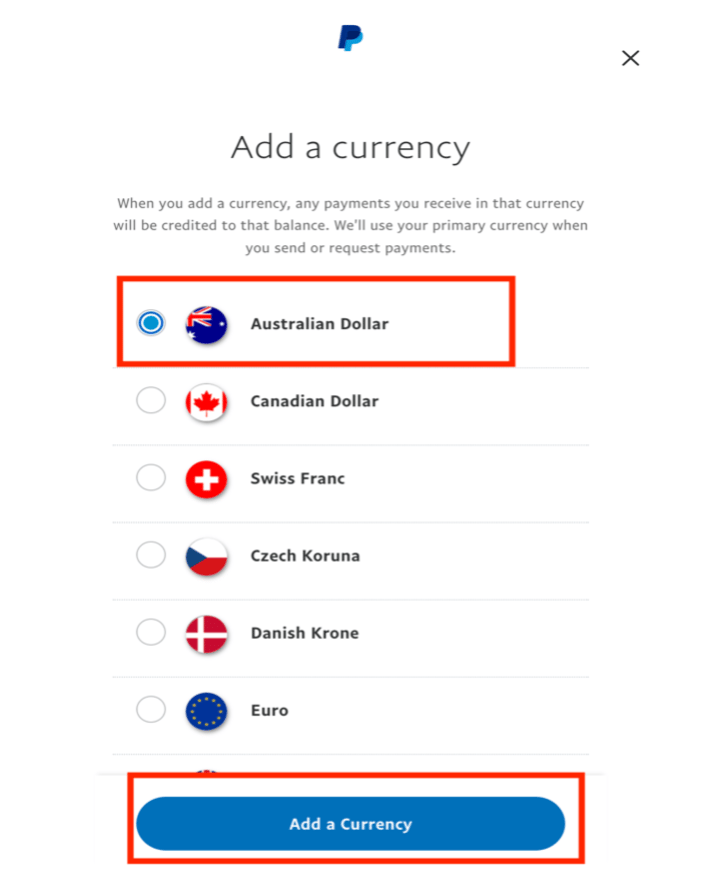

PayPal is available in more than 200 countries/regions and PayPal users can accept payments in 24 currencies around the globe. To start accepting payments in different currenciesusing PayPal, follow these straightforward steps:

1. On your Money page, you can add a new currency, change your primary currency, or close a currency.

2. Here's how to add a currency:

- Go to Money.

- Click + Add a currency.

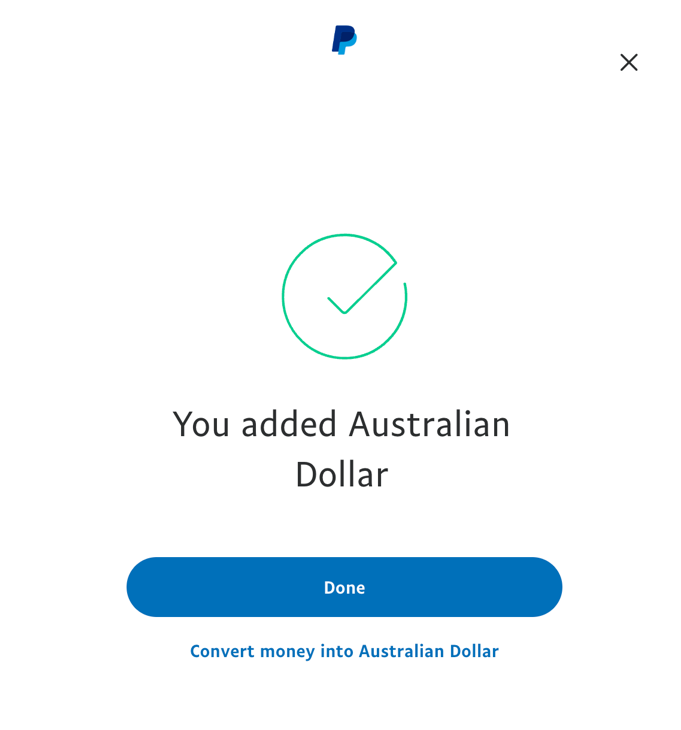

- Select the currency you want and click Add a currency.

3. Here's how to change your primary currency:

- Go to Money.

- Click Make primary beside the desired currency.

4. Here's how to close a currency:

- Go to Money.

- Click on the Close currency button beside the currency you want to close.

5. If you receive a payment in a different currency, a new currency balance is opened in your PayPal account. You can change this setting on your Money page.

Benefits of Using PayPal for Multi-Currency Transactions

User-Friendly Interface:

PayPal is designed to be accessible, allowing anyone to accept multi-currency payments without needing advanced financial expertise. ·

Access to Global Markets:

With hundreds of millions of active accounts worldwide, PayPal enables businesses to tap into international markets with ease, expanding their customer base.

Quick Transaction Processing:

Payments through PayPal are typically processed rapidly, allowing businesses to maintain healthy cash flow by having funds available almost instantly.

Enhanced Security Features:

PayPal employs cutting-edge encryption technologies to secure transactions, providing both buyers and sellers with confidence in their online dealings.

Multi-Currency Wallet:

By supporting multiple currencies, PayPal users can avoid the inconveniences of frequent conversions, making it easier to manage international funds.

Conclusion

Utilizing PayPal for currency conversion and acceptance of multiple currencies streamlines international transactions for both individuals and businesses. Its automated conversion processes, coupled with the flexibility of managing multiple currencies, make it a top choice for those looking to expand their global reach. By understanding and leveraging these features, users can enhance their transaction experiences and effectively navigate the complexities of international payments. Whether you’re a freelancer working with clients worldwide or a business venturing into international sales, PayPal’s multi-currency capabilities can simplify your operations and boost your global engagement.

Recommended

A Faster Guest Checkout: How to Integrate Fastlane by PayPal

8 min read

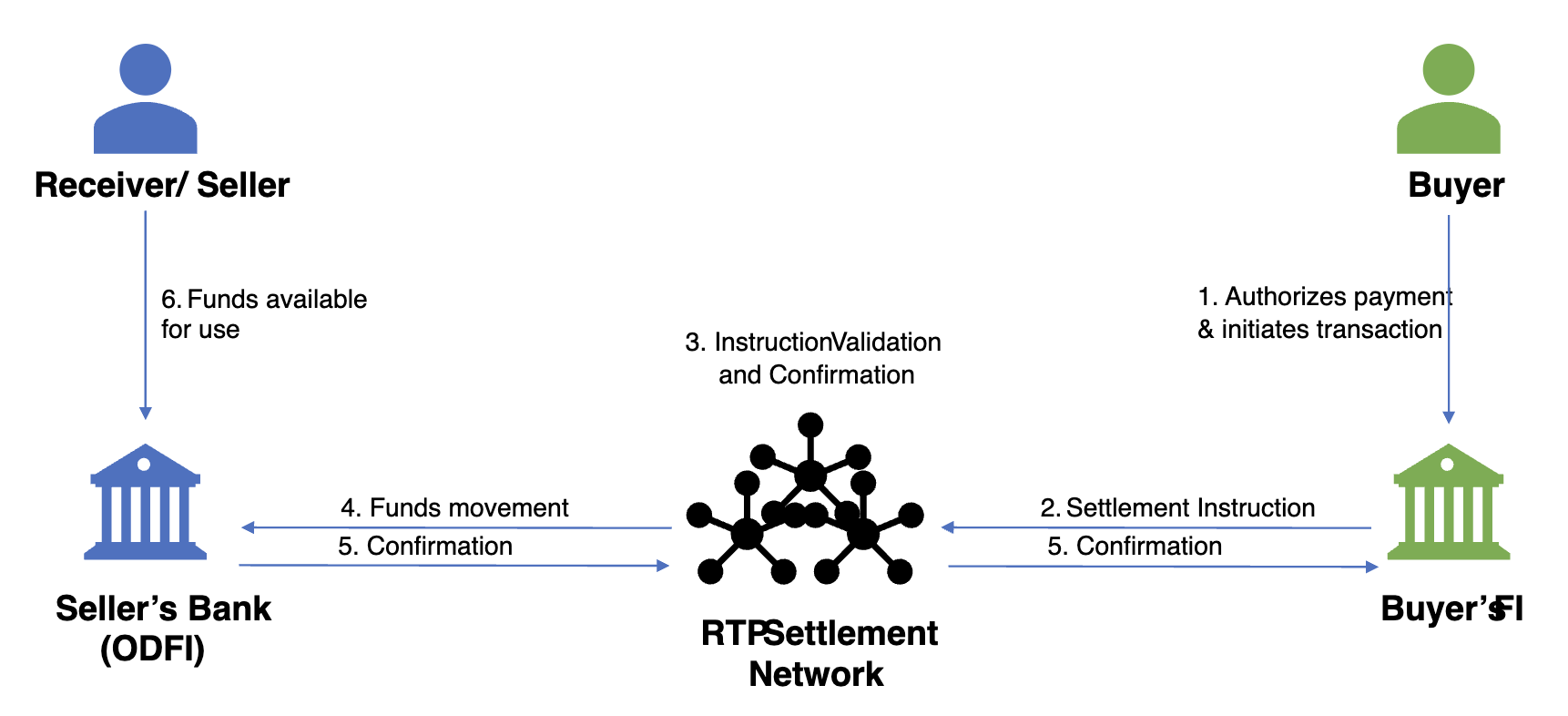

Exploring the Growth of Real Time Payment Systems

5 min read

Pay by Bank for E-Commerce | Using Bank Accounts to Make Purchases with SMBs [ACH]

5 min read