Fastlane Integration Paths for PayPal Complete Payments

Oct 08, 2024

7 min read

In today’s digital economy, having streamlined payment processes is crucial for maintaining competitiveness and meeting customer expectations. Efficient payment systems speed up transactions, reduce errors, and enhance security, which not only improves cash flow and lowers costs but also boosts customer loyalty and drives business growth.

Fastlane is an innovative guest checkout solution designed to streamline the purchasing process. With Fastlane, merchants can provide a seamless, efficient checkout experience, helping to drive higher sales. It improves transaction speed, security, and the overall customer experience while offering flexible setup options for businesses of all sizes.

Fastlane is a product offering within the PayPal Complete Payments platform. PayPal Complete Payments provides a comprehensive solution for accepting a range of diverse payment methods, including cards, PayPal accounts, and other popular digital wallets and alternative payment methods. With detailed financial insights, PayPal Complete Payments streamlines payment processes, helping businesses efficiently manage transactions and stay competitive in the evolving digital marketplace.

Fastlane by PayPal offers two integration patterns for developers and tech savvy merchants: Quick Start and Flexible. In this article, we discover how the two integration paths suit distinct kinds of businesses and help you find the right fit for your usage.

Quick Start vs Flexible Integration

The Quick Start option provides a fast, straightforward setup for businesses needing a rapid deployment of payment solutions with minimal customization.

In contrast, the Flexible Integration is an integration that merchants can use in cases where they want to control guest and return user flow. It requires more work for developers to implement the Flexible Integration. Both patterns aim to streamline payment processes, but they cater to various levels of complexity and customization.

Let’s take a detailed look at how these integrations pan out:

1. Implementation

Quick Start offers a streamlined setup process, designed for businesses that need to get up and running quickly with minimal effort. It is the most preferred way recommended by PayPal to integrate Fastlane. Flexible is recommended only in use-cases where merchants want to handle guest and return user flow by themselves and are willing to do the additional integration lift.

2. Flexibility and Customization

For a streamlined setup with minimal customization, Quick Start is ideal for businesses with payments needed and caters to their customization requests. Flexible Integration should only be used if your business needs a solution to handle guest and return user flow separately and needs extensive customization.

3. Performance

For reliable performance in typical payment scenarios, Quick Start is your best choice, providing a dependable solution for everyday use. Flexible integrations can be opted for only those customers who need to control guest and return user flow and customize billing address collection.

4. Business Size and Needs

Quick Start is ideal for smaller businesses or those with straightforward payment needs, offering a simple and efficient integration process. Quick start also offers robust customization and performance enhancing options. The Flexible Integration, on the other hand, is only required in case of complex payment requirements.

Exploring PayPal Complete Payments as a Key Payments Platform

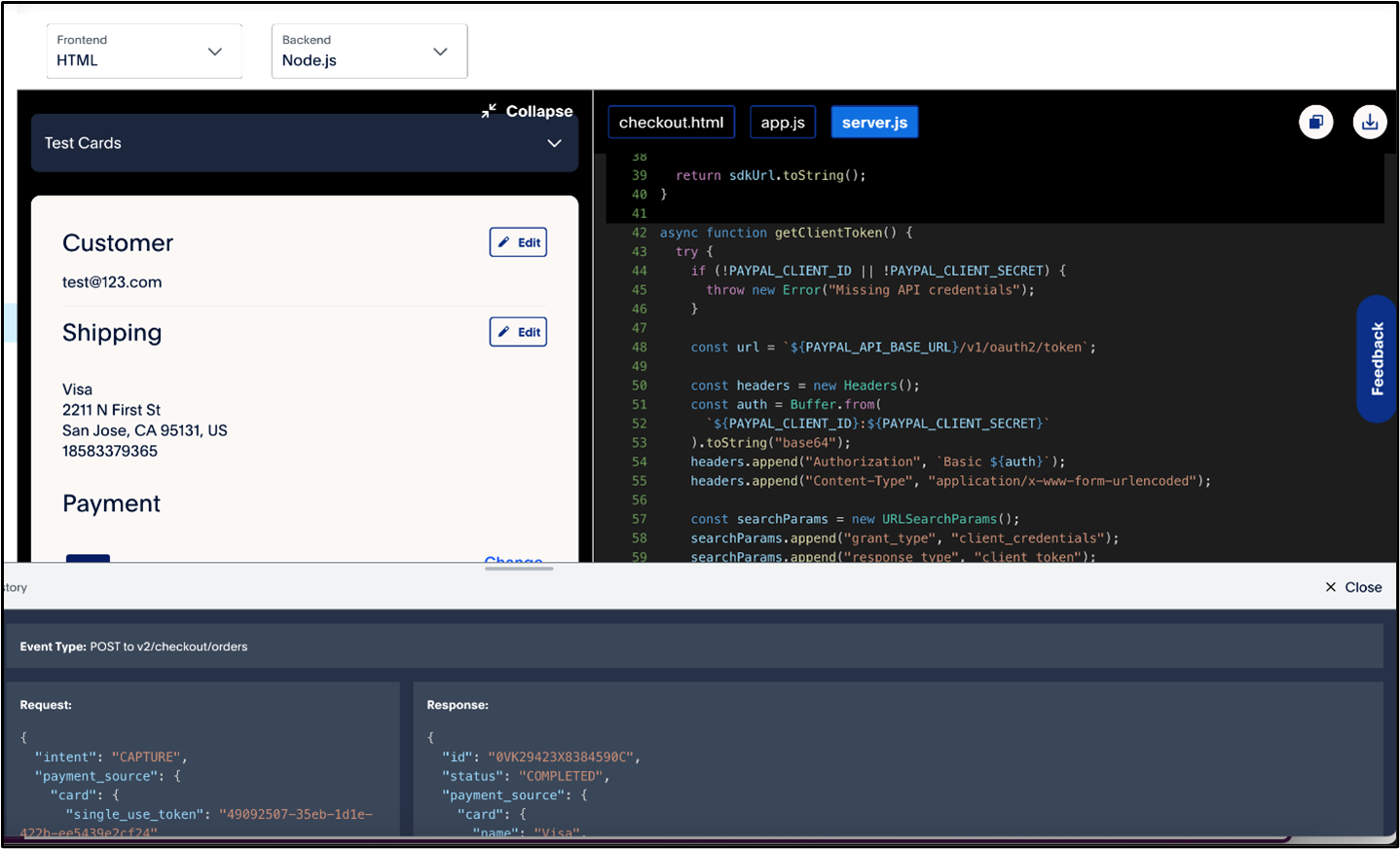

If you are on the legacy stack with NVP/SOAP API, you will need to upgrade to the latest stack that includes JavaScript SDK v5 and Orders v2 API to benefit from PayPal’s product innovations including Fastlane. You can upgrade through integrating PayPal Complete Payments client-side and server-side components. Here’s how this integration works using the PayPal Web SDK (Software Development Kit) on the client side and the Orders API, Vault API, and Disputes API on the server side.

Client-Side Integration: Web SDK

1. Add PayPal JavaScript SDK

Integrate the PayPal JavaScript SDK into your website to use PayPal’s payment features directly on your site. (Refer to Step 2 here)

2. Render PayPal Button

Use the PayPal SDK to display the PayPal payment button on your checkout page. This button allows users to initiate payments with PayPal accounts or credit/debit cards.

3. Handle Payment Approval

After users complete their payment, the `onApprove` function in the SDK manages the payment approval and captures the transaction by sending necessary details to your server. (Refer to Step 5 here)

Server-Side Integration

1. Orders API:

Create Order:

On your server, use the Orders API to create a payment order with PayPal. This includes specifying payment details such as amount and currency. The API response includes an order ID, which is used on the client side to complete the payment.

Capture Payment:

Once the user approves the payment, your server calls the Orders API to capture the payment and finalize the transaction.

2. Vault API:

The Vault API allows you to securely store customer payment methods for future use. This involves saving payment information such as credit card details securely on PayPal’s servers.

3. Disputes API:

If a customer disputes a transaction or initiates a chargeback, the Disputes API helps manage and respond to these issues. It provides tools for tracking disputes and resolving them efficiently. By implementing these client-side and server-side steps, you can effectively integrate PayPal Complete Payments, ensuring a seamless and secure payment experience for customers while efficiently managing transactions and disputes.

Evaluating Integration Patterns: A Side-by-Side Review

When implementing payment integrations, choosing between the Quick Start and Flexible paths depends on your specific use case and business needs. The Quick Start path is designed for ease of implementation, offering a streamlined setup that gets you up and running quickly with minimal configuration. This approach is ideal for businesses seeking a fast, straightforward solution.

Performance considerations also play a crucial role in your choice. The Quick Start path can be optimal for businesses prioritizing speed and simplicity, as it delivers consistent performance with minimal adjustments. Conversely, the Flexible path is more complex to integrate but can be considered for specific business needs.

For businesses, the choice between these paths often hinges on size and operational needs. Matching the right integration pattern to your business's size and needs ensures that you achieve both optimal performance and a tailored payment experience.

Choosing the Right Integration for Your Business

Choosing the right integration pattern for your business involves understanding your current needs and planning for future growth. Start by looking at how complex your payment requirements are and how quickly you expect your business to grow.

If you need a solution that can adapt as your business expands or has specific customization needs, the Flexible integration path might be the best choice. It allows for more tailoring and can scale your business.

On the other hand, if you’re looking for a quick and straightforward setup with less need for customization, the Quick Start pattern could be more suitable.

To make the best choice, consider consulting with PayPal Complete Payments experts who can offer guidance and support. They can help you navigate the integration process and ensure you select a solution that not only meets your current needs but also supports your long-term growth.

Conclusion

Choosing the right payment integration is crucial for your business’s long-term success. Quick Start offers a fast and straightforward setup, making it ideal for businesses with basic, immediate needs. It’s easy to implement, has a lot of customization and should be able to adapt to your growing business needs. This approach allows you to tailor the payment experience to fit your specific requirements and ensures better scalability and operational efficiency. In contrast, the Flexible Integration provides extensive customization and adaptability for specific businesses.

Carefully evaluate your business’s needs before deciding. Making the right choice will help you optimize performance, enhance customer satisfaction, and support your business’s long-term objectives. Explore Fastlane for an efficient payments solution.

Recommended

A Faster Guest Checkout: How to Integrate Fastlane by PayPal

8 min read

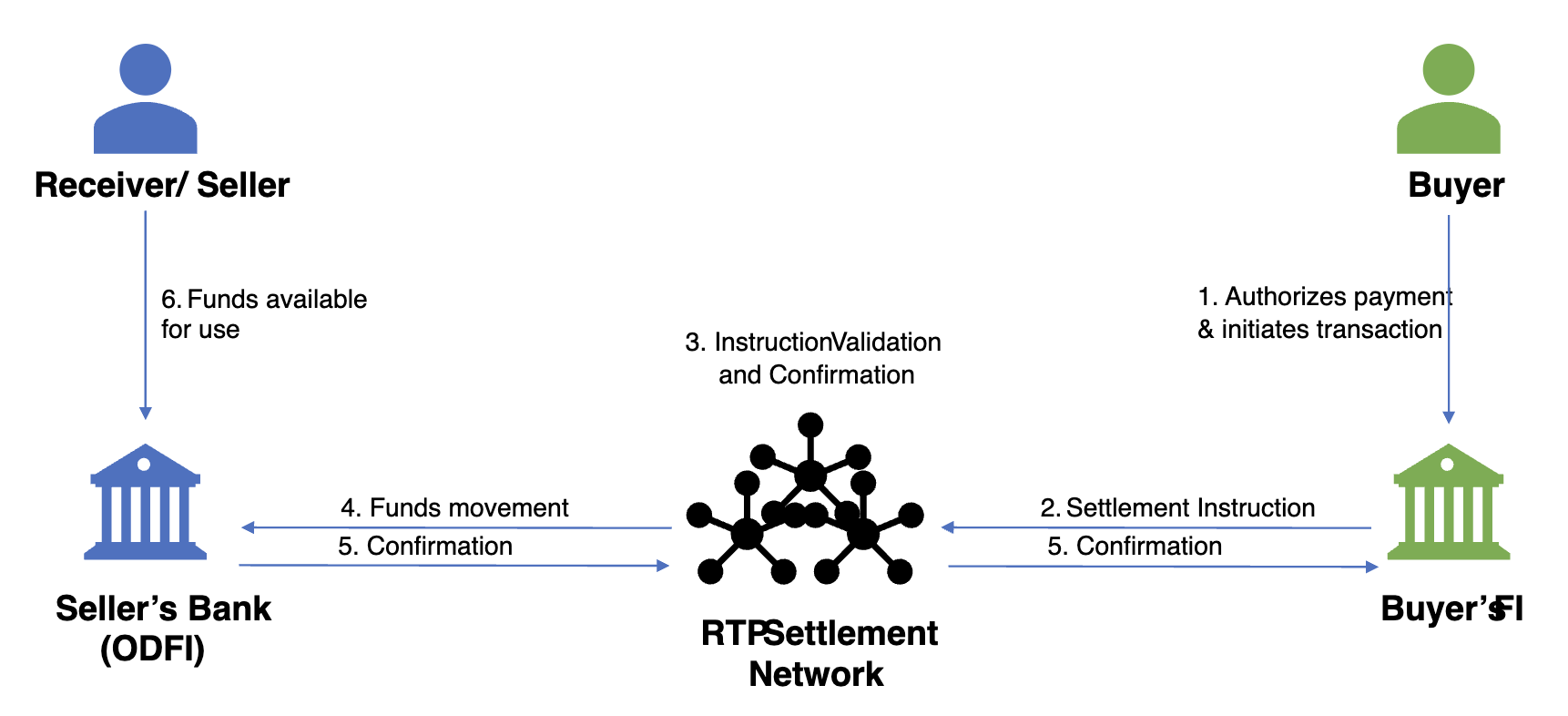

Exploring the Growth of Real Time Payment Systems

5 min read

Pay by Bank for E-Commerce | Using Bank Accounts to Make Purchases with SMBs [ACH]

5 min read