Payment Links in PayPal

Apr 15, 2025

11 min read

Payment links are interactive URLs or scannable codes created to facilitate fast and efficient online transactions. When users select a payment link or scan a QR code, they are promptly taken to a secure payment page to input their payment information and finalize the transaction. Typically, users have various payment options available, including credit cards, debit cards, and PayPal, which offers convenience and flexibility. The payment link system is intended to streamline the process, minimizing the time and effort needed to complete an online purchase.

In this blog, we explore the various kinds of payment links available to you in PayPal, how they work and how to troubleshoot common problems around them.

How do payment links work?

Payment links are a simple and secure way for businesses to accept payments online through a unique URL. They allow developers to integrate a fast and easy payment solution without needing complex checkout systems.

By sharing a link with customers, they’re directed to a secure page where they can choose from various payment options like credit cards or digital wallets, streamlining the process. For developers, payment links enable quicker integration, reduce coding effort, and improve user experience by speeding up the checkout process. For users, payment links offer flexible payment methods and a seamless, one-click checkout experience. With the growing popularity of online transactions, payment links have become a go-to solution for developers, merchants, and consumers alike.

Creating Payment Links: A step-by-step guide

Let’s take a look at how to create different kinds of payment links in PayPal:

PayPal.me

- Open the PayPal app: Launch the app on your mobile device and log in to your PayPal account.

- Navigate to 'Pay & Get Paid': Tap on the "Pay & Get Paid" option at the bottom of the screen. This section allows you to manage your transactions and create payment links.

- Create a Payment Link: Look for an option like "Create a PayPal.me link" or "Request Money". If you see "Create PayPal.me link", select it. PayPal will guide you through setting up a personalized link, where you can specify the amount, description, and currency.

- Customize Your Link: You can customize the link with a specific amount or leave it open-ended if you want the payer to enter the amount themselves.

- Share the Link: Once the link is created, you'll be given the option to share it directly via text, email, or social media, or simply copy it for later use.

No-Code Payment Links

Access the Fastlane Platform:

- Go to PayPal's developer site and access the Fastlane platform.

- Use the drag-and-drop functionalities to create payment links without any coding.

- Set the amount for the payment.

- Add a description for the payment link.

- Choose the preferred payment method.

- Distribute the payment link via social media, email, or direct link sharing options.

- Use available analytics tools to monitor the performance of your payment links.

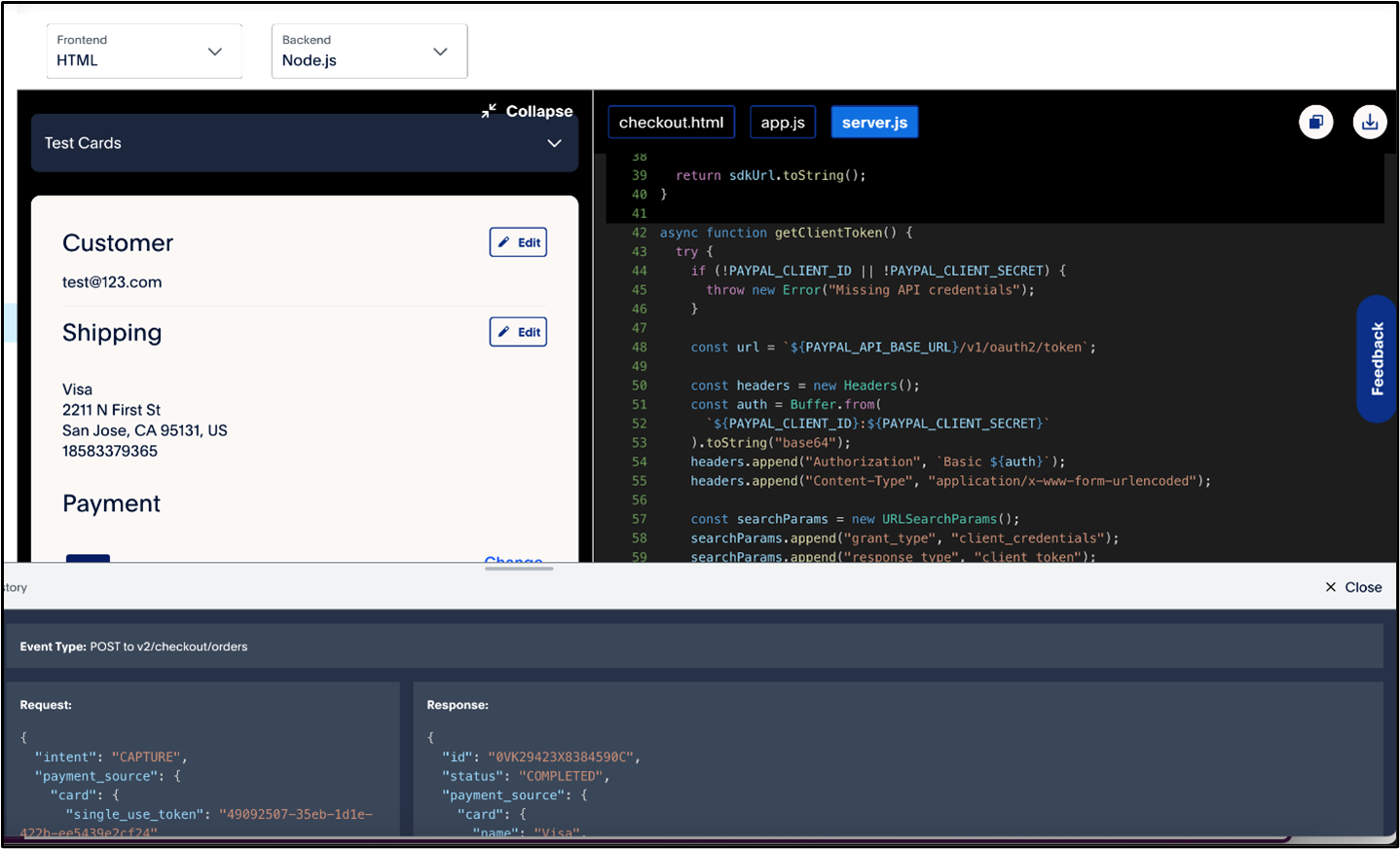

Fastlane API

- First, log in to your PayPal developer account and navigate to the Fastlane setup page here.

- Once you have integrated Fastlane into your system, use the API to generate a payment link. You can customize the link by specifying the amount you wish to charge, which can be done by setting the amount parameter in your API request.

- Additionally, you can add a description for the transaction by using the description field to provide more context to the payer.

The platform also allows you to choose a payment method, such as PayPal or credit/debit card, giving you flexibility in how to link payment methods to your service. By tailoring these settings, you can create a personalized and seamless experience for your customers when you create a link for online payment.

How to Share Payment Links

When you’re looking to share a PayPal payment link with customers or recipients, there are several methods to consider.

- You can share payment link via social media platforms like Meta, Instagram, or X, where you can either post the link publicly or send it privately in direct messages. This is especially useful for businesses looking to promote products or services to a wide audience.

- Another option is email: simply copy the PayPal payment link into the email, add a brief explanation, and encourage recipients to click and pay securely.

- For more personalized communication, direct link sharing is a great choice, just send the PayPal link via text, WhatsApp, or a messaging app like Telegram, making it easy for recipients to pay right away.

When thinking about how to send a payment link to a customer, it’s important to tailor your approach. Use email or direct messaging for personal transactions or service-related payments and leverage social media for broader business outreach.

Always include a clear call to action (e.g., "Pay Now via PayPal") to make the process simple and encourage timely payments.

How to deactivate a payment link

Once you've created your PayPal.Me link, you won't be able to delete or change it.

If you want to hide your PayPal.Me link, log into PayPal.Me, tap or click turn off My Link. This will prevent people from sending you money.

Your PayPal.Me link will still be linked to your PayPal account and won't be available for others to grab.

Tracking the performance of your payment links

PayPal provides useful analytics and reporting tools for users of Pay links, enabling real-time tracking of payment link performance.

With PayPal's reporting dashboard, you can keep an eye on essential metrics such as clicks, conversions, and total payments received. When you set up a PayPal payment link, the platform monitors how many times your link is accessed, offering insights into the level of interest it generates.

You can also assess conversion rates, which indicate how many of those clicks led to successful payments, thus highlighting the effectiveness of your payment link in driving sales and completing transactions.

Moreover, PayPal offers transaction history reports that detail the total amounts collected through each payment link, including fees and net totals. To maximize the benefits of these tools, it's advisable to regularly evaluate your link’s performance and make adjustments based on the data, whether improving the link’s visibility or refining the payment process to enhance conversions. Utilizing these analytics can significantly enhance your understanding of customer behavior and improve your strategy for using payment links.

Fastlane: Simplifying payment link creation

Fastlane is a suite of tools that simplifies online payment link creation for developers. With pre-built features, it allows quick integration and customization to fit specific business needs. Fastlane adheres to industry security standards, ensuring a safe solution for payment processing. For more details on improving your payment processes, explore Fastlane's payment solutions.

No code solutions with Fastlane

Fastlane provides no-code solutions that enable developers with minimal coding skills to create and manage custom payment links easily. With a user-friendly interface and drag-and-drop functionality, Fastlane simplifies the payment solution process, making it accessible to a broader audience. This approach allows businesses to deploy flexible payment links quickly, saving time and resources while enhancing customer experience. The no-code features facilitate agility and control over customizations. To get started, visit this integration guide.

Upgrading to Fastlane

For developers using PayPal's checkout solutions, upgrading to Fastlane enhances features and improves the payment experience. The seamless upgrade process minimizes disruption to your setup.

Fastlane provides a suite of tools that streamline payment link creation, customization, and integration with functionalities that reduce complex coding needs. This allows for quicker management of payment links while offering a smoother checkout experience.

Fastlane scales with your business, offering flexible solutions and improved security to meet industry standards. This upgrade enhances efficiency and keeps you competitive with faster deployment of new payment solutions. For more information on the upgrade process, visit this upgrade guide.

Troubleshooting Fastlane integrations

When integrating Fastlane into your payment system, developers might occasionally encounter issues such as a payment link not working, which can disrupt the user experience.

Common challenges include misconfigured parameters, incomplete API setup, or issues with payment gateways. Fastlane, however, simplifies the debugging process by offering clear and informative error messages that help pinpoint the root cause of the issue. These error messages are designed to provide developers with direct feedback on what needs to be fixed, whether it's an invalid URL, missing credentials, or an integration problem. This allows for a much quicker resolution compared to dealing with ambiguous errors.

Additionally, Fastlane offers readily available solutions and troubleshooting steps, ensuring that developers can solve problems swiftly without extensive downtime. By following Fastlane's comprehensive troubleshooting guide, developers can efficiently address issues such as links not working, ensuring a smoother integration and more reliable payment link performance.

For further assistance with resolving integration issues, check out the Fastlane troubleshooting guide.

Frequently Asked Questions

How can I create my payment link?

Fastlane offers two primary approaches: coding and No Code solutions. For developers comfortable with coding, Fastlane provides a flexible way to integrate payment links, offering full control and customization.

Alternatively, Fastlane's No Code solutions allow for easy creation of payment links using a drag-and-drop interface, perfect for those with minimal coding experience. For No Code setup, visit the No Code Solutions guide.

How do I create a pay me link?

Fastlane allows developers to create highly customizable payment links tailored to request payments from users. With flexible options, you can easily specify the payment amount, add descriptions to provide context for the payment, and incorporate branding elements to ensure the payment experience aligns with your business identity. Whether you're requesting payments for an invoice or setting up a simple transaction, Fastlane lets you create a link for people to pay an invoice with personalized details.

To explore how to create a link for people to pay an invoice and utilize these customization options, visit the Fastlane integration guide.

How do I create a payment link without a website?

Fastlane simplifies the process of creating payment links by eliminating the need for a complex website backend. With Fastlane, developers can generate an easy payment link that functions as a standalone solution, requiring no additional infrastructure.

These links can be seamlessly shared across various online environments, such as emails, social media, or messaging platforms, allowing businesses to request payments from users with ease. Whether you're a small business or a large enterprise, Fastlane's flexibility ensures that payment links are easily accessible and can be used in almost any context.

What is a payment link example?

A real-world payment link example is a small business using Fastlane to request invoice payments. Instead of a bank transfer, the business sends a clickable payment link, making it easy for customers to pay securely. Similarly, donation platforms use payment links to collect contributions, sharing them across social media or emails. These links simplify transactions for both businesses and individuals.

Recommended

A Faster Guest Checkout: How to Integrate Fastlane by PayPal

8 min read

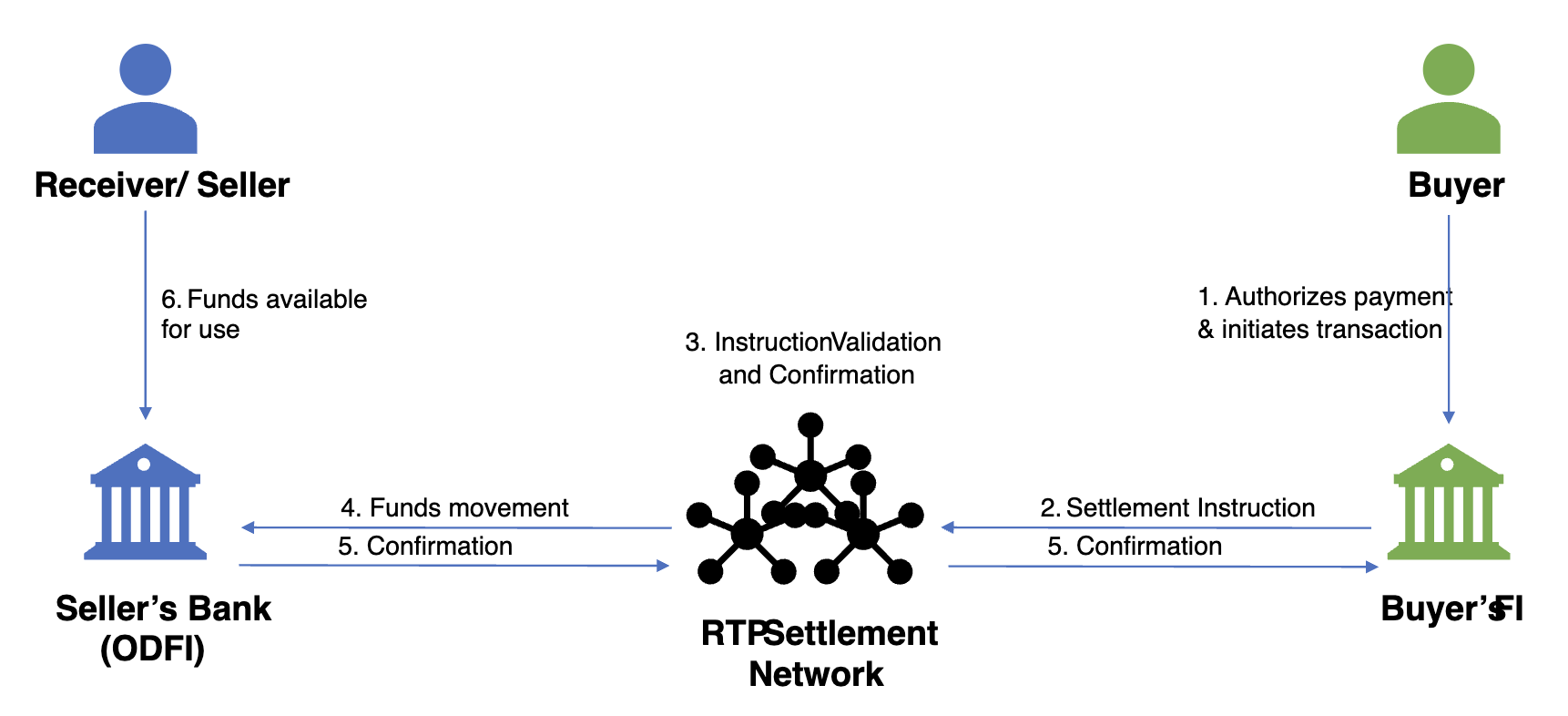

Exploring the Growth of Real Time Payment Systems

5 min read

Pay by Bank for E-Commerce | Using Bank Accounts to Make Purchases with SMBs [ACH]

5 min read