Building Trust, Transparency, and Security in Payments

Nov 12, 2025

6 min read

Artificial intelligence is revolutionizing ecommerce payments by enhancing security, accelerating transaction speeds, and creating more intuitive customer experiences. As a global leader serving over 400 million users across 200+ markets, PayPal leverages AI to protect transactions and proactively manage fraud while upholding the highest standards of ethical technology deployment. Responsible AI in payments represents the ethical application of artificial intelligence that prioritizes transparency, fairness, data privacy, and explainability—ensuring that technological advancement benefits both businesses and consumers without compromising trust or security. This approach becomes increasingly critical as digital commerce continues its rapid expansion and regulatory expectations evolve.

Current Challenges with AI Adoption in Ecommerce Payments

The integration of AI into ecommerce payment systems presents several complex challenges that businesses must navigate carefully. Organizations face mounting pressure to balance innovation with regulatory compliance, particularly as global standards continue to evolve and become more stringent. The sheer scale of data collected by AI systems creates additional complexity, as protecting sensitive payment information while maintaining system effectiveness requires sophisticated security measures and careful oversight.

One of the most significant hurdles involves the difficulty in auditing and explaining AI-driven decisions. When payment systems automatically approve or decline transactions, merchants and customers need clear explanations for these outcomes. However, many AI models operate as "black boxes," providing limited insight into their decision-making processes.

Principles of Responsible AI in Payments

Responsible AI in ecommerce payments rests on four foundational principles that work together to create trustworthy, effective, and ethical systems. These principles—governance, explainability, privacy, and fairness—form the backbone of sustainable AI implementation that meets both business objectives and societal expectations.

Each principle addresses critical aspects of payment security, customer trust, and regulatory compliance. Governance establishes clear oversight and accountability structures, while explainability ensures that AI decisions can be understood and validated. Privacy protections safeguard sensitive financial data, and fairness mechanisms prevent discriminatory outcomes. Together, these principles create AI systems that minimize risk while enhancing transparency for both merchants and consumers, meeting the evolving expectations of regulators and the public.

Governance and Accountability

Effective governance in AI payments requires establishing comprehensive frameworks to oversee the development, deployment, and monitoring of AI systems, ensuring alignment with organizational values and legal standards. This structured approach creates clear lines of responsibility and enables organizations to maintain control over their AI implementations while adapting to changing requirements.

The Model Context Protocol (MCP) exemplifies how governance structures can clarify roles and assign accountability across users, agents, and merchants in complex payment ecosystems. This protocol establishes standardized communication channels and responsibility frameworks that enable seamless interaction while maintaining oversight through human-in-the-loop governance..

Explainability and Transparency

Explainability refers to the ability of an AI system to clearly articulate the reasons behind its decisions, ensuring stakeholders can audit and trust outcomes. In payment systems, this capability becomes crucial when customers or merchants need to understand why certain transactions were approved, declined, or flagged for additional review.

The industry is experiencing a significant shift toward transparent AI models that document logic, decision rules, and actions within automated payment flows. This transparency enables financial professionals to validate system behavior, helps customers understand payment outcomes, and provides regulators with the visibility needed to ensure compliance with evolving standards.

Privacy and Data Security

Data privacy in AI-powered payments involves safeguarding personally identifiable information and payment data from unauthorized access or misuse through strict policies, encryption, and regulatory compliance. This protection becomes even more critical as AI systems process vast amounts of sensitive financial information to deliver personalized experiences and security enhancements.

PayPal implements comprehensive security measures including 24/7 fraud detection, continual monitoring, and encrypted transactions to protect customer data throughout the payment process. These multilayered safeguards help ensure that AI systems can operate effectively while maintaining high standards of data security.

The challenges associated with large-scale AI data collection require organizations to provide consumers with clear transparency regarding how their data is used, stored, and protected. This includes implementing data minimization practices, obtaining appropriate consent for data usage, and providing customers with control over their personal information while maintaining system effectiveness.

Fairness and Bias Mitigation

Fairness in AI payment systems involves designing and auditing models to prevent systemically biased or discriminatory decisions in payment approvals, fraud detection, or customer support flows. This principle ensures that AI systems treat all customers equitably regardless of their background, location, or other demographic characteristics.

Industry best practices include conducting regular fairness audits, implementing feedback mechanisms that allow customers to report potential bias incidents, and establishing correction protocols that can quickly address identified issues. These measures help ensure that AI-powered payment systems enhance rather than hinder financial inclusion and accessibility.

Innovations Driving Responsible AI in Payments

Three key innovations are reshaping how responsible AI enhances payment processes while maintaining security and usability standards. Real-time fraud detection leverages machine learning to identify threats instantly, hyper-personalization creates tailored payment experiences, and biometric security provides seamless authentication. These technologies demonstrate how AI can simultaneously improve security measures and enhance user experiences when implemented responsibly.

PayPal's leadership in advanced machine learning for proactive fraud prevention exemplifies how established payment providers are integrating cutting-edge AI technologies while maintaining their commitment to security and customer protection.

Hyper-Personalization and Customer Experience

Hyper-personalization uses AI to analyze transaction data in real time and deliver tailored recommendations, offers, and payment options to individual customers based on their unique preferences and behaviors. This approach transforms the checkout experience from a generic process into a customized interaction that anticipates customer needs.

PayPal leverages network-wide data to trigger personalized shopping and payment experiences, helping to increase both customer engagement and conversion rates. This data-driven personalization helps merchants optimize their sales processes while providing customers with relevant and convenient payment options.

Balancing Innovation with Ethical Considerations

Successfully implementing AI in ecommerce payments requires striking a careful balance between leveraging cutting-edge technologies and meeting ethical, legal, and consumer expectations. Organizations that pursue unchecked innovation risk creating systems that violate privacy rights, perpetuate algorithmic bias, or erode consumer trust through opaque decision-making processes.

Effective approaches include implementing stepwise evaluation processes for new AI technologies, conducting comprehensive risk assessments before deployment, establishing ethics board reviews for significant AI implementations, and integrating user feedback throughout the development cycle. These measures help ensure that innovation serves both business objectives and societal values.

The Future of Responsible AI in Ecommerce Payments

The future of ecommerce payments will belong to organizations that embed responsibility into the very architecture of their AI systems.

Emerging trends include agent-driven commerce, omnichannel payment flows that work across all customer touchpoints, and AI integration that becomes invisible to users while providing powerful capabilities behind the scenes.

Regulatory requirements for responsible AI will likely become more stringent and standardized across global markets, making ethical AI implementation not just a competitive advantage but a business necessity. Consumers increasingly expect transparency and control over how AI systems handle their data and make decisions about their financial transactions.

PayPal's ongoing innovations as an infrastructure leader demonstrate how established payment providers can drive the responsible development of AI-powered commerce solutions. By maintaining focus on security, transparency, and customer protection while embracing technological advancement, leading organizations are setting the standards that will shape the future of digital payments.

Recommended

A Faster Guest Checkout: How to Integrate Fastlane by PayPal

8 min read

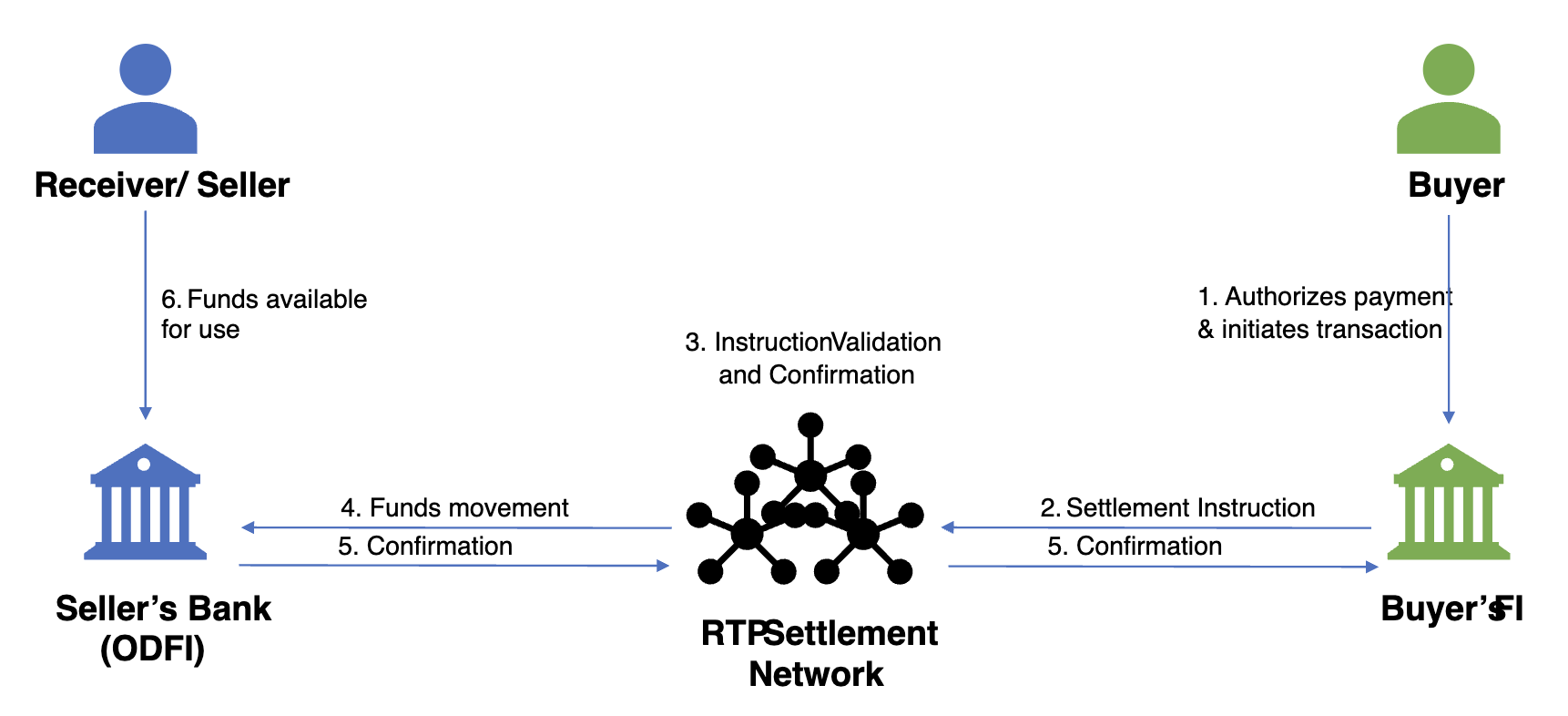

Exploring the Growth of Real Time Payment Systems

5 min read

Pay by Bank for E-Commerce | Using Bank Accounts to Make Purchases with SMBs [ACH]

5 min read