Get to Know Payflow Pro

Last updated: Sept 18th, 8:20pm

Overview

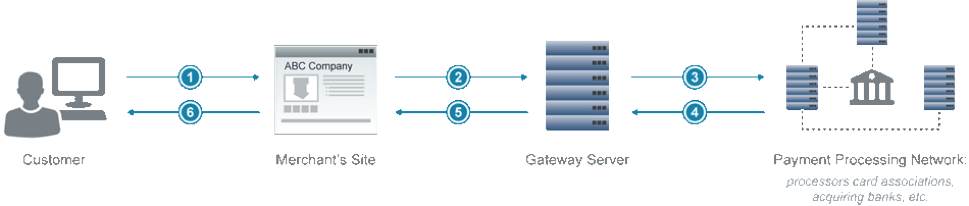

The traditional transaction flow is as follows. Numbers in the list correspond to numbers in the figure.

- A customer clicks Buy to purchase merchandise on your website.

- You send the transaction request to the PayPal Gateway server.

- The PayPal Gateway sends the transaction to the payment processing network.

- Your processor sends the response back to the PayPal Gateway server and processes the transaction (obtains the payment from the customer bank and deposits it in the merchant bank).

- The PayPal Gateway server returns the response to your website.

- Your website displays the result to the customer.

Available transaction methods

- Authorization transaction

- Delayed capture transaction

- Sale transaction

- Void transaction

- Credit/Refund transaction

Authorization, delayed capture, and sale transactions

Payflow authorization and capture is a settlement solution that provides increased flexibility in obtaining payments from buyers. An authorization transaction places a hold on the cardholder's open-to-buy limit, lowering the cardholder's limit by the amount of the transaction. It does not transfer funds.

Merchants can perform delayed captures transaction after an authorization to capture the original authorization amount. PayPal schedules the delayed capture for settlement during the next settlement period.

A sale transaction charges the specified amount against the accout and marks the transaction for immediate fund transfer during the next settlement period.

Refund transaction

You can only refund a transaction that has not been settled. You need to include the original transaction ID obtained from the transaction's response.

Void transaction

You can void any transaction that has not yet been submitted for settlement. The original transaction ID is obtained from the transaction's response.

Note: Additional advanced features are available. Please see Additional information.

Next

Know your API credentials and endpoint.

Additional information

- Advanced features: